Get BMO Tax Paperwork Easily

Introduction to BMO Tax Paperwork

Managing tax paperwork can be a daunting task, especially when dealing with financial institutions. For individuals and businesses banking with BMO (Bank of Montreal), accessing and understanding tax-related documents is crucial for compliance with tax regulations and for taking advantage of eligible deductions. This guide aims to simplify the process of obtaining and navigating BMO tax paperwork, ensuring that users can easily find and manage the necessary documents for their tax needs.

Understanding BMO Tax Documents

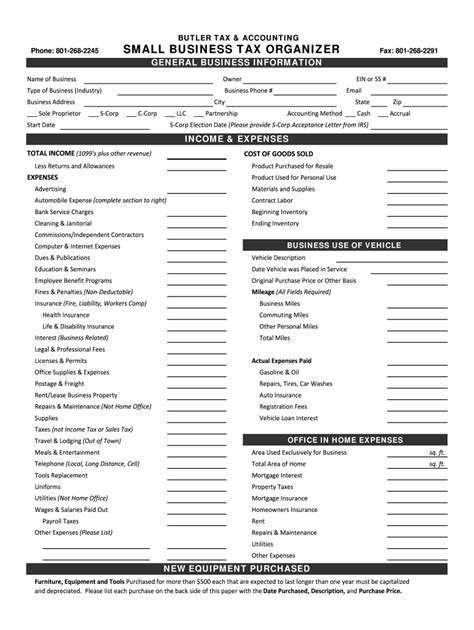

BMO provides various tax documents to its customers, reflecting the different types of accounts and financial activities. These documents are designed to help individuals and businesses report their income and claim deductions accurately. The most common tax documents issued by BMO include: - T4RSP/RRSP Receipts: For contributions made to Registered Retirement Savings Plans (RRSPs) or Registered Retirement Income Funds (RRIFs). - T5 Statement of Investment Income: Reports investment income such as interest, dividends, and capital gains from investments in non-registered accounts. - T4RIF Statement of Registered Retirement Income Fund (RRIF) Income: For individuals receiving income from a RRIF. - NR4 Statement of Amounts Paid or Credited to Non-Residents of Canada: Pertains to income paid to non-residents of Canada.

Accessing BMO Tax Paperwork

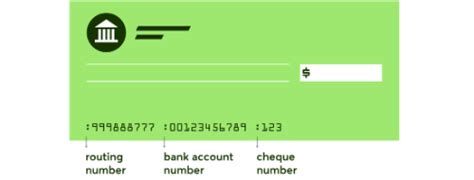

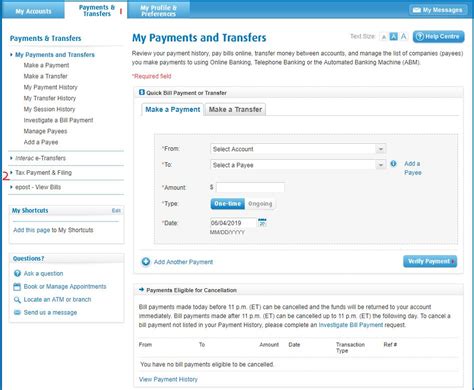

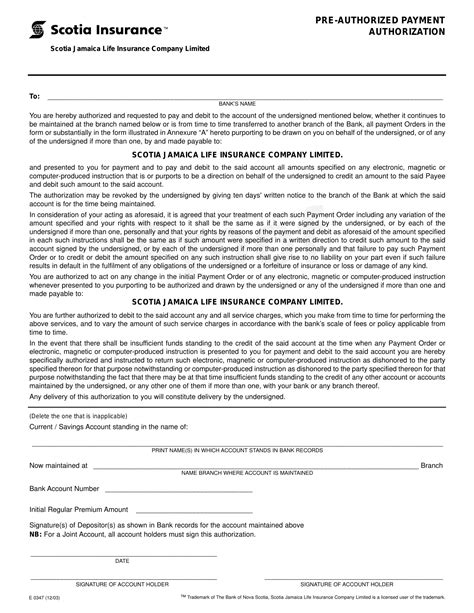

BMO offers convenient ways to access tax documents, catering to different user preferences: - Online Banking: Through BMO Online Banking, users can securely view and download their tax documents once they are available. This method is environmentally friendly and allows for easy storage and retrieval of documents. - Mobile Banking App: The BMO Mobile Banking App provides another convenient avenue for accessing tax documents on-the-go. - Mail: For those who prefer traditional methods or require physical copies for their records, BMO also sends tax documents by mail to the address on file.

Managing Your BMO Tax Paperwork

Effective management of tax paperwork involves organization, understanding, and timely action. Here are some steps to help manage BMO tax documents: - Verify Information: Ensure all personal and account information on the tax documents is accurate. - Save Digitally: Consider saving digital copies of your tax documents in a secure, easily accessible location. - Consult a Tax Professional: If unsure about how to report income or claim deductions, consulting a tax professional can provide clarity and ensure compliance with tax laws.

Important Dates for BMO Tax Paperwork

Being aware of the timelines for receiving and submitting tax documents is crucial for meeting tax deadlines: - Issuance of Tax Documents: BMO typically issues tax documents by the end of February each year. - Tax Filing Deadline: The deadline for filing personal taxes in Canada is usually April 30th, but this can vary for businesses and in special circumstances.

📝 Note: It's essential to check the BMO website or consult with a banking representative for the most current information on tax document issuance and any specific deadlines that may apply to your situation.

Security and Privacy of BMO Tax Paperwork

BMO prioritizes the security and privacy of customer information, including tax documents. When accessing tax paperwork online or through the mobile app, users are protected by robust security measures, including encryption and two-factor authentication. It’s also important for customers to take personal responsibility for protecting their information by using strong passwords, keeping software up-to-date, and being cautious of phishing attempts.

Conclusion and Next Steps

Obtaining and managing BMO tax paperwork is a straightforward process thanks to the bank’s digital platforms and customer support. By understanding the types of tax documents available, how to access them, and the importance of managing this paperwork effectively, individuals and businesses can ensure they are well-prepared for tax season. Whether you’re a seasoned taxpayer or new to managing financial documents, BMO’s resources and the tips outlined here can help navigate the process with ease.

What is the deadline for receiving BMO tax documents?

+

BMO typically issues tax documents by the end of February each year. However, it’s always a good idea to check your online banking or contact BMO directly for the most accurate and up-to-date information.

How can I access my BMO tax documents online?

+

You can access your BMO tax documents through BMO Online Banking or the BMO Mobile Banking App. Simply log in to your account, navigate to the section for tax documents, and you will be able to view and download your documents.

What should I do if I notice an error on my BMO tax document?

+

If you identify an error on your tax document, it’s crucial to contact BMO as soon as possible. They will guide you through the process of correcting the error and issuing a revised document if necessary.