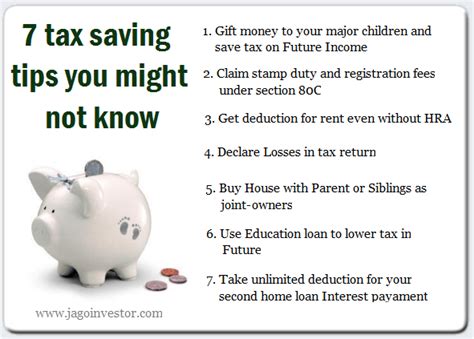

7 Tax Tips

Introduction to Tax Planning

Tax planning is an essential aspect of personal and business finance, as it helps individuals and companies navigate the complex world of taxes and ensure they are in compliance with all relevant laws and regulations. With the ever-changing tax landscape, it’s crucial to stay up-to-date on the latest developments and strategies for minimizing tax liabilities. In this article, we will explore seven tax tips that can help individuals and businesses optimize their tax planning and make the most of their hard-earned money.

Understanding Tax Deductions

Tax deductions are a crucial component of tax planning, as they can significantly reduce an individual’s or business’s tax liability. Deductions are expenses that can be subtracted from taxable income, resulting in a lower tax bill. Some common deductions include charitable donations, mortgage interest, and business expenses. It’s essential to keep accurate records of deductions, as the Internal Revenue Service (IRS) may request documentation to support claims.

Tax Tip 1: Maximize Retirement Contributions

Contributing to a retirement account, such as a 401(k) or IRA, can provide significant tax benefits. These contributions are made with pre-tax dollars, reducing taxable income and lowering tax liability. Additionally, the funds grow tax-deferred, meaning that taxes are only paid when withdrawals are made in retirement. Maximizing retirement contributions can also help individuals save for their golden years and reduce their reliance on Social Security benefits.

Tax Tip 2: Take Advantage of Tax Credits

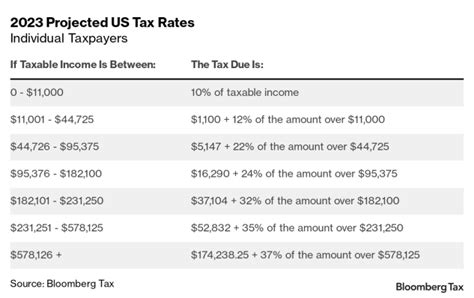

Tax credits are even more valuable than deductions, as they provide a dollar-for-dollar reduction in tax liability. Some common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the Education Credit. These credits can be worth thousands of dollars, making them a crucial component of tax planning. It’s essential to review eligibility requirements and claim these credits when filing taxes.

Tax Tip 3: Itemize Deductions

Itemizing deductions involves listing specific expenses on a tax return, rather than claiming the standard deduction. This can be beneficial for individuals with significant expenses, such as mortgage interest, medical bills, or charitable donations. Itemizing deductions can help reduce tax liability, but it’s essential to keep accurate records and ensure that the total deduction amount exceeds the standard deduction.

Tax Tip 4: Consider a Home Office Deduction

For self-employed individuals or those who work from home, a home office deduction can provide significant tax benefits. This deduction allows individuals to claim a portion of their rent or mortgage interest as a business expense, reducing taxable income. Home office deductions can be complex, so it’s essential to consult with a tax professional to ensure accuracy and compliance with IRS regulations.

Tax Tip 5: Harvest Investment Losses

Investment losses can be used to offset gains from other investments, reducing tax liability. Tax-loss harvesting involves selling securities that have declined in value to realize losses, which can then be used to offset gains from other investments. This strategy can help minimize tax liability and optimize investment returns.

Tax Tip 6: Consider a Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged account that allows individuals to save for medical expenses on a tax-free basis. HSAs are available to individuals with high-deductible health plans and can provide significant tax benefits. Contributions are made with pre-tax dollars, and the funds grow tax-deferred, meaning that taxes are only paid when withdrawals are made for qualified medical expenses.

Tax Tip 7: Consult a Tax Professional

Finally, consulting a tax professional can provide valuable guidance and support throughout the tax planning process. A tax professional can help individuals and businesses navigate the complex tax landscape, identify areas for improvement, and ensure compliance with all relevant laws and regulations. This can provide peace of mind and help minimize the risk of audits or penalties.

💡 Note: Tax laws and regulations are subject to change, so it's essential to stay up-to-date on the latest developments and consult with a tax professional to ensure accuracy and compliance.

In summary, tax planning is a critical component of personal and business finance, and there are several strategies that can help individuals and companies minimize their tax liability. By maximizing retirement contributions, taking advantage of tax credits, itemizing deductions, considering a home office deduction, harvesting investment losses, considering an HSA, and consulting a tax professional, individuals and businesses can optimize their tax planning and make the most of their hard-earned money. By following these tax tips and staying informed about the latest tax developments, individuals and businesses can reduce their tax liability and achieve their financial goals.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces taxable income, while a tax credit provides a dollar-for-dollar reduction in tax liability.

Can I claim a home office deduction if I work from home occasionally?

+

Yes, but you must meet specific requirements and keep accurate records to support your claim.

How do I know if I’m eligible for a tax credit?

+

Review the eligibility requirements for each tax credit and consult with a tax professional to determine your eligibility.