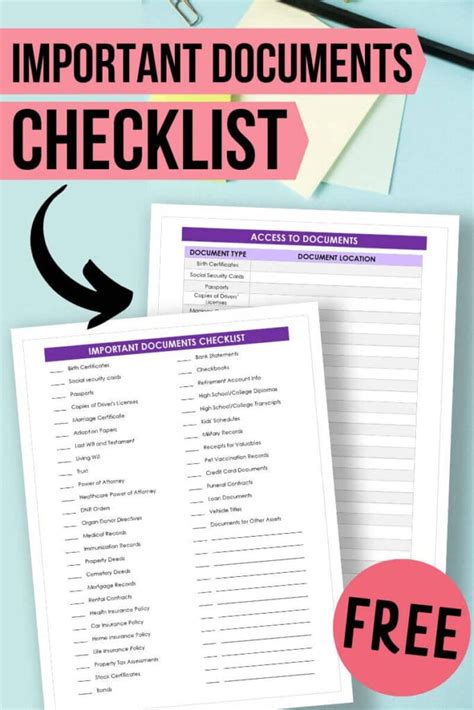

5 Documents Needed

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in place is crucial. These documents not only provide a sense of security but also ensure that your wishes are respected and your loved ones are protected. In this article, we will delve into the 5 essential documents that everyone should have, explaining their importance and how they can impact your life and the lives of those around you.

1. Last Will and Testament

A Last Will and Testament is a legal document that outlines how you want your assets to be distributed after you pass away. It allows you to appoint an executor who will manage your estate, pay off any debts, and distribute your assets according to your wishes. Without a will, the state will decide how your assets are distributed, which may not align with your desires. This document is essential for ensuring that your loved ones are taken care of and that your legacy is preserved.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone you trust the authority to make decisions on your behalf if you become incapacitated. This can include financial decisions, healthcare decisions, or both. Having a POA in place ensures that your affairs are managed according to your wishes, even if you are unable to make decisions for yourself. It’s a critical document for protecting your autonomy and well-being.

3. Living Will or Advance Directive

A Living Will or Advance Directive is a document that outlines your wishes for end-of-life medical care. It specifies the types of treatments you do or do not want to receive if you become terminally ill or are in a vegetative state. This document is essential for ensuring that your healthcare wishes are respected and that you receive the care that aligns with your values and beliefs.

4. Trust

A Trust is a legal arrangement that allows you to transfer assets to a separate entity for the benefit of yourself or others. There are various types of trusts, including revocable and irrevocable trusts, each serving different purposes such as tax planning, asset protection, or providing for minors or pets. Trusts can offer flexibility and control over how your assets are managed and distributed, making them a valuable tool for estate planning.

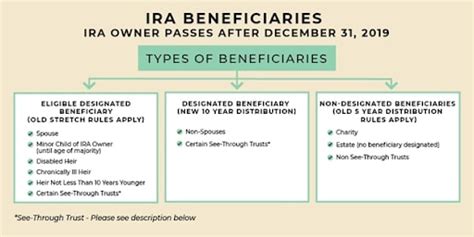

5. Beneficiary Designations

Beneficiary Designations are forms that you fill out to name who will receive certain assets, such as life insurance policies, retirement accounts, or annuities, upon your death. These designations override any instructions in your will, making them crucial for ensuring that these assets pass to the intended beneficiaries. It’s essential to review and update your beneficiary designations regularly, especially after significant life changes such as divorce, marriage, or the birth of children.

📝 Note: Regularly reviewing and updating these documents is as important as creating them. Life changes, legal updates, and personal wishes can necessitate revisions to ensure these documents continue to reflect your current situation and desires.

In summary, having the right documents in place can provide peace of mind, protect your assets, and ensure that your wishes are carried out. Whether it’s distributing your estate, managing your healthcare, or appointing someone to make decisions on your behalf, these 5 essential documents play a critical role in securing your future and the future of your loved ones.

Why is it important to have a Last Will and Testament?

+

Having a Last Will and Testament is important because it allows you to control how your assets are distributed after you pass away, ensuring that your wishes are respected and your loved ones are protected.

What happens if I don’t have a Power of Attorney?

+

If you don’t have a Power of Attorney and become incapacitated, the court may appoint a guardian to make decisions on your behalf, which could lead to decisions that don’t align with your wishes.

Can I change my beneficiary designations at any time?

+

Yes, you can typically change your beneficiary designations at any time, but it’s crucial to follow the specific procedures required by your policy or account administrator to ensure the changes are valid.