Paperwork

FSBO Buyers Pre Qualified Loan Paperwork

Understanding the Importance of Pre-Qualified Loan Paperwork for FSBO Buyers

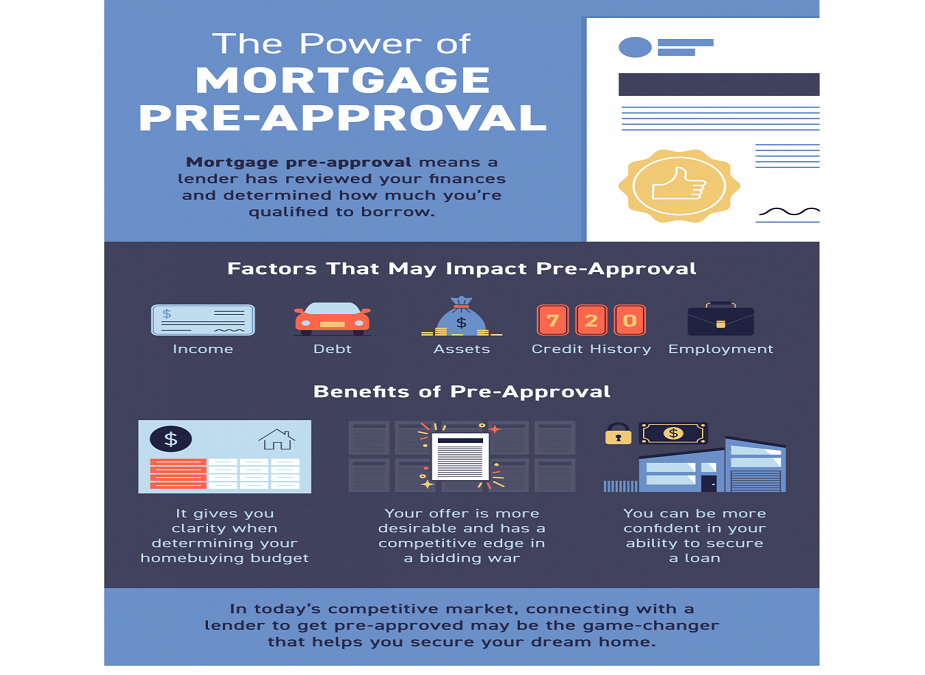

When navigating the world of For Sale By Owner (FSBO) properties, buyers often find themselves in a complex and sometimes daunting process. One crucial aspect that can make a significant difference in the success of such transactions is the pre-qualified loan paperwork. Pre-qualification is essentially a preliminary assessment by a lender of how much a buyer can borrow. This step is vital for both the buyer and the seller as it sets the stage for a smoother, more transparent transaction.

The Role of Pre-Qualified Loan Paperwork in FSBO Transactions

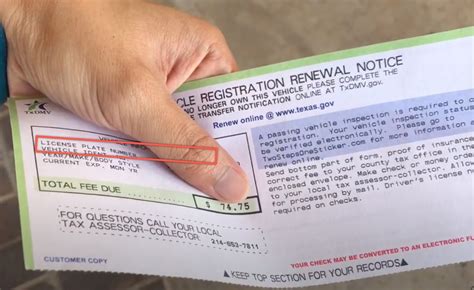

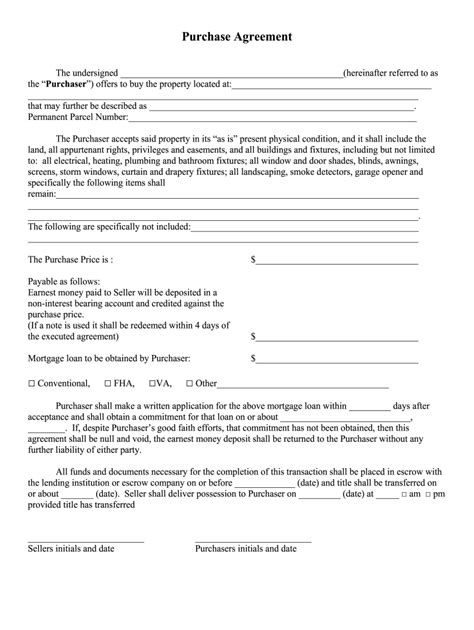

In traditional real estate transactions, the role of real estate agents is to facilitate communication between buyers and sellers, including handling paperwork and ensuring that both parties are aware of their financial obligations. However, in FSBO transactions, buyers and sellers must handle these aspects directly. Pre-qualified loan paperwork serves as a document that proves a buyer’s creditworthiness and ability to secure a loan for the purchase. This paperwork typically includes: - Income verification: Proof of income, such as pay stubs or tax returns. - Credit report: A detailed report of the buyer’s credit history. - Employment verification: Confirmation of the buyer’s employment status. - Bank statements: To verify the buyer’s savings and financial stability.

Benefits for Buyers

For buyers, having pre-qualified loan paperwork offers several benefits: - Clarifies budget: It helps buyers understand exactly how much they can afford, preventing them from overspending. - Strengthens negotiating position: Sellers are more likely to consider offers from pre-qualified buyers, as it indicates a serious and financially capable buyer. - Saves time: By knowing their budget upfront, buyers can focus on properties within their price range, streamlining their search.

Benefits for Sellers

Sellers also benefit from dealing with pre-qualified buyers: - Reduces risks: The seller can be more confident that the sale will go through, as the buyer’s ability to secure financing has been preliminarily assessed. - Encourages serious offers: Sellers are less likely to receive low-ball offers from buyers who are not serious about purchasing, as pre-qualification indicates a level of commitment. - Speeds up the process: With financing less likely to be an issue, the transaction can proceed more quickly.

Steps to Obtain Pre-Qualified Loan Paperwork

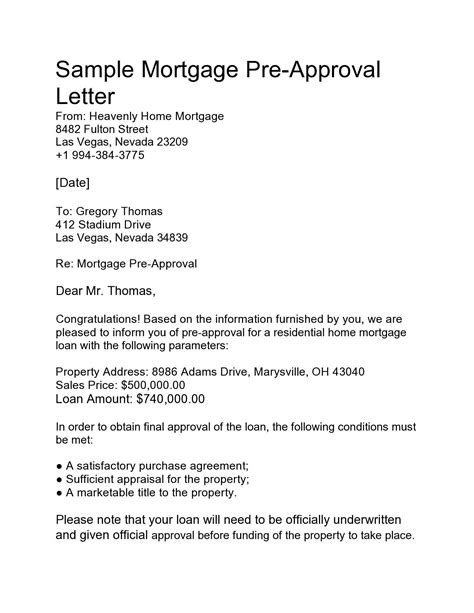

To obtain pre-qualified loan paperwork, buyers should follow these steps: - Research lenders: Look for lenders that offer pre-qualification services and compare their rates and terms. - Gather necessary documents: This includes income verification, credit reports, employment verification, and bank statements. - Apply for pre-qualification: Submit the application and wait for the lender’s response. - Review and understand the pre-qualification letter: This letter will state the amount the lender is willing to lend and under what terms.

📝 Note: It's essential for buyers to understand that pre-qualification is not a guarantee of a loan but rather an indication of borrowing power.

Common Mistakes to Avoid

Buyers should be aware of the following common mistakes: - Not shopping around for lenders: Different lenders may offer better rates or terms. - Not carefully reviewing the pre-qualification letter: Buyers should ensure they understand all the terms and conditions. - Assuming pre-qualification means guaranteed loan approval: Final loan approval depends on a more detailed assessment of the buyer’s financial situation and the property’s value.

Conclusion Without a Heading

In conclusion, pre-qualified loan paperwork is a critical component of FSBO transactions, offering numerous benefits for both buyers and sellers by facilitating smoother, more transparent, and financially secure transactions. By understanding the importance and process of obtaining pre-qualified loan paperwork, buyers can navigate the FSBO market with confidence, knowing their financial capabilities and limitations. This preliminary step in securing financing not only streamlines the home buying process but also sets the foundation for a successful transaction.

What is the difference between pre-qualification and pre-approval?

+

Pre-qualification is an initial assessment of how much a buyer can borrow, while pre-approval is a more formal commitment from a lender stating the loan amount and terms after a thorough financial review.

How long does it take to get pre-qualified for a loan?

+

The pre-qualification process can often be completed within a few minutes to an hour, depending on the lender and the complexity of the buyer’s financial situation.

Is pre-qualified loan paperwork necessary for FSBO transactions?

+

While not strictly necessary, having pre-qualified loan paperwork can significantly strengthen a buyer’s position and facilitate a smoother transaction for both parties.