Early Retirement Paperwork Guide

Introduction to Early Retirement Planning

Planning for early retirement requires careful consideration and preparation. It involves not just saving enough money, but also understanding the various paperwork and legal documents that need to be in place to ensure a smooth transition into retirement. This guide aims to walk you through the essential steps and documents you’ll need to navigate for a successful early retirement.

Understanding Early Retirement

Before diving into the paperwork, it’s crucial to have a clear understanding of what early retirement means to you. Early retirement typically refers to retiring before the age of 65, which is often considered the traditional retirement age. This could be due to various reasons such as achieving financial independence, health considerations, or simply the desire to pursue other interests earlier in life. Financial planning and investing wisely are key components of making early retirement a reality.

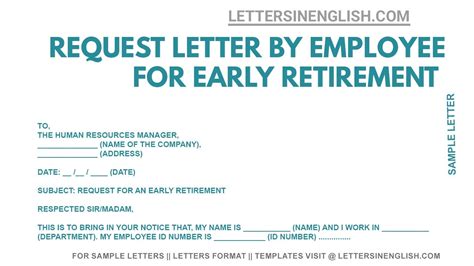

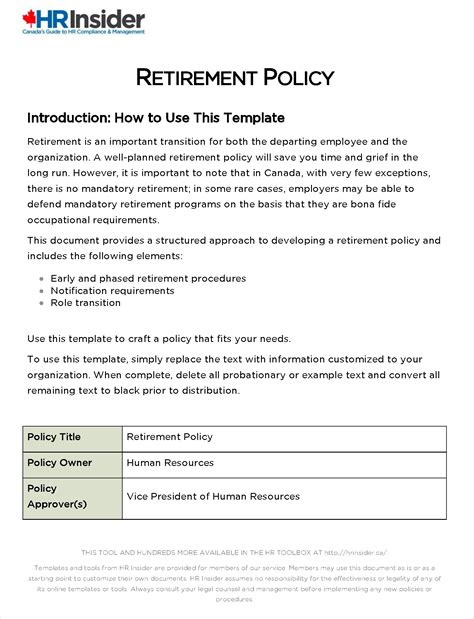

Essential Paperwork for Early Retirement

Several documents and plans are essential for a secure and enjoyable early retirement. These include:

- Retirement Accounts: Such as 401(k), IRA, or Roth IRA, which are crucial for saving for retirement. Understanding the rules and benefits of each, including contribution limits and withdrawal rules, is vital.

- Social Security Benefits: If you’re planning to retire early, you need to understand how Social Security benefits work, especially if you plan to start collecting them before your full retirement age.

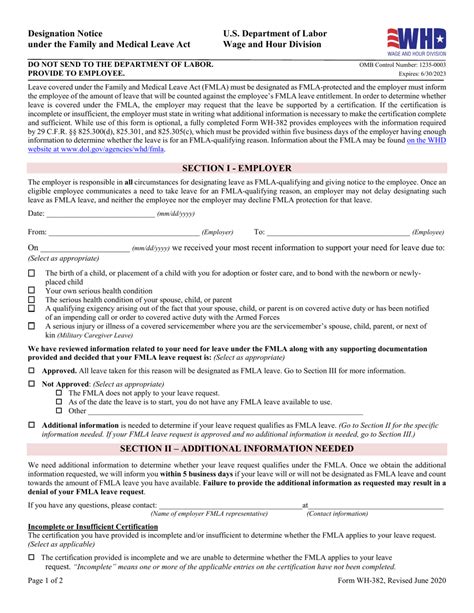

- Health Insurance: Since Medicare typically kicks in at age 65, early retirees need to secure health insurance until they become eligible. This could involve COBRA, private insurance plans, or spousal coverage.

- Will and Estate Planning: Having a will, power of attorney, and considering trusts can ensure your assets are distributed according to your wishes and protect your loved ones.

- Tax Planning: Early retirement can significantly impact your tax situation. Understanding how your retirement income will be taxed and planning accordingly can help minimize your tax liability.

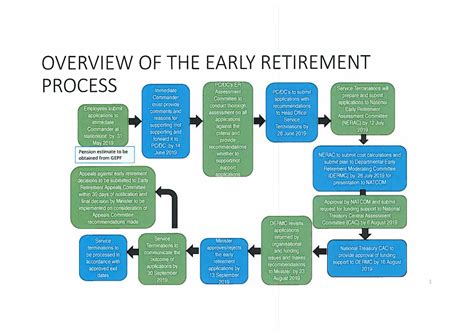

Steps to Prepare for Early Retirement

Preparing for early retirement involves several strategic steps:

- Assess Your Finances: Calculate your current expenses and estimate what they will be in retirement. Consider inflation and any lifestyle changes.

- Boost Your Savings: Increase your contributions to retirement accounts, and consider catch-up contributions if you’re 50 or older.

- Invest Wisely: Ensure your investment portfolio is aligned with your retirement goals and risk tolerance.

- Plan for Healthcare: Research health insurance options and consider Health Savings Accounts (HSAs) for tax-advantaged savings.

- Review and Update Legal Documents: Ensure your will, power of attorney, and other legal documents are up to date and reflect your current wishes.

Financial Planning Tools and Resources

Utilizing the right tools and resources can make a significant difference in your retirement planning. Consider:

- Retirement Calculators: Online tools that help estimate how much you need to save for retirement based on your goals and expenses.

- Financial Advisors: Professionals who can provide personalized advice tailored to your financial situation and retirement goals.

- Budgeting Apps: Tools to help track your expenses and stay on top of your finances.

📝 Note: Regularly reviewing and adjusting your retirement plan is crucial to ensure you're on track to meet your goals.

Conclusion and Final Thoughts

Planning for early retirement is a complex process that involves careful financial planning, understanding of legal documents, and a clear vision of your post-work life. By starting early, being disciplined in your savings and investments, and staying informed about the paperwork and planning required, you can set yourself up for a successful and fulfilling early retirement. Remember, it’s not just about stopping work; it’s about starting a new chapter in your life with financial security and peace of mind.

What is the best age to start planning for early retirement?

+

The best age to start planning for early retirement is as soon as possible. The earlier you begin saving and planning, the more time your money has to grow. Many financial advisors recommend starting to plan for retirement in your 20s or 30s.

How much money do I need to save for early retirement?

+

The amount of money you need to save for early retirement varies widely depending on your desired lifestyle, expenses, and the age at which you plan to retire. A common rule of thumb is to save enough to replace 70% to 80% of your pre-retirement income. However, this can vary significantly from person to person.

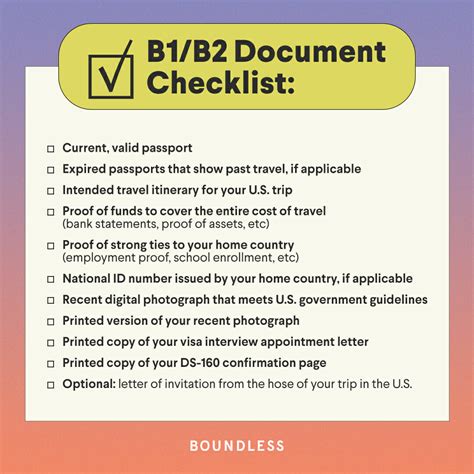

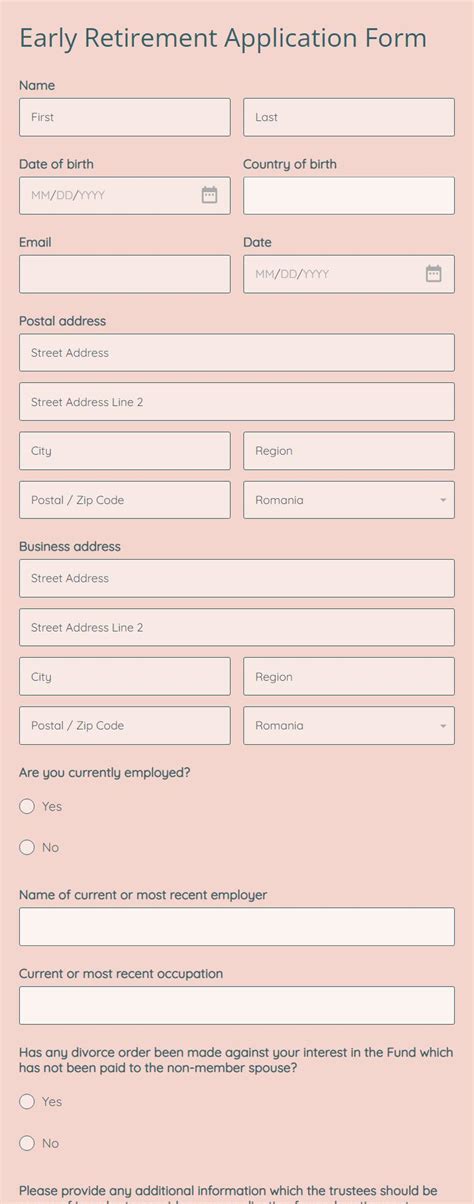

What are the most important documents to have in place for early retirement?

+

Key documents include a will, power of attorney, and potentially trusts. It’s also crucial to have a clear understanding of your retirement accounts, such as 401(k) or IRA, and to plan for health insurance until you’re eligible for Medicare.