7 IRS Record Tips

Introduction to IRS Record Keeping

When it comes to managing your finances, one of the most critical aspects is maintaining accurate and comprehensive records, especially for tax purposes. The Internal Revenue Service (IRS) requires taxpayers to keep detailed records to support their tax returns, ensuring compliance with tax laws and regulations. In this blog post, we will delve into the importance of IRS record keeping and provide you with 7 essential tips to help you stay organized and prepared for tax season.

Why IRS Record Keeping is Crucial

Maintaining accurate and detailed records is vital for several reasons. Firstly, it helps you to accurately report your income, deductions, and credits, reducing the risk of errors or audits. Secondly, it provides a clear picture of your financial situation, enabling you to make informed decisions about your tax strategy. Finally, it helps you to support your tax return in case of an audit, ensuring that you can substantiate your claims and avoid potential penalties.

7 IRS Record Tips

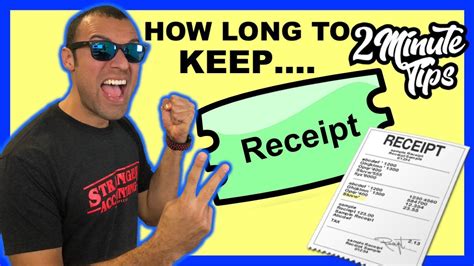

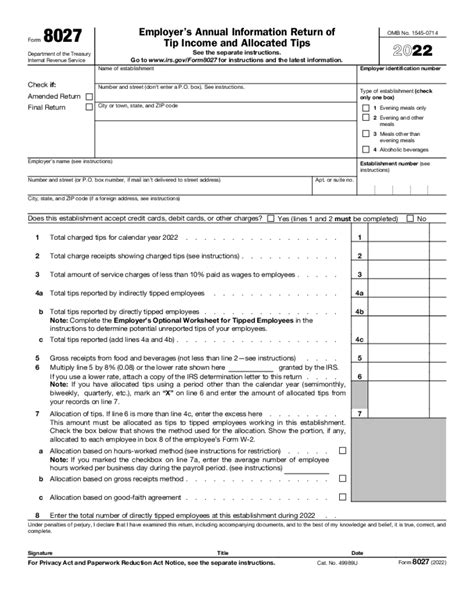

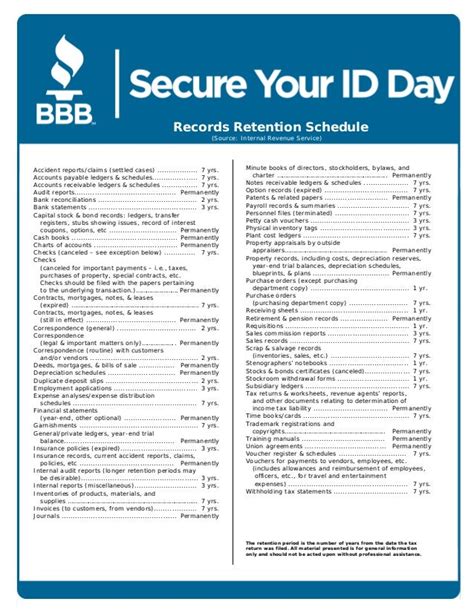

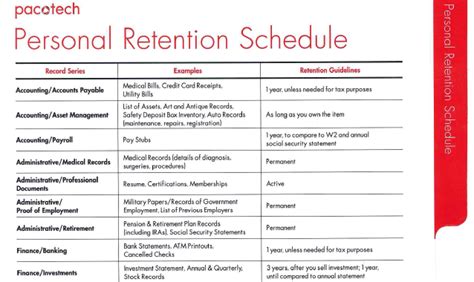

To help you stay on top of your record keeping, here are 7 essential tips to keep in mind: * Keep accurate and detailed records: Ensure that your records are accurate, complete, and up-to-date. This includes income statements, receipts, invoices, and bank statements. * Use a record keeping system: Implement a record keeping system that works for you, such as a spreadsheet, folder, or digital tool. This will help you to stay organized and quickly locate the information you need. * Keep records for the right amount of time: The IRS requires taxpayers to keep records for at least three years from the date of filing. However, it’s recommended to keep records for up to seven years in case of an audit. * Make digital copies: Consider making digital copies of your records, such as scanning receipts or invoices. This will help to protect your records from loss or damage. * Keep business and personal records separate: If you’re self-employed or have a business, it’s essential to keep your business and personal records separate. This will help you to accurately report your business income and expenses. * Keep records of charitable donations: If you make charitable donations, ensure that you keep records of the donation, including the date, amount, and recipient. * Review and update your records regularly: Regularly review and update your records to ensure that they are accurate and complete. This will help you to identify any discrepancies or errors and make necessary corrections.

📝 Note: It's essential to keep your records organized and up-to-date to avoid any potential issues with the IRS. By following these 7 tips, you can ensure that your records are accurate, complete, and easily accessible.

Best Practices for IRS Record Keeping

In addition to the 7 tips outlined above, here are some best practices to keep in mind: * Use a cloud-based storage system: Consider using a cloud-based storage system, such as Dropbox or Google Drive, to store your records. This will help to protect your records from loss or damage and provide easy access. * Use a tax preparation software: Consider using a tax preparation software, such as TurboTax or H&R Block, to help you prepare and file your tax return. These software programs can help you to accurately report your income, deductions, and credits. * Keep receipts and invoices organized: Keep receipts and invoices organized by category, such as business expenses or charitable donations. This will help you to quickly locate the information you need.

| Record Type | Retention Period |

|---|---|

| Income statements | At least 3 years |

| Receipts and invoices | At least 3 years |

| Bank statements | At least 3 years |

| Charitable donation records | At least 3 years |

In summary, maintaining accurate and comprehensive records is essential for tax purposes. By following the 7 tips outlined above and implementing best practices, such as using a cloud-based storage system and tax preparation software, you can ensure that your records are accurate, complete, and easily accessible. This will help you to accurately report your income, deductions, and credits, reducing the risk of errors or audits.

What records do I need to keep for tax purposes?

+

You should keep records of your income, deductions, and credits, including income statements, receipts, invoices, and bank statements.

How long do I need to keep my tax records?

+

The IRS requires taxpayers to keep records for at least three years from the date of filing. However, it’s recommended to keep records for up to seven years in case of an audit.

Can I use a digital record keeping system?

+

Yes, you can use a digital record keeping system, such as a cloud-based storage system or tax preparation software, to store and manage your tax records.