Paperwork

Mortgage Refinance Tax Filing Paperwork Needed

Introduction to Mortgage Refinance Tax Filing

When considering a mortgage refinance, it’s essential to understand the tax implications and the necessary paperwork involved. Refinancing a mortgage can have significant effects on your tax filing, and being prepared with the right documents can make the process smoother. In this article, we will explore the mortgage refinance tax filing paperwork needed and provide guidance on how to navigate this complex process.

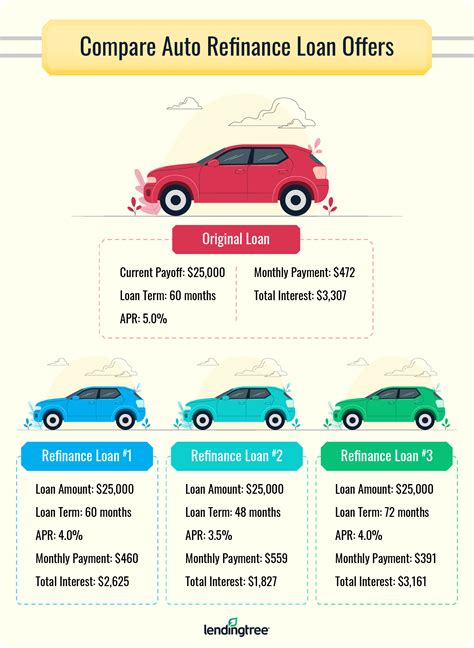

Understanding Mortgage Refinance Tax Implications

Before diving into the paperwork, it’s crucial to understand the tax implications of refinancing a mortgage. When you refinance, you may be able to deduct the interest paid on your mortgage, which can result in significant tax savings. However, there are specific rules and limitations to be aware of, such as the deduction limit on mortgage interest and the potential impact on your taxable income. It’s essential to consult with a tax professional to ensure you understand the tax implications of your specific situation.

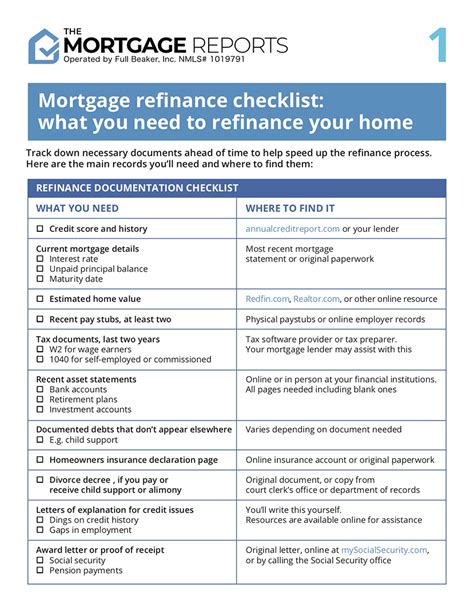

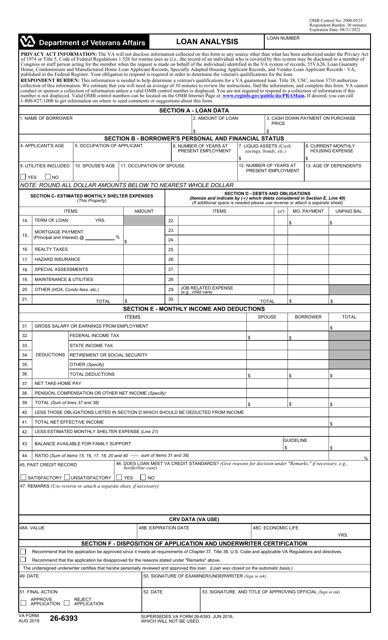

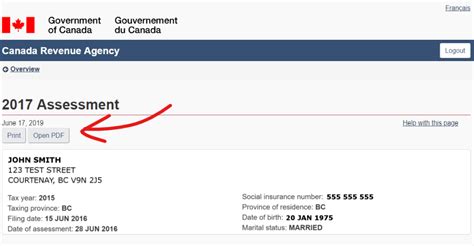

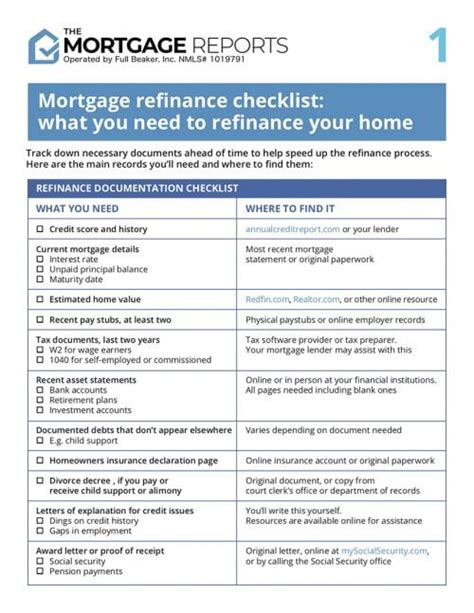

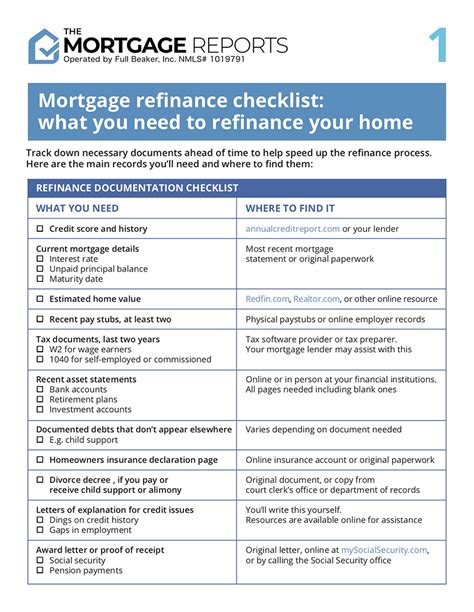

Necessary Paperwork for Mortgage Refinance Tax Filing

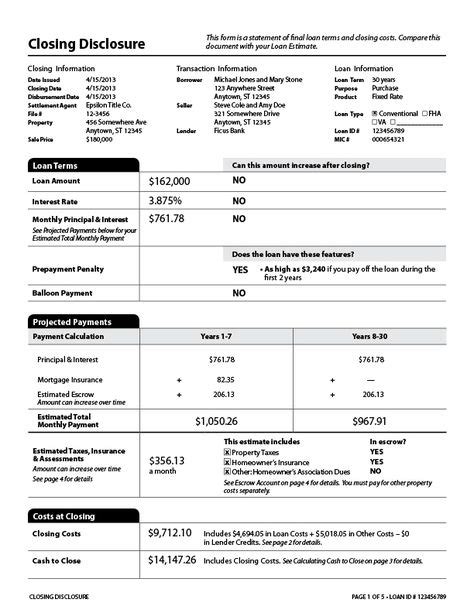

To prepare for tax filing, you will need to gather the following documents: * Form 1098: This form, also known as the Mortgage Interest Statement, will be provided by your lender and will show the amount of interest paid on your mortgage during the tax year. * Form 1099-INT: If you paid points on your refinance, you may receive this form, which will report the interest income earned on your escrow account. * Refinance closing statement: This document will outline the terms of your refinance, including the loan amount, interest rate, and closing costs. * Loan estimate and closing disclosure: These documents will provide a detailed breakdown of your loan terms and costs. * Property tax statement: If you pay property taxes through an escrow account, you will need to provide a statement showing the amount of taxes paid.

Additional Documents for Itemized Deductions

If you plan to itemize your deductions, you may need to provide additional documents, such as: * Receipts for home improvements: If you made home improvements, such as installing new windows or doors, you may be able to deduct these expenses. * Records of energy-efficient upgrades: If you made energy-efficient upgrades, such as installing solar panels or a new heating system, you may be eligible for tax credits. * Documentation of property tax payments: If you pay property taxes directly, you will need to provide documentation of these payments.

Table of Tax-Related Documents

The following table summarizes the tax-related documents you may need for your mortgage refinance tax filing:

| Document | Description |

|---|---|

| Form 1098 | Mortgage Interest Statement |

| Form 1099-INT | Interest Income Statement |

| Refinance closing statement | Outlines loan terms and closing costs |

| Loan estimate and closing disclosure | Provides detailed breakdown of loan terms and costs |

| Property tax statement | Shows amount of property taxes paid |

📝 Note: It's essential to keep accurate records and documentation to ensure you can take advantage of all eligible tax deductions and credits.

Conclusion and Final Thoughts

In conclusion, mortgage refinance tax filing requires careful attention to detail and the right paperwork. By understanding the tax implications and gathering the necessary documents, you can ensure a smooth tax filing process and potentially save thousands of dollars in taxes. Remember to consult with a tax professional to ensure you are taking advantage of all eligible deductions and credits.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return is typically April 15th of each year, but it’s essential to check with the IRS or a tax professional for specific deadlines and extensions.

Can I deduct my mortgage interest on my tax return?

+

Yes, you can deduct your mortgage interest on your tax return, but there are specific rules and limitations. Consult with a tax professional to ensure you understand the rules and can take advantage of this deduction.

What documents do I need to provide to my tax professional?

+

You will need to provide your tax professional with documents such as your Form 1098, refinance closing statement, loan estimate, and closing disclosure, as well as any other relevant tax-related documents.