5 Tips Save Turbotax Paperwork

Introduction to Turbotax Paperwork

When it comes to tax preparation, Turbotax is one of the most popular and user-friendly options available. However, one of the downsides of using Turbotax is the amount of paperwork that can be generated during the tax preparation process. From receipts and invoices to W-2s and 1099s, it can be overwhelming to keep track of all the documents needed to file your taxes. In this article, we will provide 5 tips to help you save and organize your Turbotax paperwork, making it easier to file your taxes and reducing the risk of errors or audits.

Tip 1: Go Digital with Your Receipts

One of the best ways to reduce paperwork is to go digital with your receipts. Instead of keeping physical copies of receipts, consider using a digital receipt scanner or app to store them electronically. This will not only save space but also make it easier to categorize and search for specific receipts when needed. Some popular digital receipt scanner options include Neat, Shoeboxed, and Expensify. By going digital, you can easily upload your receipts to Turbotax and avoid the hassle of physical paperwork.

Tip 2: Use a Filing System

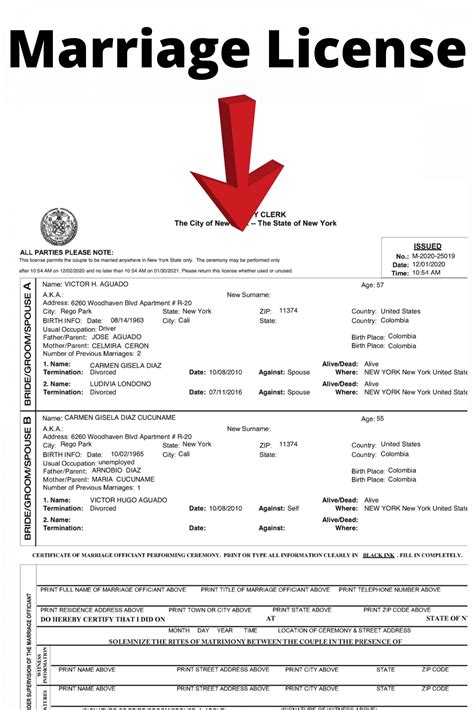

A filing system is essential for keeping your Turbotax paperwork organized. Consider using a file folder or binder to store all your tax-related documents, including receipts, invoices, and tax returns. You can also use dividers to separate different categories of documents, such as income, deductions, and credits. By having a filing system in place, you can quickly locate the documents you need when filing your taxes.

Tip 3: Take Advantage of Turbotax’s Import Feature

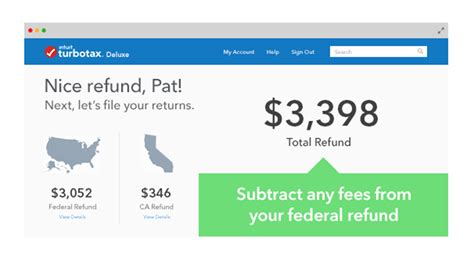

Turbotax offers an import feature that allows you to import your W-2s, 1099s, and other tax documents directly into the software. This can save you time and reduce the risk of errors when entering your tax information. To use this feature, simply log in to your Turbotax account and follow the prompts to import your tax documents. You can also import your tax documents from participating employers and financial institutions.

Tip 4: Keep a Record of Your Charitable Donations

Charitable donations can be a significant deduction on your tax return, but they can also generate a lot of paperwork. To keep track of your charitable donations, consider using a log or spreadsheet to record the date, amount, and type of donation. You can also use a receipt scanner or app to store electronic copies of your donation receipts. By keeping a record of your charitable donations, you can ensure that you don’t miss out on any deductions and can easily upload your donation information to Turbotax.

Tip 5: Consider Using a Tax Organizer

A tax organizer is a tool that helps you gather and organize your tax information, making it easier to file your taxes. Tax organizers can be found online or in print and typically include worksheets and checklists to help you gather your tax information. By using a tax organizer, you can ensure that you don’t miss out on any deductions or credits and can easily upload your tax information to Turbotax.

📝 Note: It's essential to keep your Turbotax paperwork organized and easily accessible in case of an audit or if you need to reference your tax information in the future.

In summary, saving and organizing your Turbotax paperwork is crucial for a smooth and stress-free tax preparation process. By going digital with your receipts, using a filing system, taking advantage of Turbotax’s import feature, keeping a record of your charitable donations, and considering using a tax organizer, you can reduce the amount of paperwork and make it easier to file your taxes.

What is the best way to store my Turbotax paperwork?

+

The best way to store your Turbotax paperwork is to use a combination of digital and physical storage methods. Consider using a digital receipt scanner or app to store your receipts electronically, and use a file folder or binder to store your physical tax documents.

Can I import my W-2s and 1099s directly into Turbotax?

+

Yes, Turbotax offers an import feature that allows you to import your W-2s, 1099s, and other tax documents directly into the software. This can save you time and reduce the risk of errors when entering your tax information.

How long should I keep my Turbotax paperwork?

+

It’s recommended to keep your Turbotax paperwork for at least three years in case of an audit or if you need to reference your tax information in the future. You can store your paperwork electronically or physically, depending on your preference.