5 Tips Iowa Bankruptcy

Understanding Bankruptcy in Iowa: A Comprehensive Guide

Bankruptcy is a legal process that allows individuals or businesses to reorganize or eliminate debts under the protection of the federal bankruptcy court. In Iowa, as in other states, bankruptcy laws are governed by federal law, but there are specific rules and exemptions that apply to Iowa residents. If you are considering filing for bankruptcy in Iowa, it is essential to understand the process, the different types of bankruptcy, and how they can affect your financial situation.

Types of Bankruptcy in Iowa

There are several types of bankruptcy that individuals and businesses can file in Iowa, including Chapter 7, Chapter 13, and Chapter 11. Chapter 7 bankruptcy involves the liquidation of non-exempt assets to pay off creditors, while Chapter 13 bankruptcy allows individuals to create a repayment plan to pay off a portion of their debts over time. Chapter 11 bankruptcy is typically used by businesses to restructure their debts. Each type of bankruptcy has its own eligibility requirements, advantages, and disadvantages.

Tip 1: Determine Eligibility for Bankruptcy

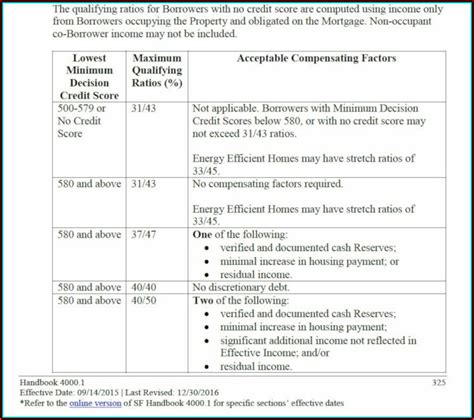

Before filing for bankruptcy in Iowa, it is crucial to determine which type of bankruptcy you are eligible for. For Chapter 7, you must pass the means test, which assesses your income and expenses to ensure you do not have enough disposable income to repay a significant portion of your debts. For Chapter 13, you must have a regular income and your debts must be below certain thresholds. Consulting with a bankruptcy attorney can help you understand which chapter you are eligible for and which would be most beneficial for your financial situation.

Tip 2: Understand Iowa Exemptions

Iowa law allows for certain exemptions that protect specific assets from being sold to pay off creditors in a bankruptcy. These exemptions include portions of your home equity, personal property like household goods and clothing, and tools of your trade. Understanding these exemptions is critical because they can help you keep essential assets while still gaining the benefits of bankruptcy.

Tip 3: Prepare for the Bankruptcy Process

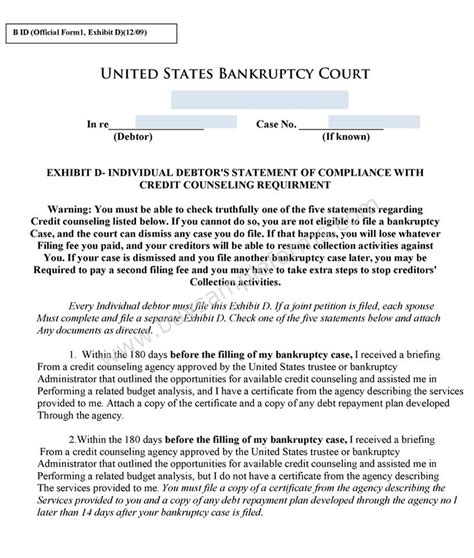

Preparing for bankruptcy involves several steps, including gathering financial documents, attending credit counseling, and filling out bankruptcy forms. It is highly recommended to work with a bankruptcy attorney who can guide you through the process, ensure all paperwork is correctly filled out, and represent you in court if necessary. Additionally, you will need to attend a meeting of creditors where you will be questioned under oath by your creditors and the trustee assigned to your case.

Tip 4: Consider the Alternatives to Bankruptcy

Before deciding to file for bankruptcy, it is essential to consider alternatives such as debt consolidation, debt management plans, or negotiating with creditors directly. These alternatives may offer a way to manage your debt without the long-term impact of a bankruptcy on your credit score. However, for many people, bankruptcy provides the most effective way to deal with overwhelming debt and can offer a fresh start.

Tip 5: Rebuild Your Credit After Bankruptcy

After completing the bankruptcy process, it is crucial to start rebuilding your credit. This can involve obtaining a secured credit card, making on-time payments, and keeping credit utilization low. Over time, with responsible credit habits, you can improve your credit score and regain access to better credit terms. Remember, bankruptcy is not a failure but a legal tool to help individuals and businesses deal with debt and move towards financial stability.

💡 Note: It's essential to consult with a financial advisor or bankruptcy attorney to understand how bankruptcy will affect your specific situation and to discuss the best strategies for rebuilding your credit afterward.

In summary, filing for bankruptcy in Iowa requires careful consideration of the types of bankruptcy, eligibility, exemptions, and the process itself. By understanding these factors and seeking professional advice, individuals can make informed decisions about how to manage their debt and work towards a more stable financial future.

What are the main types of bankruptcy that individuals can file in Iowa?

+

The main types of bankruptcy that individuals can file in Iowa are Chapter 7 and Chapter 13. Chapter 7 involves the liquidation of non-exempt assets to pay off creditors, while Chapter 13 allows individuals to create a repayment plan.

How do Iowa exemptions work in bankruptcy?

+

Iowa exemptions protect certain assets from being sold to pay off creditors. These include portions of your home equity, personal property, and tools of your trade. Understanding these exemptions is crucial to keeping essential assets during bankruptcy.

Can I rebuild my credit after filing for bankruptcy in Iowa?

+

Yes, it is possible to rebuild your credit after filing for bankruptcy. This can involve obtaining a secured credit card, making on-time payments, and keeping credit utilization low. With responsible credit habits, you can improve your credit score over time.