5 Chapter 7 Filing Tips

Understanding the Basics of Chapter 7 Filing

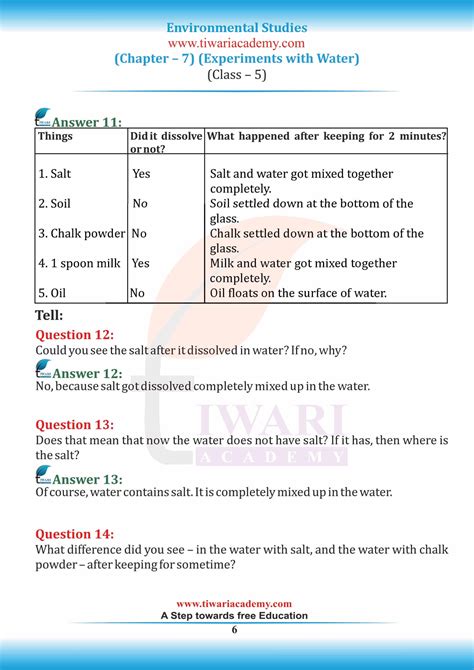

When considering bankruptcy, one of the most common types of personal bankruptcy is Chapter 7. This chapter allows individuals to liquidate their assets to pay off creditors. However, the process can be complex, and understanding the basics is crucial before proceeding. Chapter 7 filing involves a trustee who oversees the process, selling non-exempt assets to repay debts. It’s essential to know that not all debts can be discharged, such as student loans and child support.

Pre-Filing Preparations

Before filing for Chapter 7 bankruptcy, several steps must be taken. Firstly, gathering all financial documents is crucial. This includes income statements, expense reports, asset valuations, and debt lists. Understanding the difference between secured and unsecured debts is also vital, as this affects how debts are treated in the bankruptcy process. Secured debts, such as mortgages and car loans, are tied to specific assets, whereas unsecured debts, like credit card debt, are not.

Exemptions in Chapter 7 Bankruptcy

One of the critical aspects of Chapter 7 filing is understanding exemptions. Exemptions are assets that are protected from being sold by the trustee. These can include primary residences, personal vehicles, household goods, and retirement accounts. The specific exemptions available vary by state, so it’s crucial to understand the laws in your jurisdiction. Some individuals may choose to use federal exemptions instead of state exemptions, depending on which provides more protection for their assets.

Steps to Filing Chapter 7 Bankruptcy

The process of filing for Chapter 7 bankruptcy involves several key steps: - Credit Counseling: Before filing, individuals must complete a credit counseling course from an approved agency. - Filing the Petition: The bankruptcy petition, along with supporting documents, is filed with the court. - Automatic Stay: Once the petition is filed, an automatic stay goes into effect, stopping most collection activities by creditors. - Trustee Appointment: A trustee is appointed to oversee the bankruptcy estate. - Meeting of Creditors: The individual must attend a meeting of creditors, also known as a 341 meeting, where the trustee and creditors can ask questions. - Discharge: After the process is complete, the court grants a discharge of debts, releasing the individual from personal liability for discharged debts.

Tips for a Smooth Chapter 7 Filing Process

To ensure a smooth Chapter 7 filing process, consider the following tips: - Honesty is Key: Be completely honest in your filings. Bankruptcy fraud is a serious offense. - Choose the Right Attorney: Working with an experienced bankruptcy attorney can make a significant difference in the outcome of your case. - Understand the Costs: Filing for Chapter 7 bankruptcy involves costs, including filing fees and attorney fees. - Rebuilding Credit: After the discharge, focus on rebuilding your credit by making timely payments on any remaining debts and considering a secured credit card.

💡 Note: The Chapter 7 bankruptcy process can be complex and varies significantly depending on individual circumstances. It's always recommended to consult with a bankruptcy attorney to understand how the process applies to your specific situation.

In the end, Chapter 7 bankruptcy can provide a fresh start for individuals overwhelmed by debt. By understanding the process, preparing thoroughly, and seeking professional advice, individuals can navigate the bankruptcy system effectively and move towards financial recovery. The key is to approach the process with a clear understanding of the steps involved and the implications of each decision. With the right mindset and preparation, it’s possible to emerge from Chapter 7 bankruptcy with a cleaner financial slate and a renewed sense of financial stability.

What is the primary purpose of filing for Chapter 7 bankruptcy?

+

The primary purpose of filing for Chapter 7 bankruptcy is to liquidate non-exempt assets to pay off creditors and receive a discharge of debts, providing a fresh financial start.

Are all debts discharged in Chapter 7 bankruptcy?

+

No, not all debts can be discharged in Chapter 7 bankruptcy. Examples of non-dischargeable debts include student loans, child support, and certain taxes.

How long does the Chapter 7 bankruptcy process typically take?

+

The length of the Chapter 7 bankruptcy process can vary, but it typically takes about 4 to 6 months from the filing of the petition to the discharge of debts.