5 Solar Tax Forms

Understanding Solar Tax Forms

The world of solar energy is not just about harnessing the power of the sun to reduce our reliance on fossil fuels, but it also comes with a plethora of financial incentives designed to encourage the adoption of solar technologies. Among these incentives are various tax forms that individuals and businesses must navigate to claim their rightful deductions and credits. In this article, we’ll delve into five key solar tax forms that are crucial for anyone looking to maximize their solar investment returns.

Importance of Solar Tax Forms

Before we dive into the specifics of each form, it’s essential to understand why these documents are so vital. Solar tax credits and deductions can significantly reduce the cost of installing solar panels, making this renewable energy source more accessible to a wider audience. However, to benefit from these incentives, individuals and businesses must accurately complete and submit the necessary tax forms. Failure to do so can result in missed opportunities for savings, which is why understanding these forms is crucial.

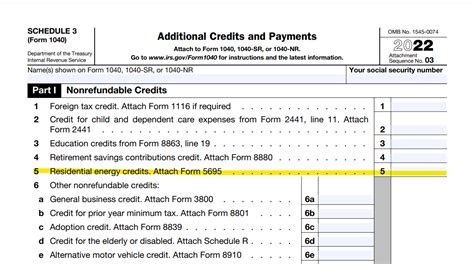

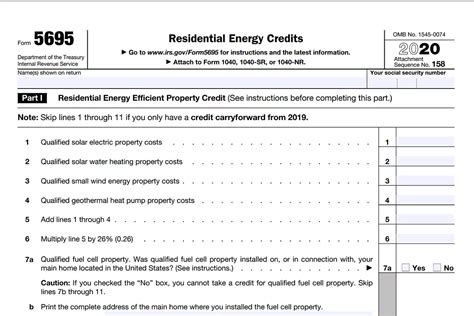

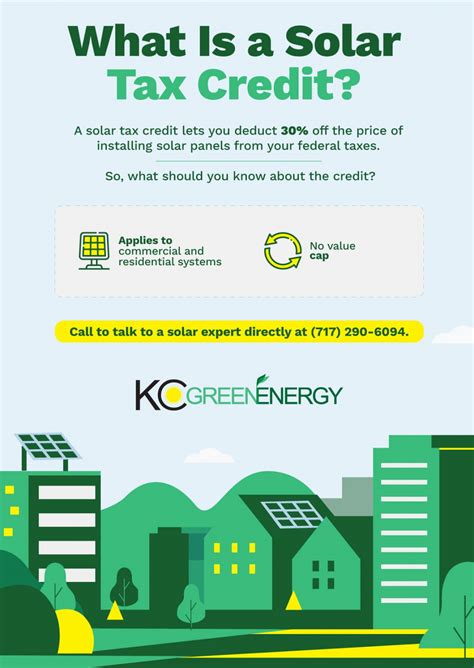

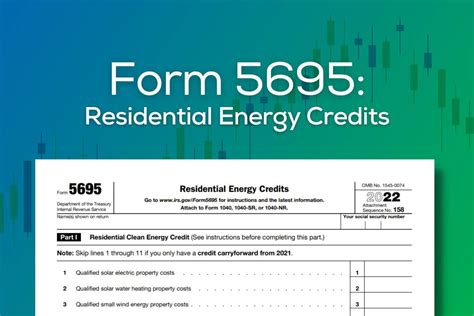

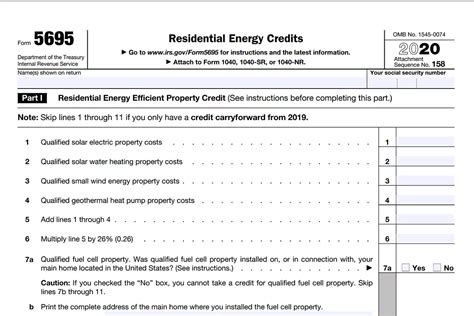

1. Form 5695: Residential Energy Credits

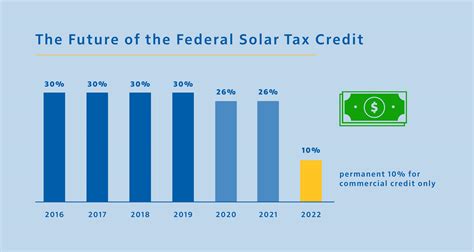

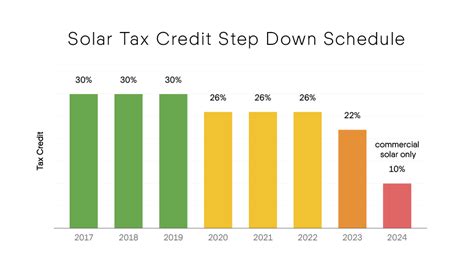

Form 5695 is used by residential taxpayers to claim credits for residential energy-efficient property, including solar panels. This form is where you calculate the Residential Energy Efficient Property Credit, which can cover up to 26% of the cost of eligible solar energy systems installed in a primary residence or a second home. To qualify, the system must be placed in service during the tax year, and the credit can be claimed for both the cost of the system and the labor costs associated with the installation.

2. Form 3468: Investment Credit

For businesses or individuals with larger solar installations, Form 3468 is used to claim the Investment Credit, which can also cover a portion of the costs associated with solar energy systems. This form is particularly relevant for commercial solar installations or residential installations that exceed the residential energy credit limits. The investment credit rate mirrors that of the residential credit, offering up to 26% of the system’s cost, including equipment and installation labor.

3. Form 3800: General Business Credit

Businesses claiming the solar investment tax credit will also need to complete Form 3800. This form is used to calculate the General Business Credit, which includes the investment tax credit for solar energy systems. The general business credit can be used to reduce a taxpayer’s liability, dollar for dollar, and any excess credit can be carried back one year or forward up to 20 years.

4. Form 8834: Qualified Electric Vehicle and Qualified Plug-in Electric Vehicle Credits (For Solar Charging Stations)

While primarily associated with electric vehicles, Form 8834 can also be relevant for solar installations when they involve charging stations for electric vehicles. This form allows taxpayers to claim a credit for the purchase and installation of qualified electric vehicle charging stations, which can be powered by solar energy systems. The credit can help offset the costs of these stations, making the adoption of both solar energy and electric vehicles more financially attractive.

5. Form 8911: Alternative Fuel Vehicle Refueler Credit (For Solar-Powered Charging Stations)

For businesses and individuals investing in solar-powered charging stations for alternative fuel vehicles, Form 8911 is necessary to claim the Alternative Fuel Vehicle Refueler Credit. This credit supports the development of infrastructure for alternative fuels, including electricity generated from solar energy. By claiming this credit, taxpayers can receive a deduction for a portion of the costs associated with installing solar-powered charging stations, further incentivizing the integration of solar energy into transportation systems.

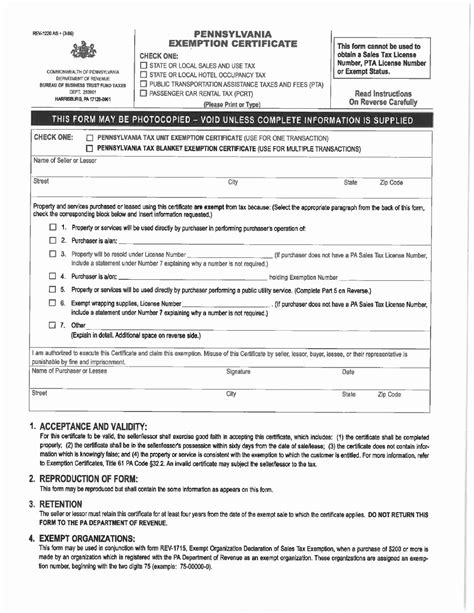

Steps to Complete Solar Tax Forms

Completing solar tax forms involves several key steps: - Determine Eligibility: Ensure the solar energy system or charging station qualifies for the desired credit. - Gather Required Documents: This includes invoices for the system and its installation, and any other relevant paperwork. - Calculate the Credit: Use the appropriate form to calculate the credit amount, ensuring to follow the form’s instructions carefully. - Submit the Form: Include the completed form with your tax return to claim the credit.

📝 Note: It's highly recommended to consult with a tax professional to ensure accuracy and compliance with all tax laws and regulations when claiming solar tax credits.

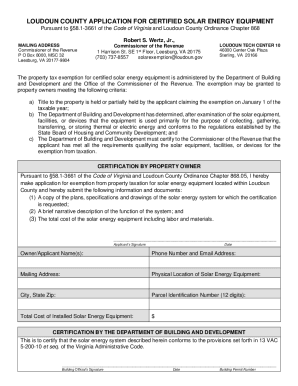

Benefits and Considerations

The benefits of solar tax forms are clear: they can significantly reduce the financial burden of transitioning to solar energy. However, it’s also important to consider the tax implications of these credits and how they might affect your overall tax situation. Additionally, state and local incentives may offer further savings, so it’s worth exploring these as well.

| Form Number | Purpose |

|---|---|

| Form 5695 | Residential Energy Credits |

| Form 3468 | Investment Credit |

| Form 3800 | General Business Credit |

| Form 8834 | Qualified Electric Vehicle and Qualified Plug-in Electric Vehicle Credits |

| Form 8911 | Alternative Fuel Vehicle Refueler Credit |

To summarize, navigating the world of solar tax forms requires a thorough understanding of the various credits available and the forms used to claim them. By accurately completing and submitting these forms, individuals and businesses can maximize their solar investment returns, making the transition to renewable energy not only environmentally friendly but also financially savvy. Understanding and leveraging these incentives can play a crucial role in the widespread adoption of solar energy, contributing to a cleaner, more sustainable future for all.

What is the purpose of Form 5695 in solar tax credits?

+

Form 5695 is used to claim the Residential Energy Efficient Property Credit, which covers up to 26% of the cost of eligible solar energy systems installed in a primary residence or a second home.

How do I determine if my solar energy system qualifies for tax credits?

+

To determine eligibility, ensure the system meets the requirements outlined by the IRS for residential or commercial solar energy systems, including the placement in service during the tax year and the type of system installed.

Can I claim solar tax credits for solar-powered charging stations for electric vehicles?

+

Yes, for solar-powered charging stations, you can claim credits using Form 8834 for qualified electric vehicle charging stations or Form 8911 for alternative fuel vehicle refueler credits, depending on the specifics of your installation.