5 Ways Claim PPI

Introduction to PPI Claims

The Payment Protection Insurance (PPI) scandal has been one of the most significant financial mis-selling scandals in recent history, with millions of people affected by the mis-selling of PPI policies alongside their loans, credit cards, and mortgages. If you believe you were mis-sold PPI, you might be eligible to claim back the premiums you paid, along with interest. This guide will walk you through the process of claiming PPI compensation.

Understanding PPI and Its Mis-selling

Before diving into the claim process, it’s essential to understand what PPI is and how it was mis-sold. PPI was designed to cover loan or credit card payments if the policyholder became unable to work due to illness, injury, or redundancy. However, many policies were mis-sold to people who did not need them, were not eligible to claim, or were not fully informed about the policy’s terms and conditions.

Step-by-Step Guide to Claiming PPI

Claiming PPI compensation can seem daunting, but breaking down the process into manageable steps makes it more approachable. Here’s how to proceed:

- Gather Information: Start by collecting all relevant documents related to your loan, credit card, or mortgage, including statements and policy documents.

- Check for PPI: Look through your documents to see if you have PPI. It might be listed under different names, such as “loan protection,” “credit protection,” or “accident, sickness, and unemployment cover.”

- Assess Your Eligibility: Consider whether you were mis-sold PPI. Were you told it was compulsory? Were you eligible to claim under the policy (e.g., if you were self-employed or retired)? Were you given clear information about the policy, including its cost and terms?

- Contact the Lender: Write to the lender explaining why you believe you were mis-sold PPI. You can use template letters available online to help with this.

- Follow Up: If you do not receive a satisfactory response or any response at all, consider contacting the Financial Ombudsman Service (FOS) for further assistance.

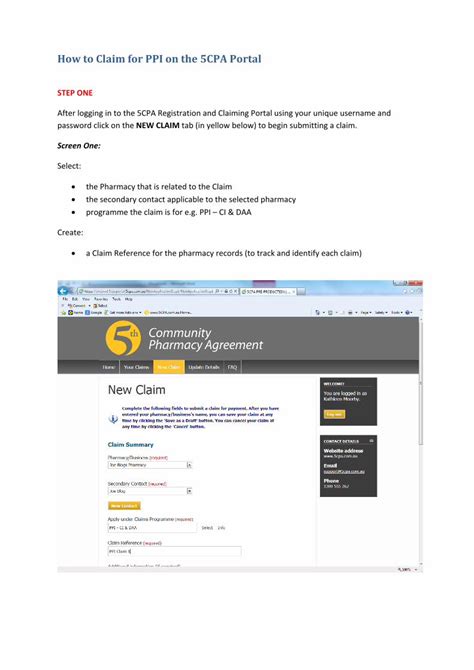

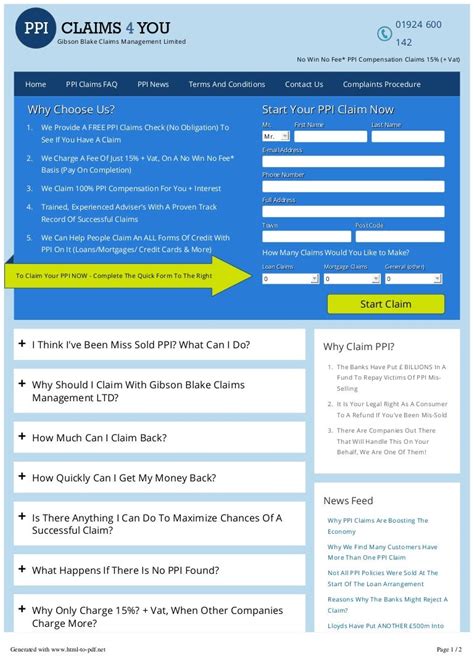

Using a Claims Management Company

While it’s possible to claim PPI compensation yourself, some people prefer to use a claims management company to handle their claim. These companies will typically handle all aspects of your claim in exchange for a fee, usually a percentage of the compensation you receive. When choosing a claims management company, ensure it is authorised by the Financial Conduct Authority (FCA) to protect yourself from scams.

Tips for a Successful Claim

- Act Quickly: There have been deadlines for making PPI claims in the past, and while these have now passed, it’s still wise to act as soon as possible. - Be Thorough: Keep detailed records of all correspondence with your lender and any claims management company you work with. - Stay Informed: Keep up-to-date with the latest news and guidelines regarding PPI claims to ensure you’re following the best course of action.

📝 Note: Always be cautious of scams related to PPI claims. Legitimate claims management companies and the Financial Ombudsman Service will not cold-call you or charge upfront fees.

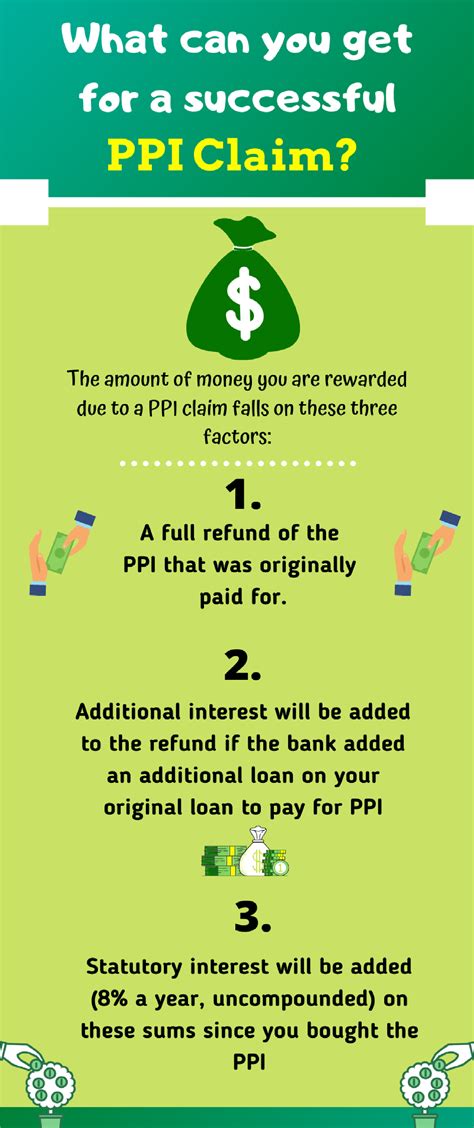

What to Expect After Claiming

After submitting your claim, the lender will review your case. If they agree that you were mis-sold PPI, they will typically offer you compensation. This can include a refund of the PPI premiums you paid, plus interest. If the lender rejects your claim and you disagree with their decision, you can take your case to the Financial Ombudsman Service for an independent review.

| Claim Status | What to Do |

|---|---|

| Claim Accepted | Review the offer to ensure it includes a full refund of premiums and interest. |

| Claim Rejected | Consider appealing the decision through the Financial Ombudsman Service. |

In summary, claiming PPI compensation involves understanding whether you were mis-sold PPI, gathering evidence, making a claim to your lender, and potentially escalating your case to the Financial Ombudsman Service. Being informed, meticulous, and patient can significantly improve your chances of a successful claim.

What is the deadline for making a PPI claim?

+

The official deadline for making PPI claims was August 29, 2019. However, you might still be able to claim if your case is particularly complex or if you only recently discovered you had PPI.

How long does a PPI claim take to process?

+

The time it takes to process a PPI claim can vary significantly. It can take a lender several weeks to several months to review your claim and make a decision.

Can I claim PPI compensation if I've already paid off my loan or credit card?

+

Yes, you can still claim PPI compensation even if you've paid off your loan or credit card. The key factor is whether you were mis-sold the PPI policy, not the status of the loan or credit card it was attached to.

Claiming PPI compensation is a process that requires patience, persistence, and attention to detail. By understanding your rights, gathering the necessary information, and following the steps outlined, you can navigate the process more effectively and potentially receive the compensation you’re owed.