5 Tips Cobra Paperwork

Understanding Cobra Paperwork: A Comprehensive Guide

When it comes to dealing with Cobra paperwork, many individuals and employers find themselves overwhelmed by the complexity and legal requirements involved. The Consolidated Omnibus Budget Reconciliation Act, commonly referred to as COBRA, is a federal law that requires certain employers to offer continued health coverage to employees and their families after a qualifying event, such as job loss, divorce, or death. Navigating through the paperwork and ensuring compliance can be challenging, but with the right approach, it can be managed efficiently.

Tip 1: Identify Qualifying Events and Eligible Beneficiaries

To start, it’s crucial to identify qualifying events and determine who is eligible for COBRA coverage. Qualifying events include termination of employment, reduction in work hours, death of the covered employee, divorce or legal separation, and a child losing dependent status. Eligible beneficiaries typically include the employee, spouse, and dependent children. Employers must provide notice to the plan administrator within 30 days of a qualifying event. This initial step sets the stage for the entire COBRA process, making it essential to get it right.

Tip 2: Notify the Plan Administrator

After identifying a qualifying event, the next step is to notify the plan administrator. This notification must be made within a specific timeframe (usually 30 days) and includes providing details about the event and the individuals affected. The plan administrator then takes over the responsibility of sending out COBRA election notices to the qualified beneficiaries, which must be done within 14 days of receiving the notification from the employer. This step is critical for initiating the COBRA election process.

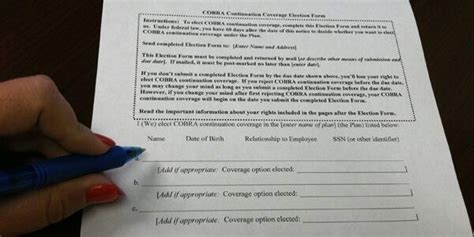

Tip 3: Manage COBRA Election Notices

The COBRA election notice is a critical document that outlines the options available to qualified beneficiaries, including the right to elect or decline continued coverage, the cost of such coverage, and the deadline by which they must make this decision. Beneficiaries typically have 60 days from the date the notice is sent (or the date coverage would otherwise end, if later) to elect COBRA coverage. It’s essential for employers and plan administrators to ensure these notices are sent out correctly and that beneficiaries understand their options and the timeframe for responding.

Tip 4: Handle Premium Payments and Coverage

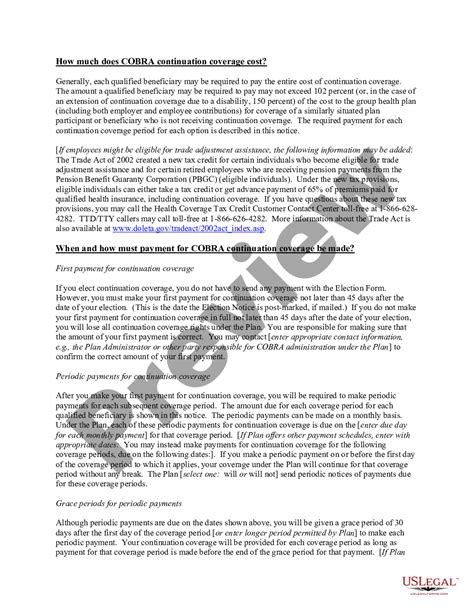

Once a beneficiary elects COBRA coverage, they are responsible for paying the full premium (plus a 2% administrative fee) for their continued health coverage. Employers must establish a process for collecting these premiums, which can be a logistical challenge, especially for smaller businesses. It’s also important to have a system in place for handling premium payments, including setting deadlines, sending reminders, and terminating coverage if payments are not made in a timely manner. Additionally, understanding the duration of COBRA coverage, which is typically up to 18 months but can be extended under certain circumstances, is vital for planning and compliance.

Tip 5: Maintain Compliance and Records

Finally, maintaining compliance with COBRA regulations and keeping accurate records is paramount. This includes documenting all qualifying events, notifications to the plan administrator, COBRA election notices sent to beneficiaries, and premium payment records. Employers must also be aware of the potential penalties for non-compliance, which can include fines and legal action. Staying up-to-date with any changes to COBRA laws and regulations is also essential for ensuring ongoing compliance.

📝 Note: Employers should consult with legal or HR professionals to ensure they are meeting all COBRA requirements and to address any specific questions or concerns about the process.

Key Considerations for Employers

In addition to the tips outlined above, employers should consider the following key points when dealing with COBRA paperwork: - Communicate clearly with beneficiaries about their options and responsibilities. - Establish a systematic process for handling COBRA notifications and premium payments. - Review and understand the terms of the health plan, including any limitations or exclusions. - Be prepared to adapt to changes in COBRA laws or regulations.

| Event | Notification Deadline | COBRA Coverage Duration |

|---|---|---|

| Termination of Employment | 30 days | Up to 18 months |

| Divorce or Legal Separation | 30 days | Up to 36 months |

| Death of the Covered Employee | 30 days | Up to 36 months |

In summary, managing COBRA paperwork effectively requires a thorough understanding of the law, careful planning, and attention to detail. By following these tips and staying informed, employers can navigate the complexities of COBRA with confidence, ensuring compliance and providing the necessary support to their employees and beneficiaries during significant life changes.

What is the purpose of COBRA paperwork?

+

The purpose of COBRA paperwork is to facilitate the continuation of health coverage for employees and their families after a qualifying event, ensuring they have access to necessary medical care without interruption.

Who is eligible for COBRA coverage?

+

Eligible beneficiaries for COBRA coverage typically include the employee, spouse, and dependent children, provided they were covered under the health plan on the day before the qualifying event.

How long do beneficiaries have to elect COBRA coverage?

+

Beneficiaries have 60 days from the date the COBRA election notice is sent (or the date coverage would otherwise end, if later) to elect COBRA coverage.