File 1099 Paperwork Requirements

Introduction to 1099 Paperwork Requirements

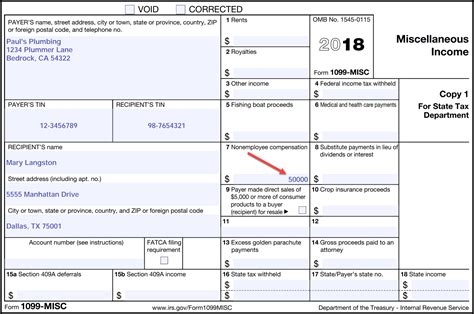

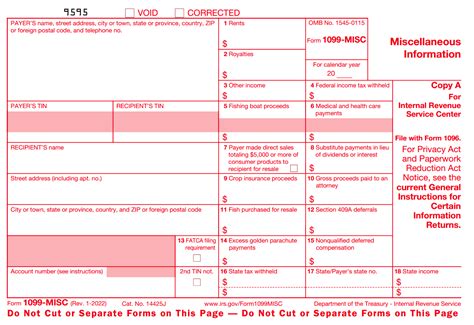

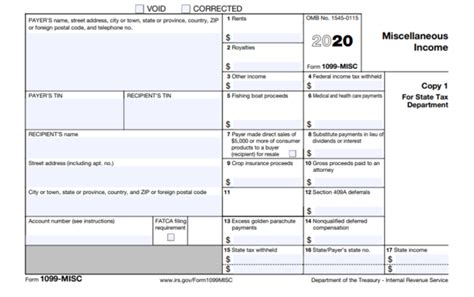

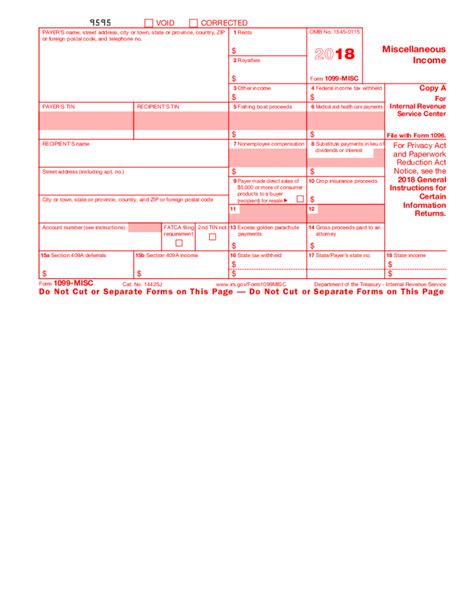

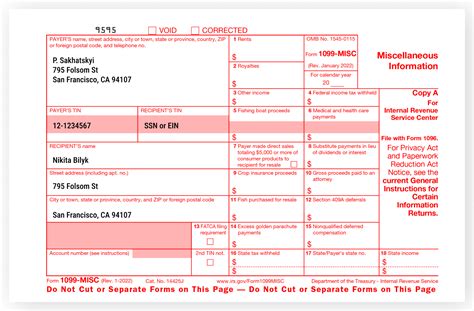

The 1099 form is a crucial document used by the Internal Revenue Service (IRS) to report various types of income, such as freelance work, rental income, and other non-employee compensation. As a payer, it’s essential to understand the 1099 paperwork requirements to ensure compliance with IRS regulations. In this article, we’ll delve into the details of 1099 paperwork requirements, including who needs to file, what information is required, and the deadlines for submission.

Who Needs to File 1099 Forms?

Any business or individual that makes payments to non-employees, such as freelancers, independent contractors, or vendors, must file 1099 forms with the IRS. This includes: * Businesses that pay more than $600 in a calendar year to a non-employee for services performed * Rental property owners who pay more than $600 in rent to a non-employee * Banks and other financial institutions that pay interest, dividends, or capital gains distributions * Brokers and barter exchanges that facilitate transactions

What Information is Required on 1099 Forms?

The 1099 form requires the following information: * Payer’s name, address, and taxpayer identification number (TIN) * Recipient’s name, address, and TIN * Type of payment made (e.g., non-employee compensation, rent, interest) * Amount of payment made * Any federal income tax withheld The following table summarizes the different types of 1099 forms and the information required for each:

| Form Type | Description | Information Required |

|---|---|---|

| 1099-MISC | Non-employee compensation, rent, and other miscellaneous income | Payer and recipient information, payment amount, and type of payment |

| 1099-INT | Interest income | Payer and recipient information, interest amount, and any federal income tax withheld |

| 1099-DIV | Dividend and capital gains distributions | Payer and recipient information, dividend and capital gains amounts, and any federal income tax withheld |

Filing Deadlines and Procedures

The deadlines for filing 1099 forms with the IRS are as follows: * January 31st: Deadline for furnishing 1099 forms to recipients * February 28th: Deadline for filing paper 1099 forms with the IRS * March 31st: Deadline for filing electronic 1099 forms with the IRS Payers can file 1099 forms electronically using the IRS’s FIRE (Filing Information Returns Electronically) system or by mailing paper forms to the IRS.

📝 Note: It's essential to keep accurate records of 1099 forms, including copies of the forms and proof of mailing or electronic submission, in case of an audit or other inquiry by the IRS.

Penalties for Non-Compliance

Failure to file 1099 forms or furnish them to recipients can result in significant penalties, including: * $250 per form for failing to file or furnish 1099 forms * $500 per form for intentional disregard of filing or furnishing requirements * Up to 47% of the unpaid tax due to failure to withhold federal income tax

Best Practices for 1099 Paperwork Compliance

To ensure compliance with 1099 paperwork requirements, follow these best practices: * Maintain accurate and complete records of payments made to non-employees * Verify recipient information, including TINs and addresses * File 1099 forms electronically to reduce errors and improve processing efficiency * Furnish 1099 forms to recipients by the deadline to avoid penalties

In summary, 1099 paperwork requirements are an essential aspect of tax compliance for businesses and individuals that make payments to non-employees. By understanding who needs to file, what information is required, and the deadlines for submission, payers can ensure compliance with IRS regulations and avoid penalties for non-compliance.

What is the deadline for filing 1099 forms with the IRS?

+

The deadline for filing 1099 forms with the IRS is February 28th for paper forms and March 31st for electronic forms.

What is the penalty for failing to file 1099 forms?

+

The penalty for failing to file 1099 forms is $250 per form, and up to 47% of the unpaid tax due to failure to withhold federal income tax.

Can I file 1099 forms electronically?

+

Yes, you can file 1099 forms electronically using the IRS’s FIRE (Filing Information Returns Electronically) system.