Paperwork

Business Paperwork Retention Period

Understanding Business Paperwork Retention Period

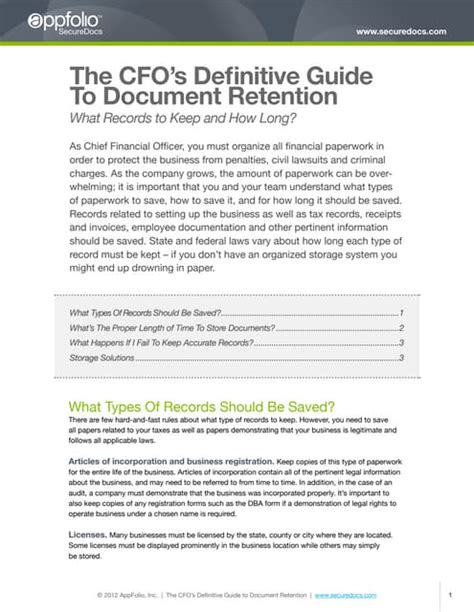

As a business owner, it is essential to understand the importance of retaining paperwork for a specific period. The retention period varies depending on the type of document, and it is crucial to comply with the relevant laws and regulations. Failure to retain documents for the required period can result in penalties, fines, and even legal action. In this article, we will discuss the different types of business paperwork, their retention periods, and the best practices for managing and storing documents.

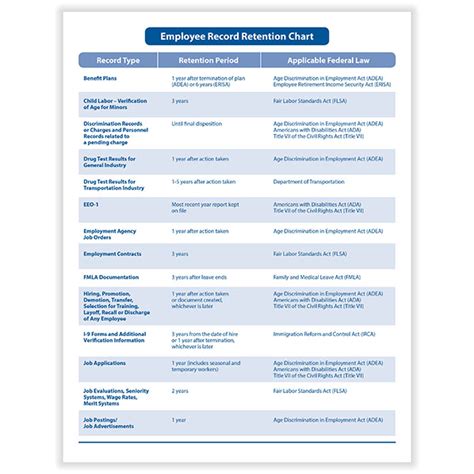

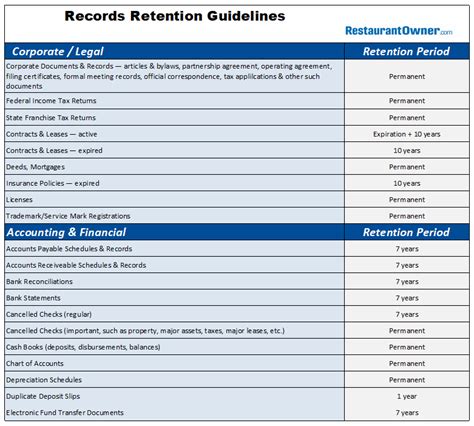

Types of Business Paperwork and Their Retention Periods

There are various types of business paperwork, including financial documents, tax returns, employment records, and contracts. Each type of document has a specific retention period, which is outlined below: * Financial documents: 7 years - This includes invoices, receipts, bank statements, and other financial records. * Tax returns: 6 years - This includes company tax returns, VAT returns, and PAYE records. * Employment records: 6 years - This includes employee contracts, payroll records, and personnel files. * Contracts: 6 years - This includes business contracts, agreements, and leases. * Health and safety records: 3 years - This includes accident reports, risk assessments, and safety records. * Environmental records: 3 years - This includes waste management records, pollution records, and environmental permits.

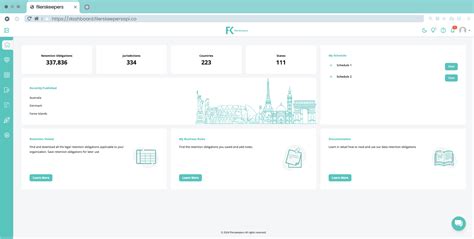

Best Practices for Managing and Storing Documents

To ensure compliance with the relevant laws and regulations, it is essential to implement a document management system. This includes: * Digitizing documents: Scanning and storing documents electronically can help reduce storage space and improve accessibility. * Creating a filing system: Organizing documents in a logical and consistent manner can help ensure that documents are easily retrievable. * Labeling and dating documents: Clearly labeling and dating documents can help ensure that documents are easily identifiable and can be retained for the required period. * Storing documents securely: Storing documents in a secure location, such as a locked cabinet or a secure online storage system, can help protect against unauthorized access or damage.

Benefits of Retaining Business Paperwork

Retaining business paperwork for the required period can have several benefits, including: * Compliance with laws and regulations: Retaining documents for the required period can help ensure compliance with relevant laws and regulations. * Protection against audits and investigations: Retaining documents can provide evidence of business transactions and activities, which can help protect against audits and investigations. * Improved financial management: Retaining financial documents can help improve financial management, including budgeting, forecasting, and financial reporting. * Enhanced business decision-making: Retaining documents can provide valuable insights and information, which can help inform business decisions.

📝 Note: It is essential to consult with a legal or financial expert to determine the specific retention periods for your business, as these can vary depending on the industry, location, and type of document.

Common Mistakes to Avoid

When managing and storing business paperwork, there are several common mistakes to avoid, including: * Failing to retain documents for the required period * Not creating a filing system * Not labeling and dating documents * Not storing documents securely * Not regularly reviewing and updating documents

Conclusion

In summary, retaining business paperwork for the required period is essential for compliance with laws and regulations, protection against audits and investigations, improved financial management, and enhanced business decision-making. By understanding the different types of business paperwork, their retention periods, and implementing a document management system, businesses can ensure that they are retaining documents for the required period. It is also essential to avoid common mistakes, such as failing to retain documents for the required period, not creating a filing system, and not storing documents securely.

What is the retention period for financial documents?

+

The retention period for financial documents is 7 years.

How should I store business paperwork?

+

Business paperwork should be stored in a secure location, such as a locked cabinet or a secure online storage system.

What are the benefits of retaining business paperwork?

+

The benefits of retaining business paperwork include compliance with laws and regulations, protection against audits and investigations, improved financial management, and enhanced business decision-making.