Rocket Mortgage Skips Paperwork

Introduction to Rocket Mortgage

Rocket Mortgage is a leading online mortgage lender that has revolutionized the way people apply for and manage their mortgages. By leveraging technology and streamlining the process, Rocket Mortgage has made it easier and faster for individuals to secure financing for their homes. One of the key features that sets Rocket Mortgage apart from traditional lenders is its ability to skip paperwork, making the entire process more efficient and convenient for borrowers.

How Rocket Mortgage Skips Paperwork

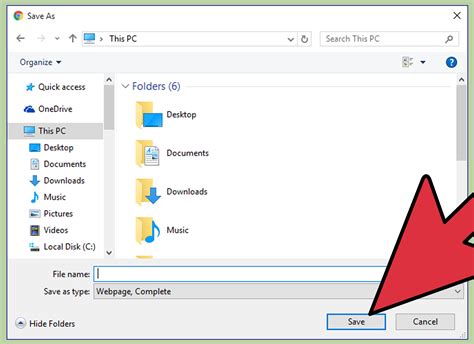

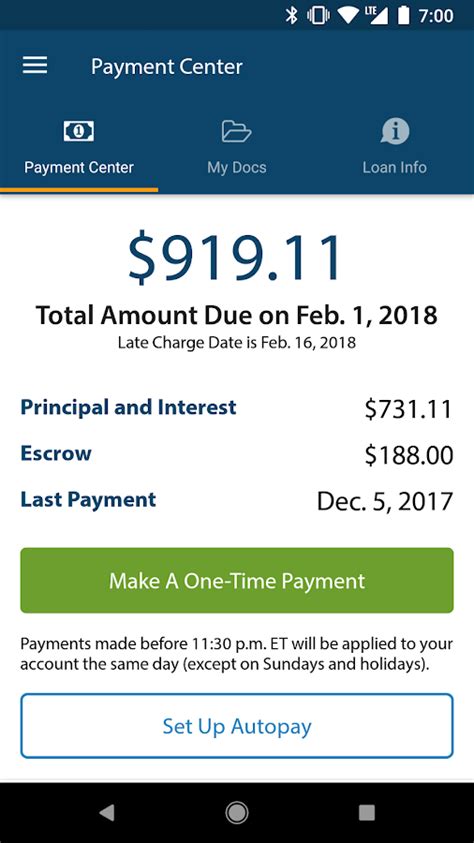

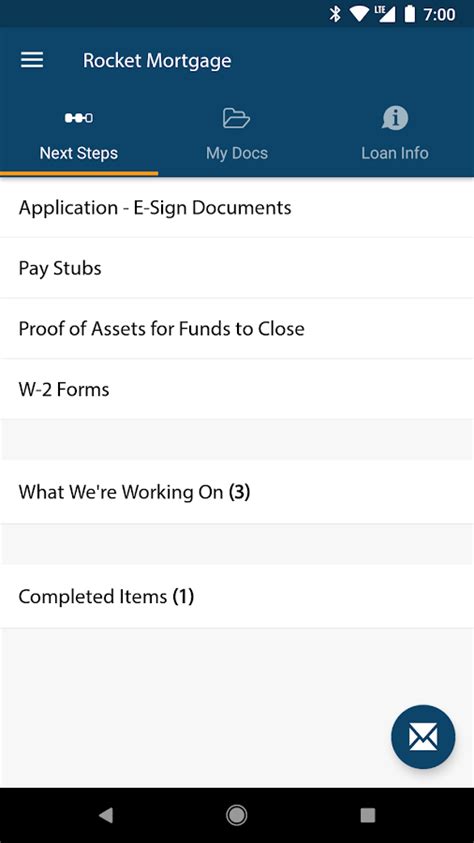

So, how does Rocket Mortgage manage to skip the paperwork that is typically associated with mortgage applications? The answer lies in its use of advanced technology and digital platforms. By using online portals and mobile apps, borrowers can upload required documents, such as pay stubs and bank statements, and access their loan information from anywhere. This not only reduces the need for physical paperwork but also enables borrowers to track the progress of their application in real-time. Rocket Mortgage’s digital platform is designed to be user-friendly, making it easy for borrowers to navigate the application process and avoid the hassle of paperwork.

Benefits of Skipping Paperwork

There are several benefits to skipping paperwork when applying for a mortgage. For one, it saves time and reduces the risk of errors or lost documents. With Rocket Mortgage, borrowers can upload their documents electronically, which are then verified and reviewed by the lender’s team. This process is not only faster but also more secure, as sensitive information is protected by advanced encryption and security measures. Additionally, skipping paperwork reduces the environmental impact of the mortgage application process, making it a more sustainable option for borrowers who are concerned about their carbon footprint.

Key Features of Rocket Mortgage

Some of the key features that make Rocket Mortgage an attractive option for borrowers include: * Online application process: Borrowers can apply for a mortgage from the comfort of their own homes, using their computer or mobile device. * Digital document upload: Borrowers can upload required documents electronically, reducing the need for physical paperwork. * Real-time updates: Borrowers can track the progress of their application in real-time, using the Rocket Mortgage online portal or mobile app. * Customized loan options: Rocket Mortgage offers a range of loan options, including fixed-rate and adjustable-rate mortgages, to suit different borrower needs and preferences.

Eligibility Criteria

To be eligible for a Rocket Mortgage, borrowers must meet certain criteria, including: * Good credit score: Borrowers must have a good credit score to qualify for a Rocket Mortgage. * Stable income: Borrowers must have a stable income to demonstrate their ability to repay the loan. * Low debt-to-income ratio: Borrowers must have a low debt-to-income ratio to qualify for a Rocket Mortgage. * Property type: Rocket Mortgage offers financing for a range of property types, including single-family homes, condos, and townhouses.

| Loan Type | Interest Rate | Loan Term |

|---|---|---|

| Fixed-Rate Mortgage | 3.5% | 30 years |

| Adjustable-Rate Mortgage | 3.0% | 5/1 ARM |

📝 Note: The interest rates and loan terms listed in the table are for illustration purposes only and may vary depending on the borrower's credit score, income, and other factors.

Application Process

The application process for a Rocket Mortgage is straightforward and can be completed online or through the mobile app. Here are the steps to follow: * Pre-approval: Borrowers can get pre-approved for a mortgage by providing basic information, such as income and credit score. * Application submission: Borrowers can submit their application, including required documents, through the online portal or mobile app. * Review and verification: The lender’s team will review and verify the borrower’s information, including credit score and income. * Loan approval: If the borrower is approved, they will receive a loan offer, including the interest rate and loan terms.

Mortgage Options

Rocket Mortgage offers a range of mortgage options to suit different borrower needs and preferences. Some of the options include: * Fixed-rate mortgages: These mortgages have a fixed interest rate for the entire loan term, providing predictable monthly payments. * Adjustable-rate mortgages: These mortgages have an adjustable interest rate, which may change over time, affecting monthly payments. * Government-backed loans: These loans are insured by government agencies, such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). * Jumbo loans: These loans are for larger loan amounts, typically above $510,400, and may have different interest rates and terms.

In summary, Rocket Mortgage has revolutionized the mortgage application process by skipping paperwork and leveraging technology to make it faster, easier, and more convenient for borrowers. With its online application process, digital document upload, and real-time updates, Rocket Mortgage is an attractive option for borrowers who want to secure financing for their homes without the hassle of paperwork.

What is Rocket Mortgage?

+

Rocket Mortgage is a leading online mortgage lender that offers a range of loan options, including fixed-rate and adjustable-rate mortgages, to suit different borrower needs and preferences.

How does Rocket Mortgage skip paperwork?

+

Rocket Mortgage skips paperwork by using advanced technology and digital platforms, enabling borrowers to upload required documents electronically and access their loan information from anywhere.

What are the benefits of skipping paperwork?

+

The benefits of skipping paperwork include saving time, reducing the risk of errors or lost documents, and minimizing the environmental impact of the mortgage application process.