Paperwork

5 Ways Claim PPI

Introduction to PPI Claims

The Payment Protection Insurance (PPI) scandal has been a major issue in the financial sector for many years, with millions of people being mis-sold PPI policies. If you believe you have been a victim of this scandal, you may be eligible to make a claim. In this article, we will explore the 5 ways to claim PPI and provide you with the necessary information to get started.

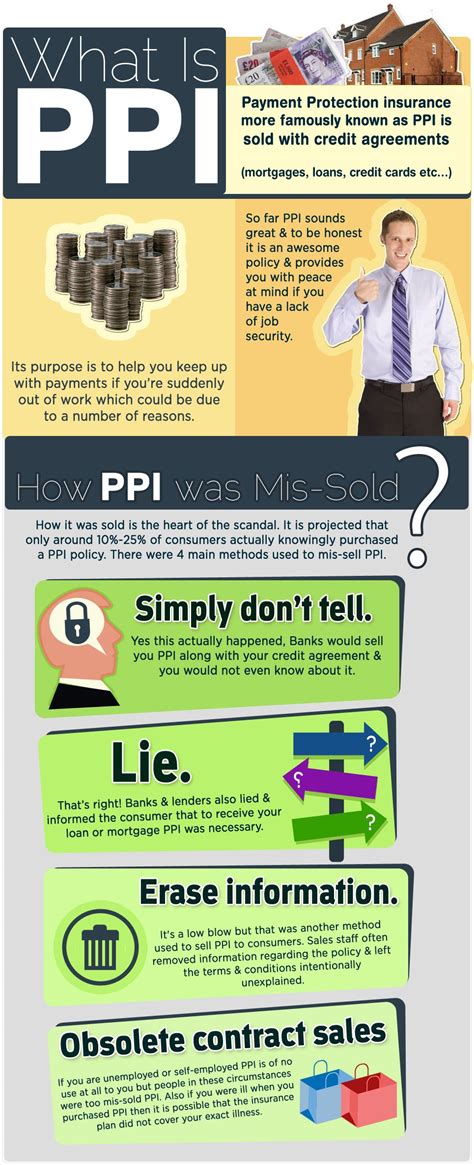

What is PPI?

PPI is an insurance policy that is designed to cover loan or credit card repayments if you are unable to work due to illness, injury, or unemployment. However, many people were mis-sold PPI policies, which were either unnecessary or unsuitable for their needs. If you have taken out a loan or credit card in the past, you may have been sold a PPI policy without your knowledge or consent.

5 Ways to Claim PPI

Here are 5 ways to claim PPI: * Check your loan or credit card documents: The first step is to check your loan or credit card documents to see if you have been sold a PPI policy. Look for any mention of PPI or payment protection insurance. * Contact your lender: If you have found evidence of a PPI policy, contact your lender to ask about the policy and to request a refund. They will be able to provide you with more information and guide you through the claims process. * Use a claims management company: If you are not sure where to start or need help with the claims process, you can use a claims management company. They will handle the claim on your behalf and ensure that you receive the maximum refund possible. * Make a claim through the Financial Ombudsman Service: If your lender has rejected your claim, you can take your case to the Financial Ombudsman Service (FOS). The FOS is an independent organization that can help resolve disputes between consumers and financial institutions. * Use a template letter: If you prefer to make a claim yourself, you can use a template letter to help guide you through the process. You can find template letters online or through consumer organizations such as the Citizens Advice Bureau.

What to Expect from the Claims Process

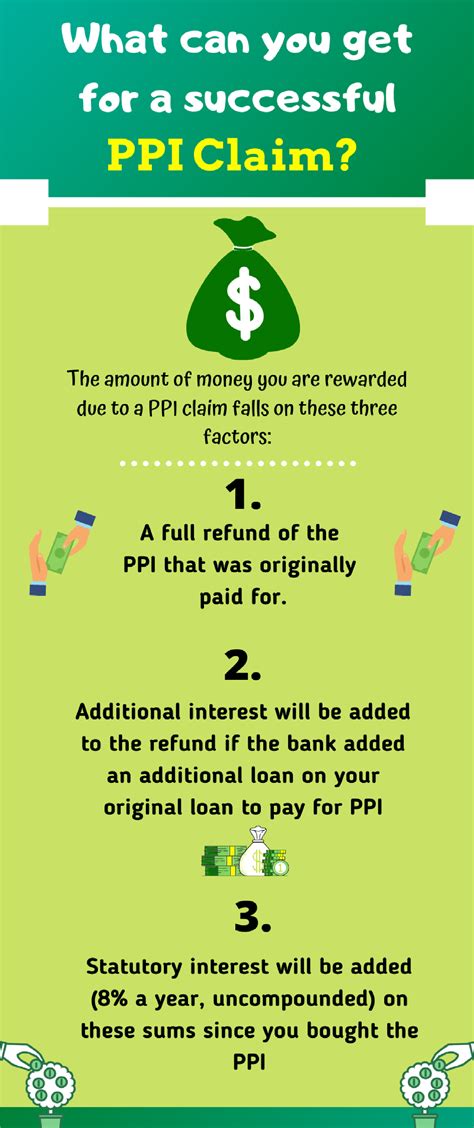

The claims process can be complex and time-consuming, but it is worth pursuing if you believe you have been mis-sold a PPI policy. Here are some things to expect: * A thorough investigation: Your lender or claims management company will investigate your claim and review your loan or credit card documents. * A decision on your claim: Once the investigation is complete, you will be informed of the decision on your claim. If your claim is successful, you will be eligible for a refund. * A refund: If your claim is successful, you will receive a refund of the PPI premiums you paid, plus interest.

Table of PPI Claim Statistics

Here is a table of PPI claim statistics:

| Year | Number of Claims | Amount Paid Out |

|---|---|---|

| 2010 | 1.5 million | £1.9 billion |

| 2011 | 2.2 million | £2.7 billion |

| 2012 | 2.5 million | £3.1 billion |

📝 Note: The statistics in the table are based on data from the Financial Conduct Authority and are subject to change.

Conclusion and Next Steps

In conclusion, making a PPI claim can be a complex and time-consuming process, but it is worth pursuing if you believe you have been mis-sold a PPI policy. By following the 5 ways to claim PPI outlined in this article, you can increase your chances of a successful claim. Remember to stay patient and persistent throughout the process, and don’t hesitate to seek help if you need it.

What is the deadline for making a PPI claim?

+

The deadline for making a PPI claim is August 29, 2019. After this date, you will no longer be able to make a claim.

How long does the PPI claims process take?

+

The PPI claims process can take several months to complete. The exact time frame will depend on the complexity of your claim and the speed at which your lender or claims management company processes your claim.

Can I make a PPI claim myself or do I need to use a claims management company?

+

You can make a PPI claim yourself or use a claims management company. Using a claims management company can be helpful if you are not sure where to start or need help with the claims process. However, be aware that claims management companies will charge a fee for their services.