Paperwork

Owner's Policy Paperwork Explanation

Introduction to Owner’s Policy Paperwork

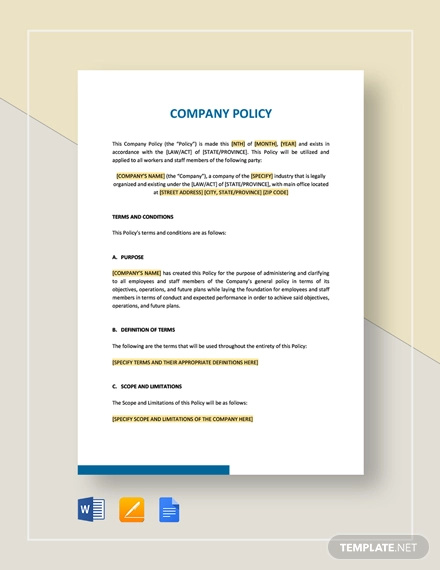

When purchasing a property, one of the most crucial documents you’ll encounter is the owner’s policy paperwork. This document is a type of title insurance policy that protects the homeowner’s equity in the property. In this explanation, we will delve into the details of owner’s policy paperwork, exploring its significance, components, and the process of obtaining it.

Understanding the Purpose of Owner’s Policy

The primary purpose of an owner’s policy is to protect the homeowner from potential title defects that may arise after the purchase of the property. These defects can include undisclosed heirs, forged documents, or unpaid liens on the property. The policy provides financial protection to the homeowner in case any of these issues come to light, ensuring that their investment is safeguarded.

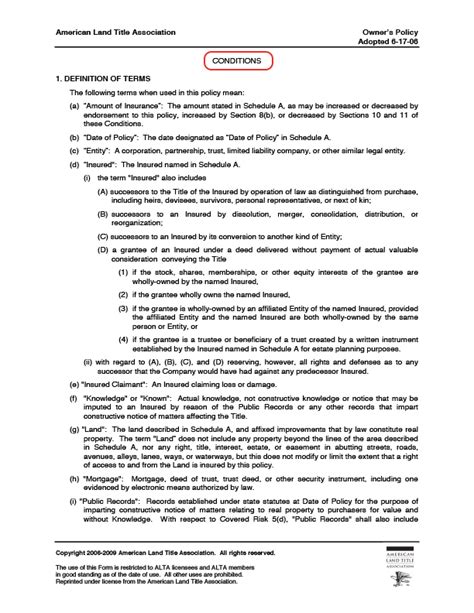

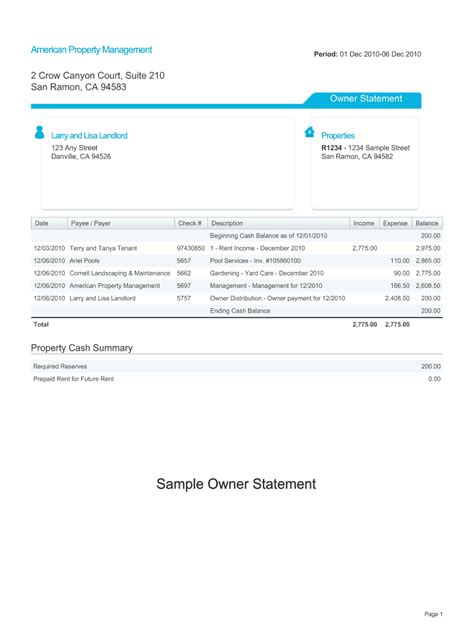

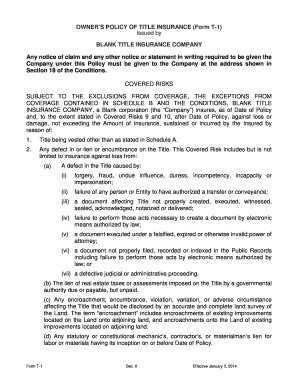

Components of Owner’s Policy Paperwork

The owner’s policy paperwork typically includes several key components: * Policy number and date: Unique identifiers for the policy * Property description: A detailed description of the property, including its location and boundaries * Policy amount: The amount of coverage provided by the policy, usually equal to the purchase price of the property * Insured party: The name of the homeowner or entity being insured * Exceptions and exclusions: A list of items not covered by the policy, such as certain types of liens or defects

The Process of Obtaining Owner’s Policy Paperwork

The process of obtaining owner’s policy paperwork typically involves the following steps: * Application submission: The homeowner or their representative submits an application for the policy * Title search: A thorough search of public records to identify any potential title defects * Policy issuance: The title insurance company issues the policy, which is then reviewed and signed by the homeowner * Payment of premium: The homeowner pays the premium for the policy, which is usually a one-time payment

📝 Note: It's essential to carefully review the policy paperwork to ensure that all information is accurate and complete.

Benefits of Owner’s Policy Paperwork

The benefits of owner’s policy paperwork are numerous: * Protection from financial loss: The policy provides financial protection to the homeowner in case of title defects * Peace of mind: The policy gives homeowners confidence in their investment, knowing that they are protected from potential title issues * Increased property value: A clear title can increase the value of the property, making it more attractive to potential buyers

Common Mistakes to Avoid

When dealing with owner’s policy paperwork, there are several common mistakes to avoid: * Failing to review the policy carefully: Homeowners should carefully review the policy to ensure that all information is accurate and complete * Not understanding the exceptions and exclusions: Homeowners should carefully review the exceptions and exclusions listed in the policy to understand what is not covered * Not paying the premium on time: Homeowners should ensure that they pay the premium on time to avoid lapses in coverage

Conclusion and Final Thoughts

In conclusion, owner’s policy paperwork is a crucial document that provides financial protection to homeowners from potential title defects. By understanding the purpose, components, and process of obtaining owner’s policy paperwork, homeowners can ensure that their investment is safeguarded. It’s essential to carefully review the policy and avoid common mistakes to ensure that the policy provides the desired level of protection.

What is the purpose of owner’s policy paperwork?

+

The purpose of owner’s policy paperwork is to protect the homeowner from potential title defects that may arise after the purchase of the property.

What are the components of owner’s policy paperwork?

+

The components of owner’s policy paperwork typically include the policy number and date, property description, policy amount, insured party, and exceptions and exclusions.

How do I obtain owner’s policy paperwork?

+

To obtain owner’s policy paperwork, you typically need to submit an application, undergo a title search, and pay the premium for the policy.