5 Tips Lendistry Accepts

Introduction to Lendistry

Lendistry is a financial technology company that provides access to capital for small businesses and commercial real estate investors. With a focus on community development and financial inclusion, Lendistry offers a range of loan products and services designed to support the growth and success of businesses and projects that may not qualify for traditional financing. In this article, we will explore 5 tips that Lendistry accepts when it comes to applying for financing.

Tip 1: Understand the Loan Options

Lendistry offers a variety of loan products, including SBA loans, conventional loans, and lines of credit. Each loan product has its own unique features, benefits, and requirements. To increase the chances of approval, it’s essential to understand the loan options and choose the one that best fits the needs of the business or project. This includes considering factors such as loan amount, interest rate, repayment term, and collateral requirements.

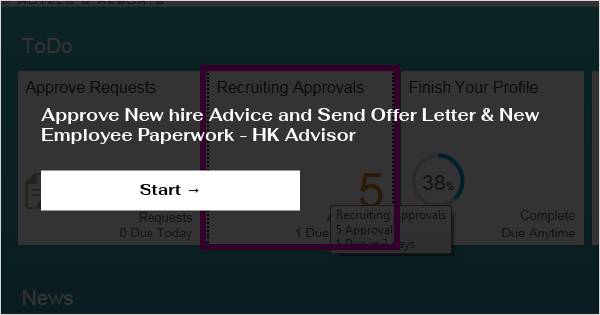

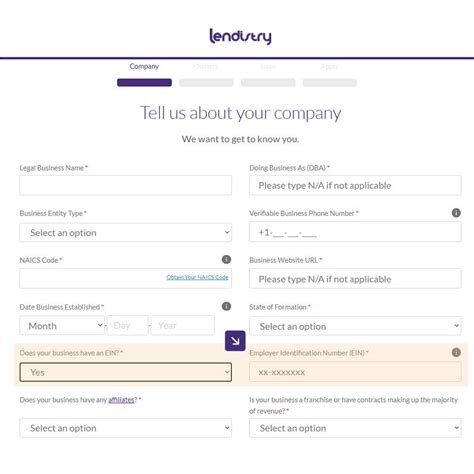

Tip 2: Prepare a Strong Application Package

A strong application package is critical to securing financing from Lendistry. This includes providing accurate and complete financial information, such as business tax returns, personal tax returns, and financial statements. Additionally, applicants should be prepared to provide detailed business plans, market research, and management team information. A well-organized and comprehensive application package demonstrates a high level of professionalism and preparedness, which can improve the chances of approval.

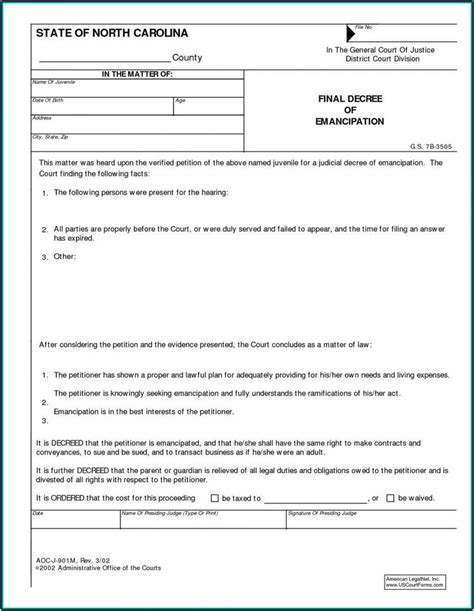

Tip 3: Demonstrate a Strong Credit Profile

Lendistry considers creditworthiness when evaluating loan applications. Applicants with a strong credit profile, including a good credit score, low debt-to-income ratio, and positive credit history, are more likely to be approved for financing. To demonstrate a strong credit profile, applicants should monitor their credit report, pay bills on time, and keep credit utilization ratios low.

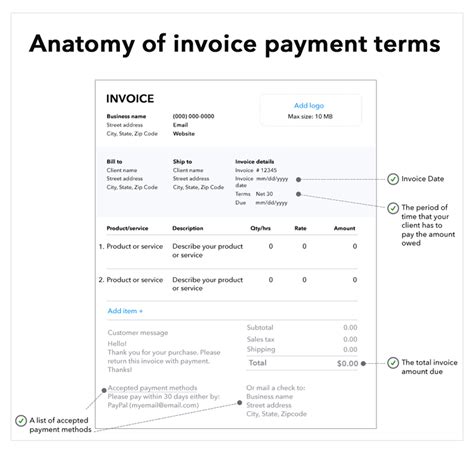

Tip 4: Show a Clear Repayment Plan

Lendistry wants to see that borrowers have a clear plan for repaying the loan. This includes providing detailed financial projections, such as income statements, balance sheets, and cash flow statements. Applicants should also be prepared to discuss their repayment strategy, including loan repayment terms, interest rates, and collateral. A well-thought-out repayment plan demonstrates a high level of financial responsibility and can improve the chances of approval.

Tip 5: Highlight Community Impact

As a company focused on community development and financial inclusion, Lendistry is more likely to approve loan applications that demonstrate a positive community impact. This includes projects that create jobs, stimulate local economic growth, and support underserved communities. Applicants should be prepared to discuss the potential community benefits of their project, including job creation, tax revenue generation, and community engagement.

📝 Note: It's essential to review Lendistry's loan requirements and application process carefully to ensure the best possible outcome.

In summary, to increase the chances of securing financing from Lendistry, applicants should understand the loan options, prepare a strong application package, demonstrate a strong credit profile, show a clear repayment plan, and highlight community impact. By following these tips, businesses and commercial real estate investors can improve their chances of approval and access the capital they need to succeed.

What types of loans does Lendistry offer?

+

Lendistry offers a range of loan products, including SBA loans, conventional loans, and lines of credit.

What is the minimum credit score required for a Lendistry loan?

+

The minimum credit score required for a Lendistry loan varies depending on the loan product and other factors, but generally, a credit score of 650 or higher is recommended.

How long does the loan application process typically take?

+

The loan application process typically takes several weeks to several months, depending on the complexity of the application and the speed of the applicant in providing required documentation.