Paperwork

Banks Keep Real Estate Loan Records

Introduction to Real Estate Loan Records

Banks play a crucial role in the real estate industry by providing financial assistance to individuals and businesses for purchasing, constructing, or renovating properties. One of the key aspects of banking in the real estate sector is maintaining accurate and detailed records of all transactions, including loans. Real estate loan records are essential for banks to manage their risk, ensure compliance with regulatory requirements, and provide excellent customer service. In this article, we will delve into the world of real estate loan records, exploring their importance, components, and benefits.

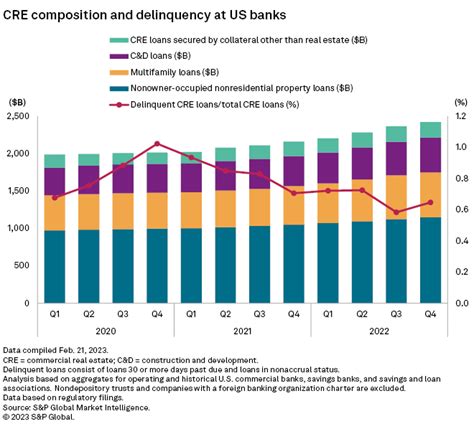

Importance of Real Estate Loan Records

Real estate loan records are vital for banks as they contain critical information about the borrower, the property, and the loan terms. These records help banks to: * Assess the creditworthiness of borrowers * Evaluate the risk associated with lending * Monitor loan performance and repayment schedules * Identify potential defaults or delinquencies * Comply with regulatory requirements and laws * Provide customer support and resolve disputes

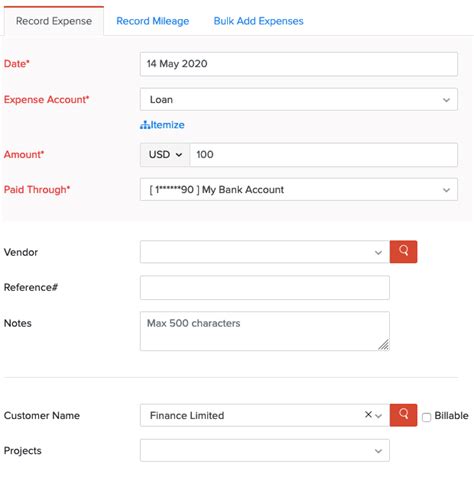

Components of Real Estate Loan Records

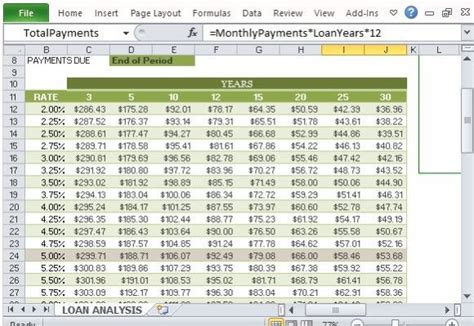

A typical real estate loan record includes the following components: * Borrower information: name, address, contact details, and employment history * Property details: address, type, value, and location * Loan terms: amount, interest rate, repayment schedule, and maturity date * Collateral information: type, value, and description of the collateral * Payment history: record of all payments made, including dates and amounts * Credit report: credit score and history of the borrower * Appraisal report: value of the property as determined by an appraiser

Benefits of Accurate Real Estate Loan Records

Maintaining accurate and up-to-date real estate loan records offers numerous benefits to banks, including: * Improved risk management: accurate records help banks to assess credit risk and make informed lending decisions * Enhanced customer service: detailed records enable banks to provide personalized support and resolve customer queries efficiently * Regulatory compliance: accurate records ensure that banks comply with regulatory requirements and laws, reducing the risk of penalties and fines * Increased efficiency: automated record-keeping systems can streamline loan processing, reduce errors, and improve productivity * Better decision-making: accurate records provide valuable insights into loan performance, enabling banks to make informed decisions about lending and risk management

Challenges in Maintaining Real Estate Loan Records

Despite the importance of real estate loan records, banks face several challenges in maintaining accurate and up-to-date records, including: * Data quality issues: inaccurate or incomplete data can lead to errors and inconsistencies in loan records * Manual record-keeping: manual processes can be time-consuming, prone to errors, and difficult to scale * Regulatory changes: frequent changes to regulatory requirements can make it challenging for banks to ensure compliance * Cybersecurity risks: electronic records are vulnerable to cyber threats, which can compromise the security and integrity of loan records

Best Practices for Maintaining Real Estate Loan Records

To overcome the challenges associated with maintaining real estate loan records, banks can adopt the following best practices: * Implement automated record-keeping systems: automate loan processing and record-keeping to reduce errors and improve efficiency * Ensure data quality: implement data validation and verification processes to ensure accuracy and completeness of loan records * Provide training and support: train staff on regulatory requirements, loan processing, and record-keeping procedures * Conduct regular audits: perform regular audits to ensure compliance with regulatory requirements and identify areas for improvement * Invest in cybersecurity: implement robust cybersecurity measures to protect electronic loan records from cyber threats

📝 Note: Banks should regularly review and update their real estate loan records to ensure accuracy and compliance with regulatory requirements.

Conclusion and Future Outlook

In conclusion, real estate loan records are a critical component of banking operations, providing valuable insights into loan performance, risk management, and customer behavior. By maintaining accurate and up-to-date records, banks can improve risk management, enhance customer service, and ensure regulatory compliance. As the banking industry continues to evolve, it is essential for banks to adopt automated record-keeping systems, ensure data quality, and invest in cybersecurity measures to protect loan records from cyber threats. By doing so, banks can navigate the complex landscape of real estate lending and maintain their competitive edge in the market.

What is the purpose of maintaining real estate loan records?

+

The purpose of maintaining real estate loan records is to manage risk, ensure compliance with regulatory requirements, and provide excellent customer service.

What are the components of a typical real estate loan record?

+

A typical real estate loan record includes borrower information, property details, loan terms, collateral information, payment history, credit report, and appraisal report.

How can banks maintain accurate and up-to-date real estate loan records?

+

Banks can maintain accurate and up-to-date real estate loan records by implementing automated record-keeping systems, ensuring data quality, providing training and support, conducting regular audits, and investing in cybersecurity measures.