IRA Beneficiary Determined By Paperwork

Understanding the Importance of IRA Beneficiary Designations

When it comes to Individual Retirement Accounts (IRAs), one of the most critical aspects that individuals often overlook is the designation of beneficiaries. The beneficiary designation is a crucial component of estate planning, as it determines who will inherit the assets in the IRA upon the account holder’s passing. It is essential to understand that the beneficiary designation supersedes any instructions provided in a will, which means that the assets will be distributed according to the beneficiary designation on file, regardless of any conflicting instructions in the will.

The Consequences of Not Designating a Beneficiary

Failing to designate a beneficiary or not keeping the beneficiary designation up to date can have significant consequences. If an individual passes away without a designated beneficiary, the IRA assets will be distributed according to the default rules of the IRA custodian. This can lead to unintended consequences, such as accelerated income tax liabilities, as the assets may be required to be distributed within a shorter timeframe, potentially resulting in higher taxes. Furthermore, if the IRA assets are not properly designated, they may be subject to probate, which can be a time-consuming and costly process.

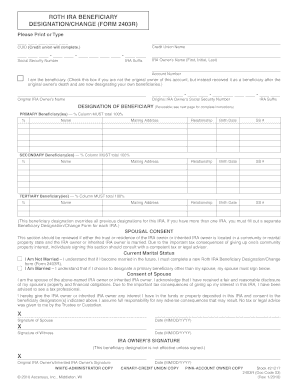

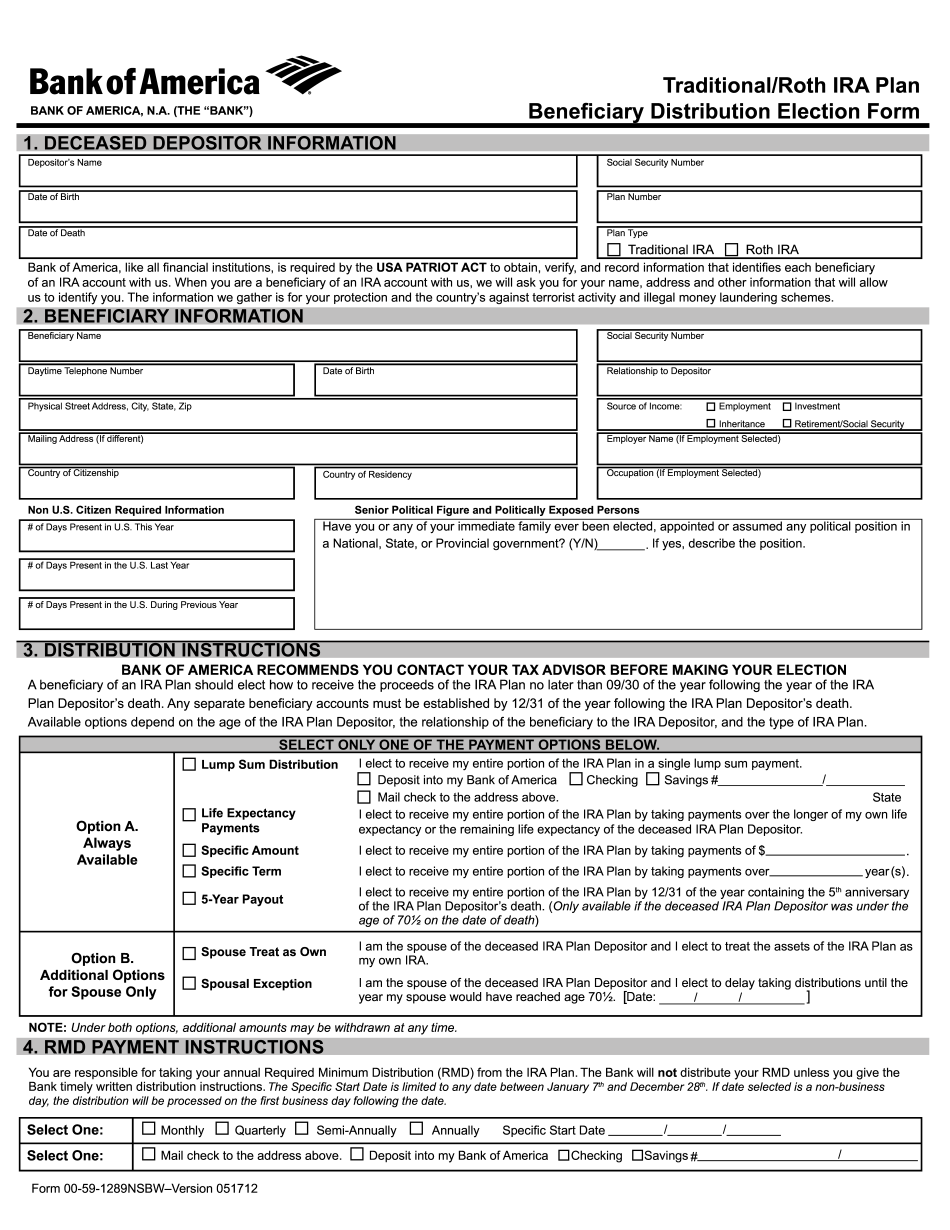

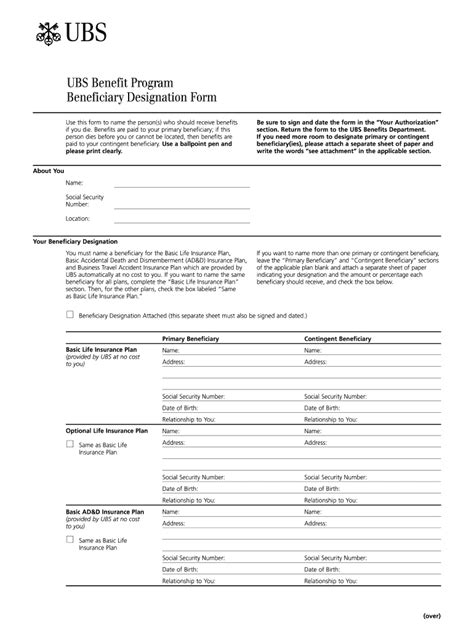

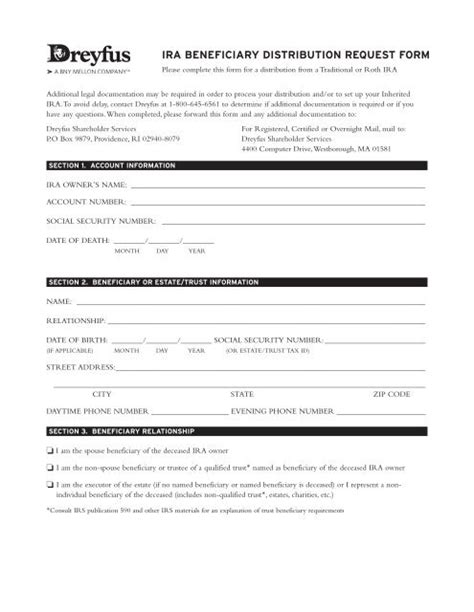

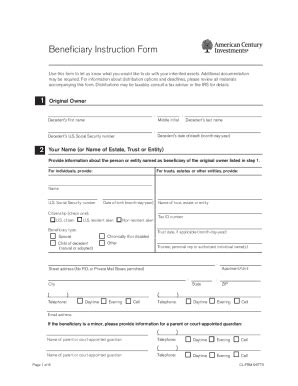

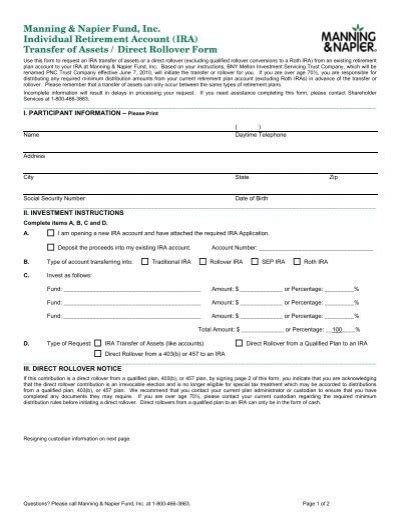

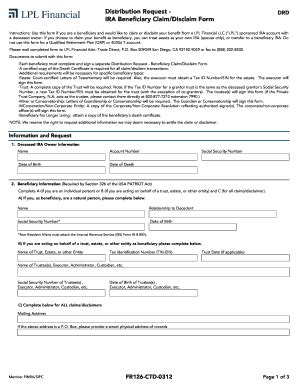

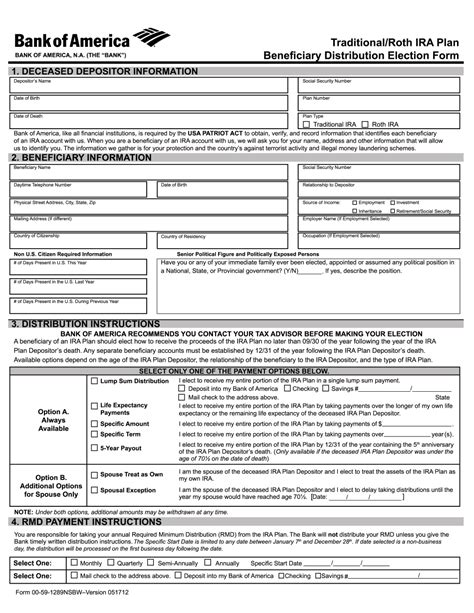

How to Designate a Beneficiary

Designating a beneficiary for an IRA is a relatively straightforward process. Typically, the IRA custodian will provide a beneficiary designation form that must be completed and returned to the custodian. The form will require the account holder to provide the name, address, and social security number of the designated beneficiary. It is essential to keep the beneficiary designation up to date, as changes in personal circumstances, such as divorce or the birth of a child, may require updates to the beneficiary designation.

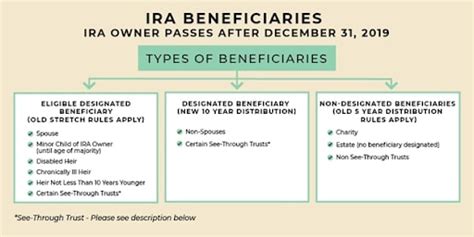

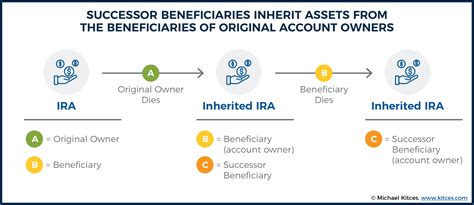

Types of Beneficiaries

There are several types of beneficiaries that can be designated for an IRA, including: * Individual beneficiaries: This can include spouses, children, or other individuals. * Charitable beneficiaries: This can include non-profit organizations or charities. * Trust beneficiaries: This can include trusts established for the benefit of minor children or other individuals. * Estate beneficiaries: This can include the estate of the deceased individual, which can lead to probate and potential tax liabilities.

Beneficiary Designation Best Practices

To ensure that the IRA assets are distributed according to the account holder’s wishes, it is essential to follow best practices when designating beneficiaries. Some key considerations include: * Review and update the beneficiary designation regularly to ensure that it remains accurate and up to date. * Consider naming contingent beneficiaries in the event that the primary beneficiary predeceases the account holder. * Use specific language when designating beneficiaries, such as “my spouse, John Doe,” rather than “my spouse.” * Keep a copy of the beneficiary designation form for records and to ensure that the designation is accurate.

Common Mistakes to Avoid

When designating beneficiaries for an IRA, there are several common mistakes to avoid, including: * Failing to designate a beneficiary or not keeping the designation up to date. * Naming the estate as the beneficiary, which can lead to probate and potential tax liabilities. * Not considering the tax implications of the beneficiary designation, such as the potential for accelerated income tax liabilities. * Not reviewing and updating the beneficiary designation regularly to ensure that it remains accurate and up to date.

📝 Note: It is essential to review and update the beneficiary designation regularly to ensure that it remains accurate and up to date, and to avoid any potential consequences or disputes.

Conclusion and Next Steps

In conclusion, designating a beneficiary for an IRA is a critical aspect of estate planning that should not be overlooked. By understanding the importance of beneficiary designations, following best practices, and avoiding common mistakes, individuals can ensure that their IRA assets are distributed according to their wishes. It is essential to review and update the beneficiary designation regularly to ensure that it remains accurate and up to date. By taking the time to properly designate beneficiaries, individuals can help ensure a smooth and efficient transfer of their IRA assets, and avoid any potential consequences or disputes.

What happens if I don’t designate a beneficiary for my IRA?

+

If you don’t designate a beneficiary for your IRA, the assets will be distributed according to the default rules of the IRA custodian. This can lead to unintended consequences, such as accelerated income tax liabilities, and may result in the assets being subject to probate.

Can I change my beneficiary designation at any time?

+

Yes, you can change your beneficiary designation at any time by completing a new beneficiary designation form and submitting it to the IRA custodian. It is essential to keep the beneficiary designation up to date to ensure that it remains accurate and reflects your current wishes.

What is the difference between a primary and contingent beneficiary?

+

A primary beneficiary is the individual or entity that will inherit the IRA assets upon the account holder’s passing. A contingent beneficiary is the individual or entity that will inherit the IRA assets if the primary beneficiary predeceases the account holder. It is essential to consider naming contingent beneficiaries to ensure that the IRA assets are distributed according to your wishes, even if the primary beneficiary is no longer alive.