Filling Total Loss Paperwork

Understanding Total Loss Paperwork

When a vehicle is involved in an accident and the damage is extensive, the insurance company may declare it a total loss. This means that the cost of repairing the vehicle exceeds its actual cash value (ACV). In such cases, the vehicle owner needs to fill out total loss paperwork to process the claim and receive a settlement. It is essential to understand the total loss paperwork process to ensure a smooth and efficient claims experience.

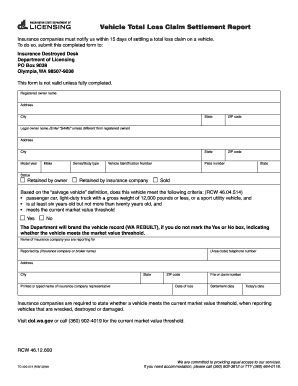

What is Total Loss Paperwork?

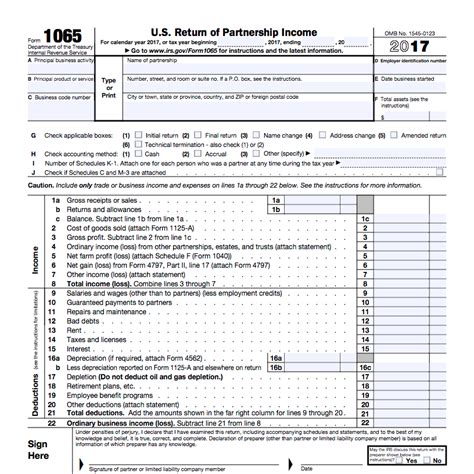

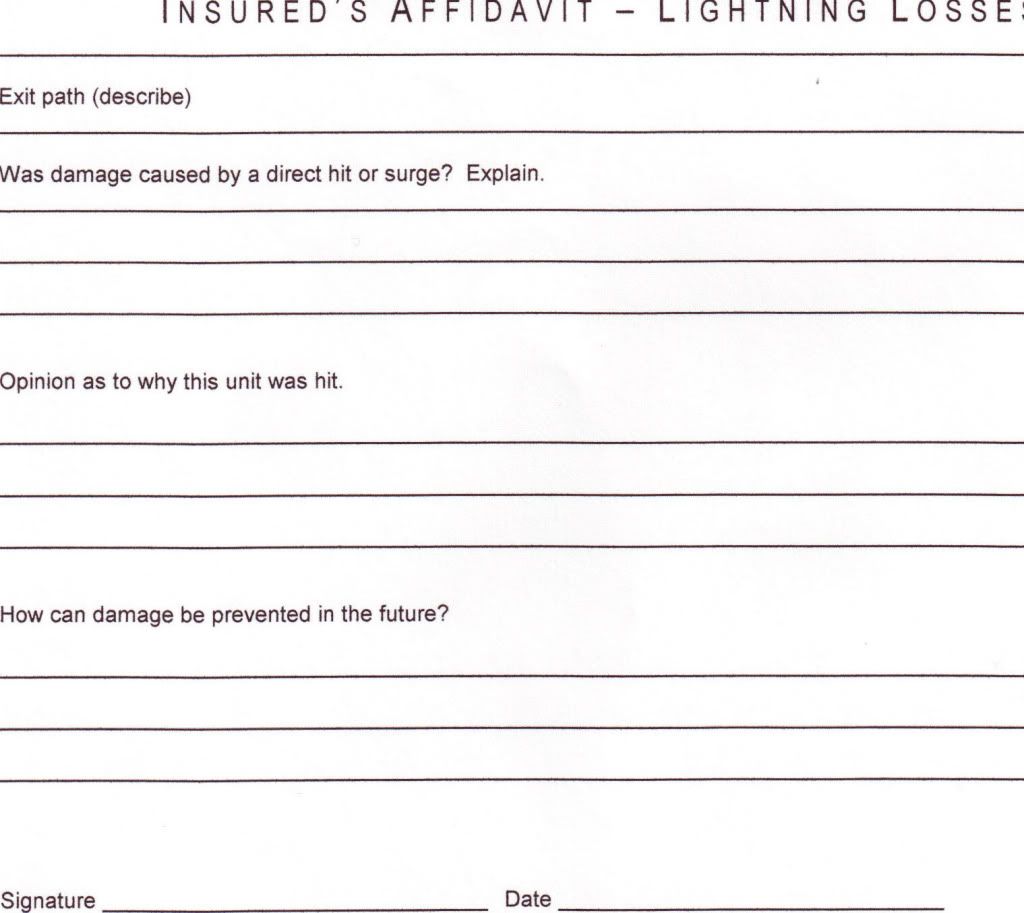

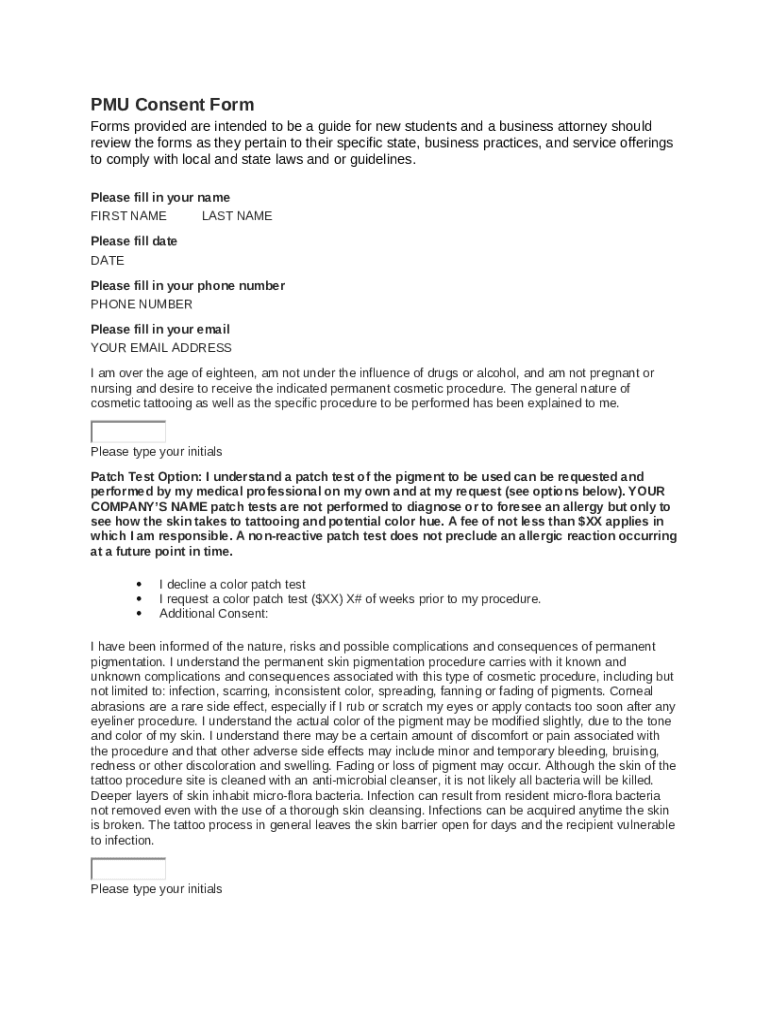

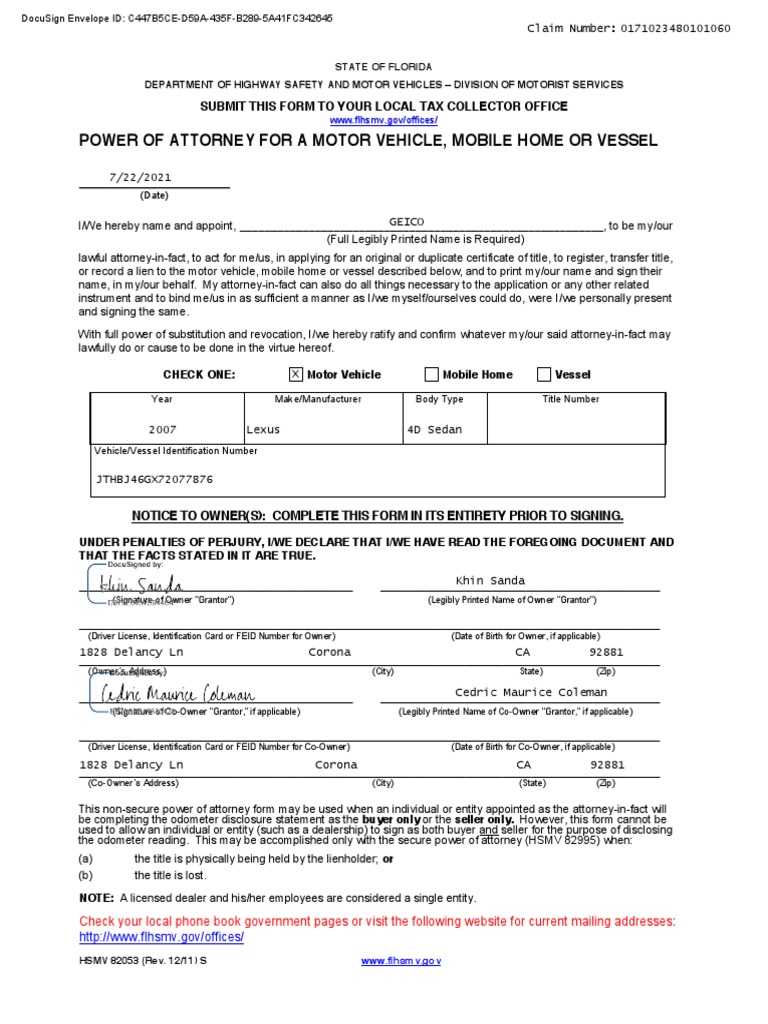

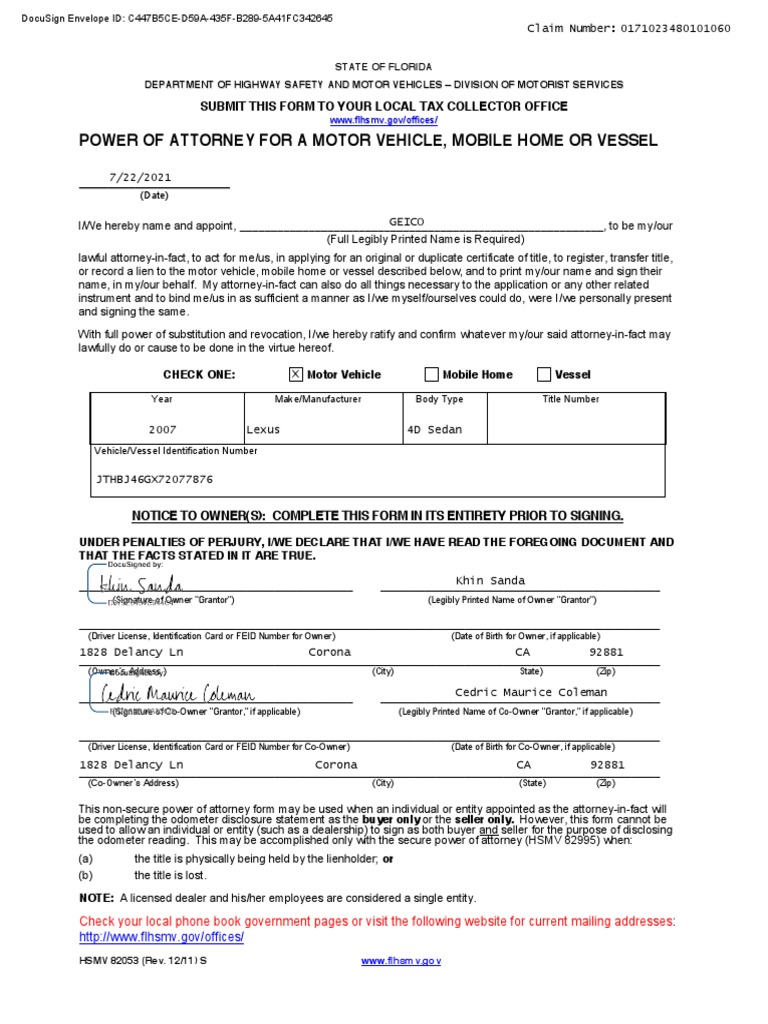

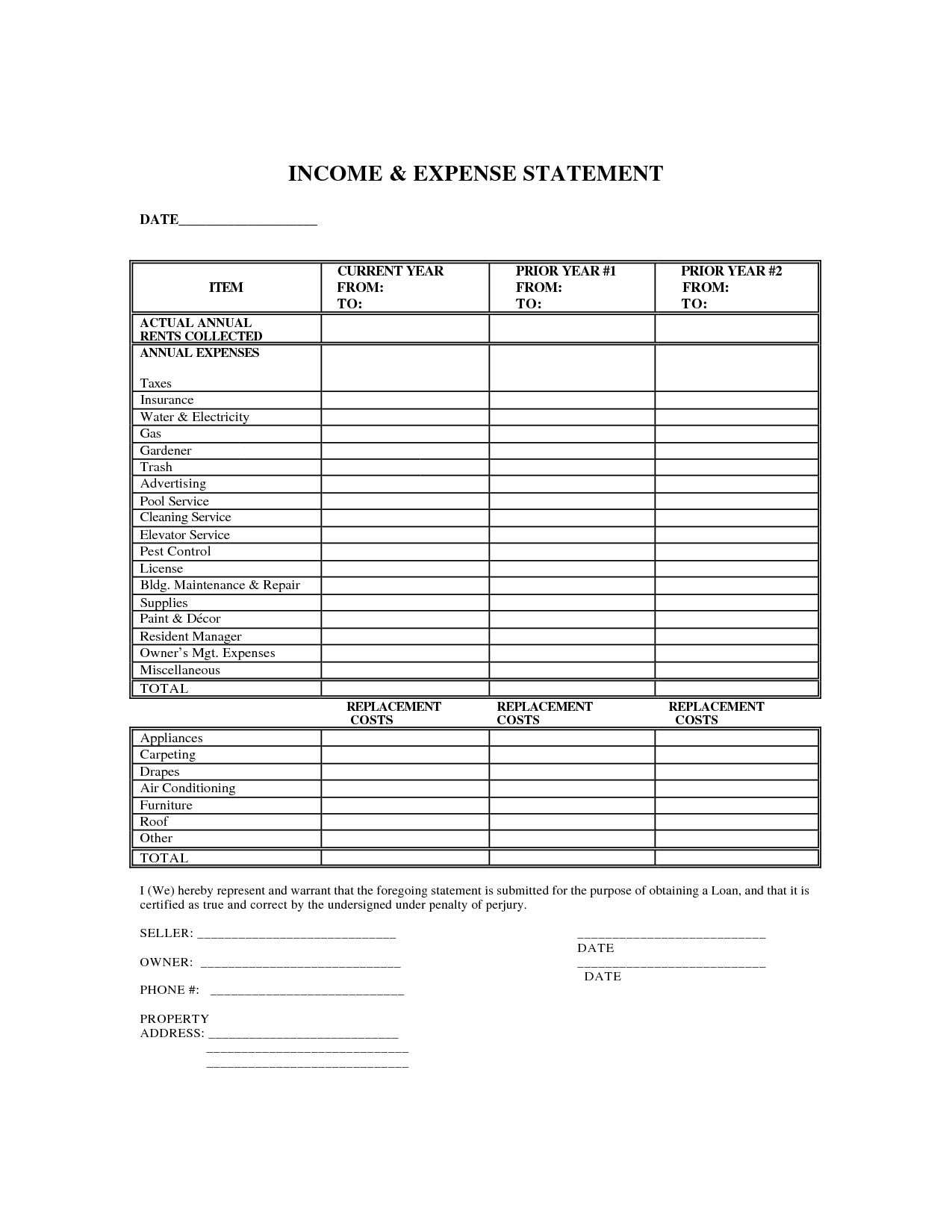

Total loss paperwork refers to the documentation required to process a total loss claim. This includes various forms, reports, and supporting documents that provide detailed information about the vehicle, the accident, and the extent of the damage. The paperwork typically involves: * A detailed description of the vehicle, including its make, model, year, and Vehicle Identification Number (VIN) * A report of the accident, including the date, time, location, and a description of what happened * Estimates of the damage, including the cost of repairs and the vehicle’s ACV * Supporting documents, such as police reports, witness statements, and photographs of the damage

Steps to Fill Out Total Loss Paperwork

Filling out total loss paperwork can be a complex and time-consuming process. Here are the steps to follow: * Review the paperwork carefully: Take the time to read and understand each form and report, and ask questions if you are unsure about anything. * Gather all necessary documents: Make sure you have all the required documents, including the vehicle’s title, registration, and any supporting documents related to the accident. * Fill out the forms accurately: Provide detailed and accurate information, and avoid leaving any fields blank. * Submit the paperwork promptly: Submit the completed paperwork to the insurance company as soon as possible to avoid delays in processing the claim. Some key points to keep in mind when filling out total loss paperwork include: * Be thorough and detailed: Provide as much information as possible to support your claim. * Keep a record of everything: Make copies of all documents and keep a record of all correspondence with the insurance company. * Seek professional help if needed: If you are unsure about any aspect of the process, consider seeking the help of a professional, such as a public adjuster or an attorney.

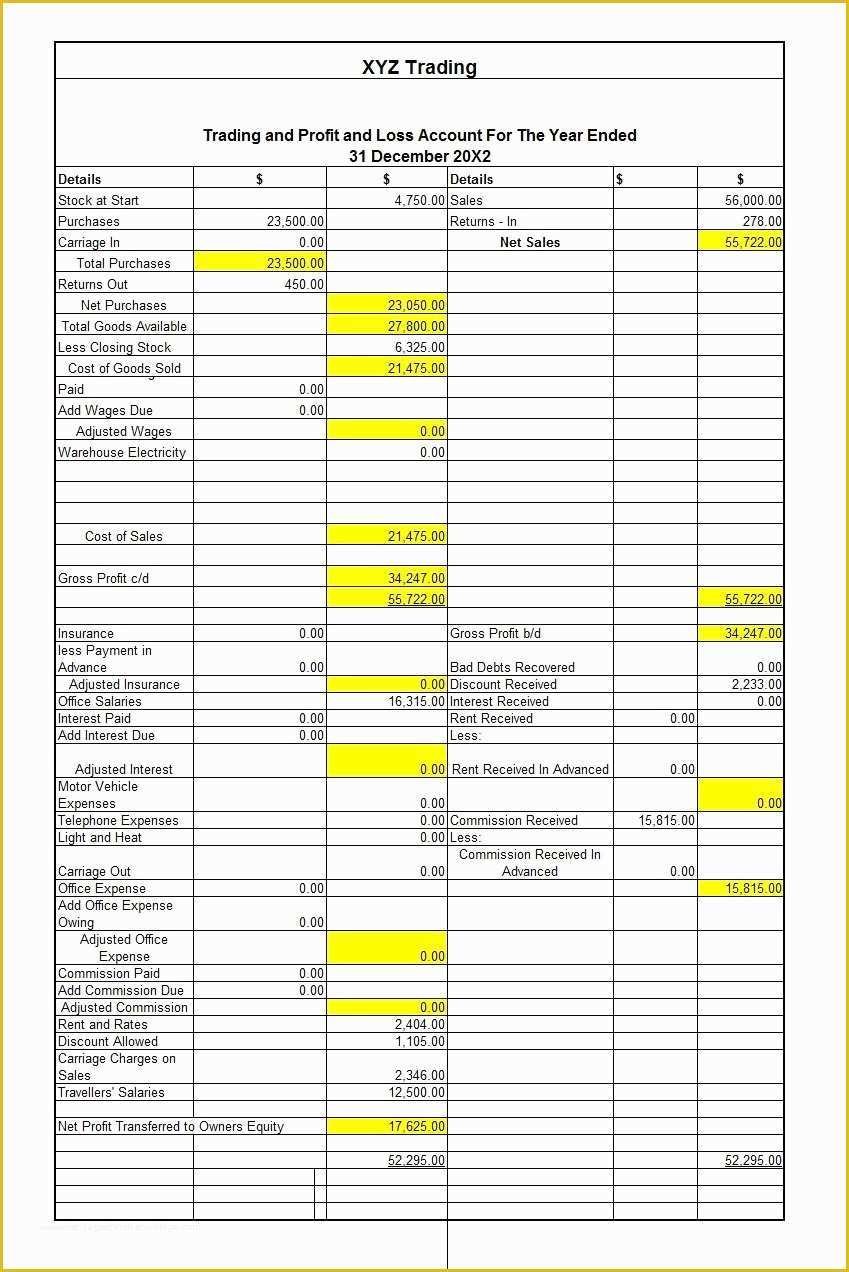

Table of Total Loss Paperwork Requirements

The following table outlines the typical requirements for total loss paperwork:

| Document | Description |

|---|---|

| Vehicle Title | Proof of ownership |

| Registration | Proof of vehicle registration |

| Police Report | Official report of the accident |

| Estimate of Damage | Detailed estimate of the damage and repair costs |

| Supporting Documents | Photographs, witness statements, and other supporting documents |

📝 Note: The specific requirements for total loss paperwork may vary depending on the insurance company and the state in which you reside.

Benefits of Filling Out Total Loss Paperwork Correctly

Filling out total loss paperwork correctly can have several benefits, including: * Faster claim processing: Accurate and complete paperwork can help to expedite the claims process. * Increased settlement: Providing detailed and supporting documentation can help to increase the settlement amount. * Reduced stress: Knowing that you have filled out the paperwork correctly can help to reduce stress and anxiety during a difficult time. Some other benefits of filling out total loss paperwork correctly include: * Improved communication: Clear and accurate paperwork can help to improve communication with the insurance company and other parties involved. * Greater transparency: Providing detailed documentation can help to increase transparency and accountability throughout the claims process.

In the end, filling out total loss paperwork requires attention to detail, patience, and persistence. By understanding the process and following the steps outlined above, you can help to ensure a smooth and efficient claims experience. The key is to be thorough, detailed, and accurate, and to seek professional help if needed. By doing so, you can help to maximize your settlement and move forward with confidence.

What is the first step in filling out total loss paperwork?

+

The first step in filling out total loss paperwork is to review the paperwork carefully and gather all necessary documents.

What are the benefits of filling out total loss paperwork correctly?

+

The benefits of filling out total loss paperwork correctly include faster claim processing, increased settlement, and reduced stress.

What happens if I make a mistake on the total loss paperwork?

+

If you make a mistake on the total loss paperwork, it can delay the claims process or result in a reduced settlement. It is essential to review the paperwork carefully and seek professional help if needed.