7 Bankruptcy Forms

Introduction to Bankruptcy Forms

Filing for bankruptcy is a serious decision that involves a complex process, including the completion of various forms. These forms are designed to provide the court with a detailed understanding of the individual’s or business’s financial situation, including their assets, liabilities, income, and expenses. In this article, we will discuss 7 key bankruptcy forms that are commonly used in the bankruptcy process.

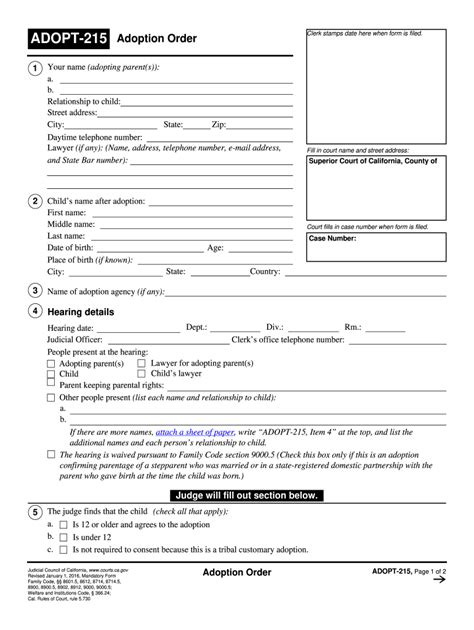

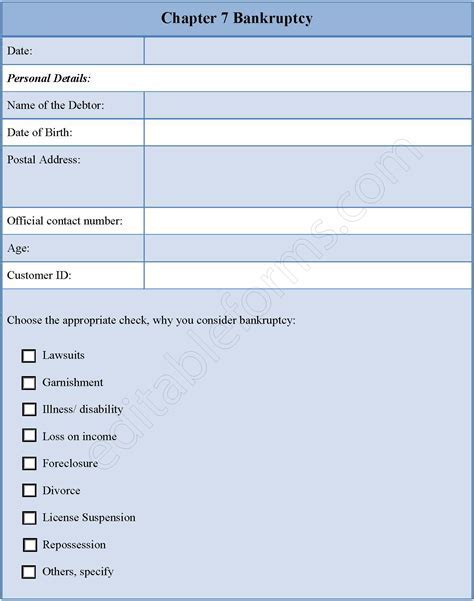

Form 1: Voluntary Petition

The Voluntary Petition is the first form that must be completed when filing for bankruptcy. This form provides basic information about the individual or business, including their name, address, and social security number. It also requires the individual to indicate which type of bankruptcy they are filing for, such as Chapter 7 or Chapter 13.

Form 2: Schedules A-J

The Schedules A-J forms are used to provide detailed information about the individual’s or business’s financial situation. These forms include: * Schedule A: Real property * Schedule B: Personal property * Schedule C: Exemptions * Schedule D: Secured creditors * Schedule E: Unsecured creditors * Schedule F: Unsecured non-priority creditors * Schedule G: Executory contracts and unexpired leases * Schedule H: Co-signers * Schedule I: Income * Schedule J: Expenses

Form 3: Statement of Financial Affairs

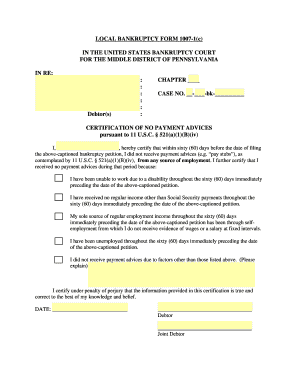

The Statement of Financial Affairs form is used to provide information about the individual’s or business’s financial transactions, including income, expenses, assets, and liabilities. This form also requires the individual to disclose any financial transactions that have occurred within the past two years, such as the sale of assets or the repayment of debts.

Form 4: Means Test

The Means Test form is used to determine whether an individual qualifies for Chapter 7 bankruptcy. This form requires the individual to provide information about their income, expenses, and debt, as well as their family size and location. The means test is used to determine whether the individual has sufficient disposable income to repay a portion of their debts.

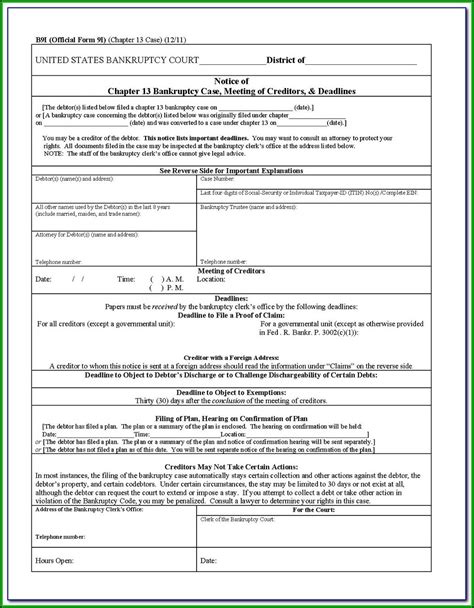

Form 5: Chapter 13 Plan

The Chapter 13 Plan form is used to propose a plan for repaying debts over a period of time, typically three to five years. This form requires the individual to provide information about their income, expenses, and debt, as well as a proposed plan for repaying their debts.

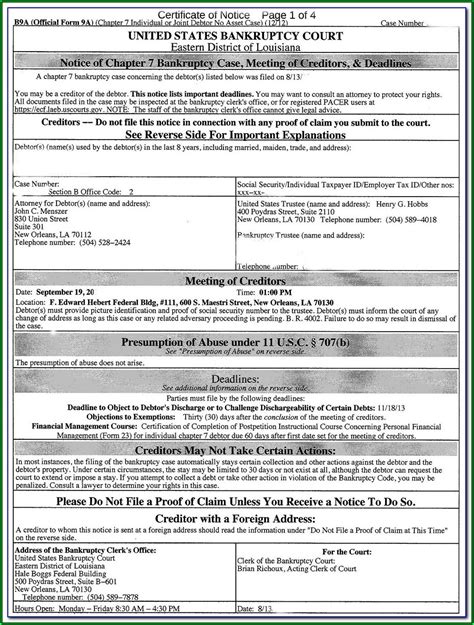

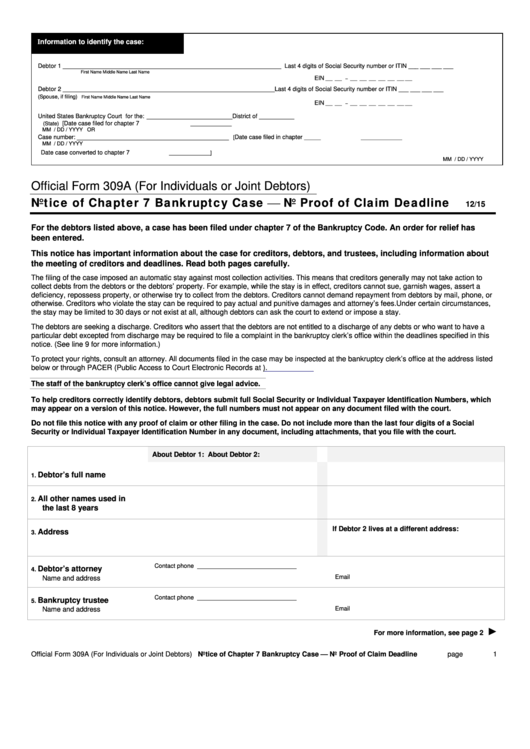

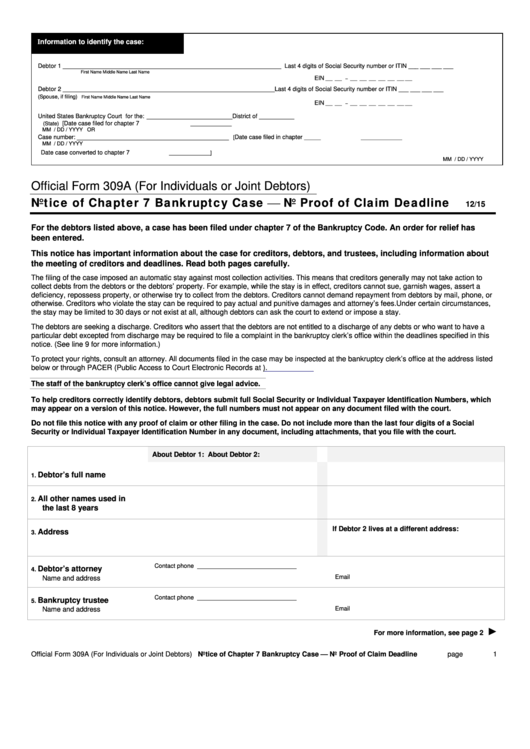

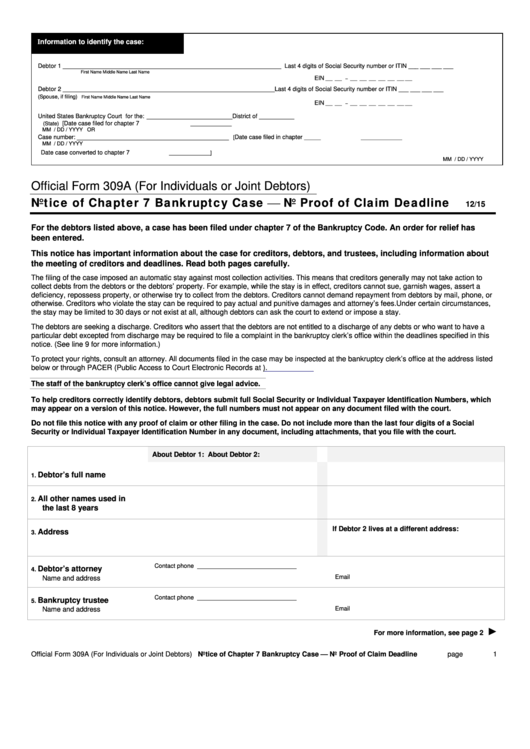

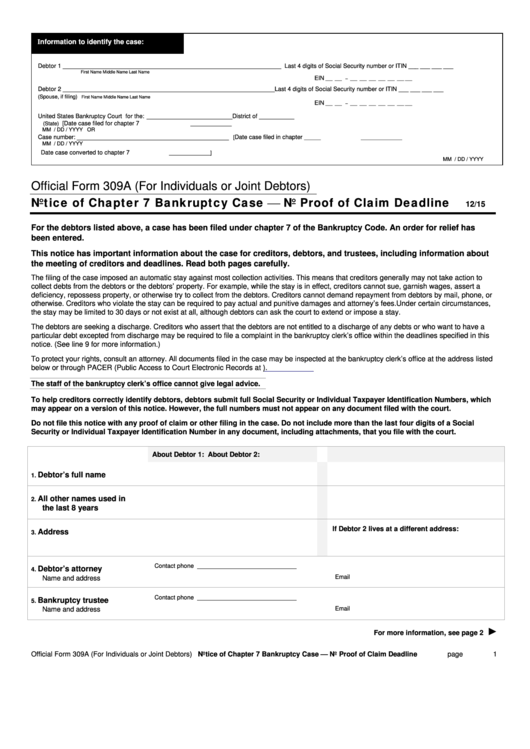

Form 6: Notice of Commencement

The Notice of Commencement form is used to notify creditors that a bankruptcy case has been filed. This form provides information about the individual’s or business’s bankruptcy case, including the case number, the type of bankruptcy filed, and the date of filing.

Form 7: Discharge of Debts

The Discharge of Debts form is used to notify creditors that certain debts have been discharged, or forgiven, as a result of the bankruptcy. This form provides information about the debts that have been discharged, as well as the date of discharge.

💡 Note: It is essential to complete these forms accurately and thoroughly to avoid delays or complications in the bankruptcy process.

| Form Number | Form Name | Description |

|---|---|---|

| 1 | Voluntary Petition | Provides basic information about the individual or business |

| 2 | Schedules A-J | Provides detailed information about the individual's or business's financial situation |

| 3 | Statement of Financial Affairs | Provides information about the individual's or business's financial transactions |

| 4 | Means Test | Determines whether an individual qualifies for Chapter 7 bankruptcy |

| 5 | Chapter 13 Plan | Proposes a plan for repaying debts over a period of time |

| 6 | Notice of Commencement | Notifies creditors that a bankruptcy case has been filed |

| 7 | Discharge of Debts | Notifies creditors that certain debts have been discharged |

In final thoughts, completing the necessary bankruptcy forms is a crucial step in the bankruptcy process. It is essential to ensure that these forms are completed accurately and thoroughly to avoid delays or complications. By understanding the different forms required and their purposes, individuals can better navigate the bankruptcy process and achieve a fresh financial start.

What is the purpose of the Voluntary Petition form?

+

The Voluntary Petition form is used to provide basic information about the individual or business and to indicate which type of bankruptcy is being filed.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the liquidation of assets to repay debts, while Chapter 13 bankruptcy involves the repayment of debts over a period of time through a court-approved plan.

What is the Means Test form used for?

+

The Means Test form is used to determine whether an individual qualifies for Chapter 7 bankruptcy by assessing their income, expenses, and debt.