5 Steps to Buy House

Introduction to Buying a House

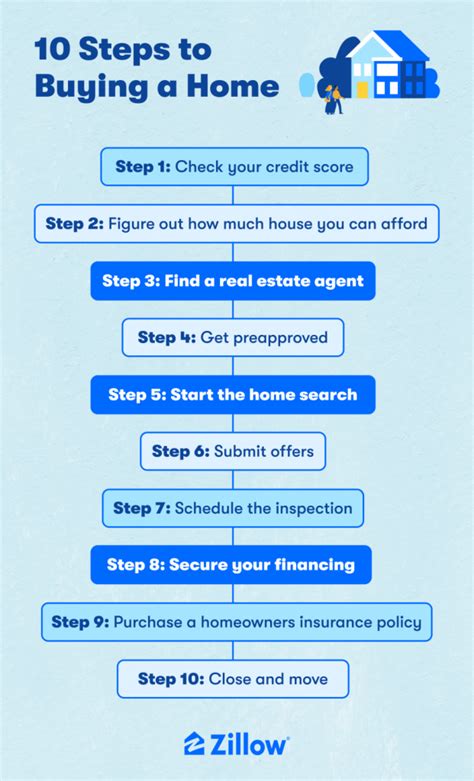

Buying a house can be a daunting task, especially for first-time buyers. The process involves several steps, from determining your budget to closing the deal. It is essential to understand each step to ensure a smooth and successful transaction. In this article, we will guide you through the 5 key steps to buy a house, providing you with valuable insights and tips to make informed decisions.

Step 1: Determine Your Budget

Before starting your house hunt, it is crucial to determine how much you can afford to spend. Calculate your income, expenses, debts, and savings to get an idea of your financial situation. Consider factors such as: * Your credit score and history * The amount you can borrow from a lender * Your down payment and closing costs * Ongoing expenses like mortgage payments, property taxes, and insurance Create a budget that accounts for all these factors to avoid financial strain in the future.

Step 2: Get Pre-Approved for a Mortgage

Once you have a clear understanding of your budget, the next step is to get pre-approved for a mortgage. This involves: * Researching and comparing mortgage rates and terms from different lenders * Gathering required documents, such as pay stubs, bank statements, and tax returns * Submitting your application and waiting for approval A pre-approval letter will give you an idea of how much you can borrow and will also make you a more attractive buyer to sellers.

Step 3: Find Your Dream Home

With your budget and pre-approval in place, it’s time to start looking for your dream home. Consider factors such as: * Location: proximity to work, schools, public transportation, and amenities * Type of property: single-family home, condo, or townhouse * Size and layout: number of bedrooms and bathrooms, square footage, and yard space * Condition and age: new construction, fixer-upper, or move-in ready * Amenities: pool, gym, parking, and community features Make a list of your priorities and start searching for homes that fit your criteria.

Step 4: Make an Offer and Inspect the Property

When you find a home you love, it’s time to make an offer. This typically involves: * Working with a real estate agent to determine a fair market price * Submitting an offer letter that includes the price, contingencies, and closing date * Negotiating with the seller to reach a mutually acceptable agreement Once your offer is accepted, hire a professional inspector to examine the property for any potential issues or defects. This will give you peace of mind and help you avoid costly surprises down the road.

Step 5: Close the Deal

The final step is to close the deal and make the home yours. This involves: * Reviewing and signing the sales contract and other documents * Transferring the funds and completing the payment * Receiving the keys and taking possession of the property * Updating the property records and notifying the relevant authorities It’s essential to stay organized and keep track of the closing process to ensure a smooth transition.

🏠 Note: Be prepared for unexpected delays or issues that may arise during the closing process. Stay calm, and work with your agent and lender to resolve any problems that may arise.

As you complete these 5 steps, you’ll be well on your way to becoming a homeowner. Remember to stay patient, persistent, and informed throughout the process. With the right guidance and support, you can find your dream home and make it a reality.

The journey to homeownership can be complex, but with a clear understanding of the steps involved, you can navigate the process with confidence. By following these 5 steps and staying focused on your goals, you’ll be enjoying your new home in no time.

What is the first step in buying a house?

+

The first step in buying a house is to determine your budget. This involves calculating your income, expenses, debts, and savings to get an idea of your financial situation.

Why is it important to get pre-approved for a mortgage?

+

Getting pre-approved for a mortgage gives you an idea of how much you can borrow and makes you a more attractive buyer to sellers. It also helps you to narrow down your search to homes that fit within your budget.

What should I consider when making an offer on a house?

+

When making an offer on a house, consider factors such as the fair market price, contingencies, and closing date. It’s also essential to work with a real estate agent to determine a fair price and negotiate with the seller.