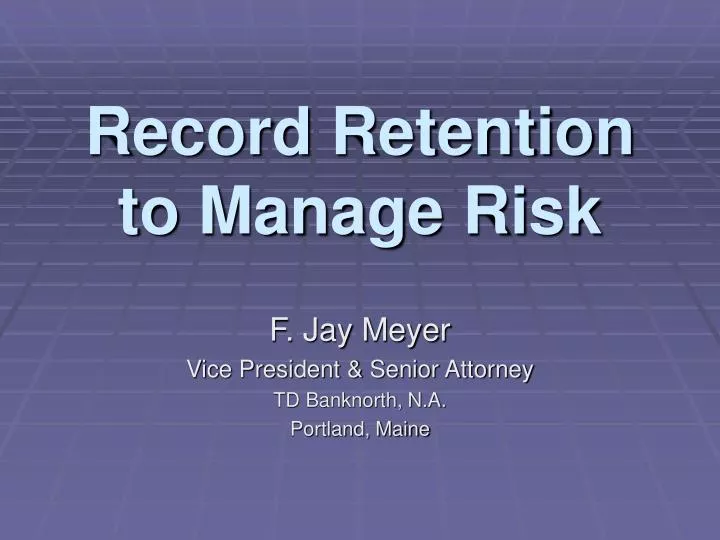

Lien Sale Paperwork Retention Period

Introduction to Lien Sale Paperwork Retention

When dealing with lien sales, it’s essential to understand the importance of retaining paperwork. A lien sale occurs when a lienholder, typically a bank or other financial institution, sells a property to satisfy a debt. The process involves various documents, and retaining these papers is crucial for accounting, auditing, and compliance purposes. In this article, we’ll delve into the world of lien sale paperwork retention, exploring the best practices, regulations, and recommended retention periods.

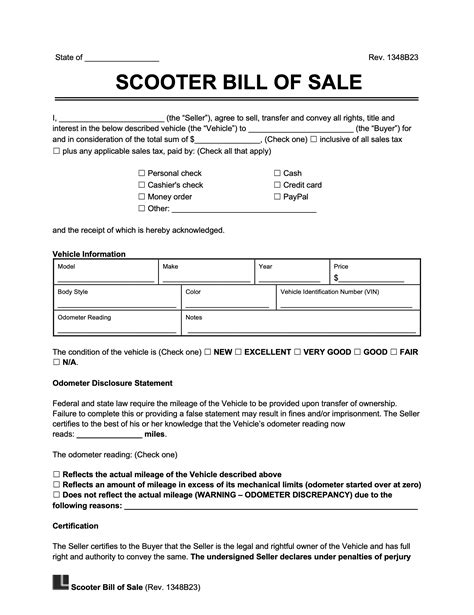

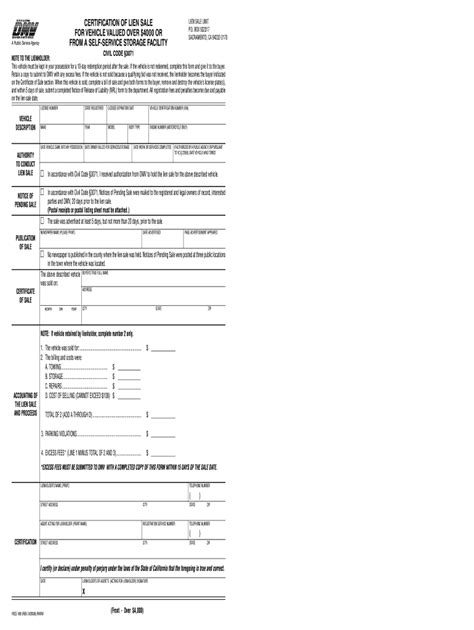

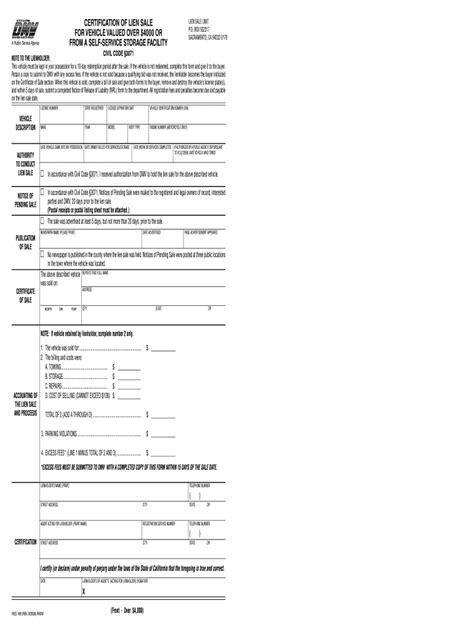

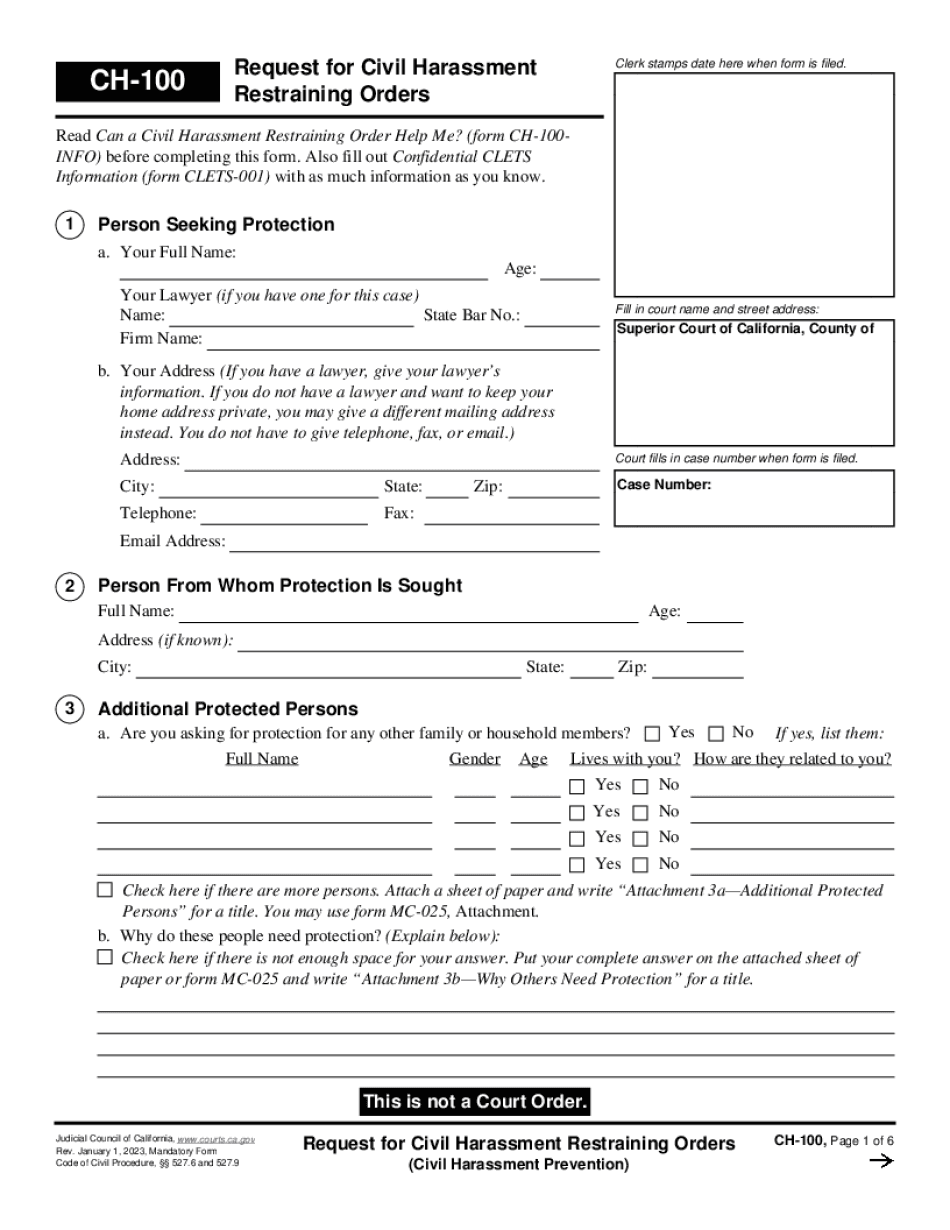

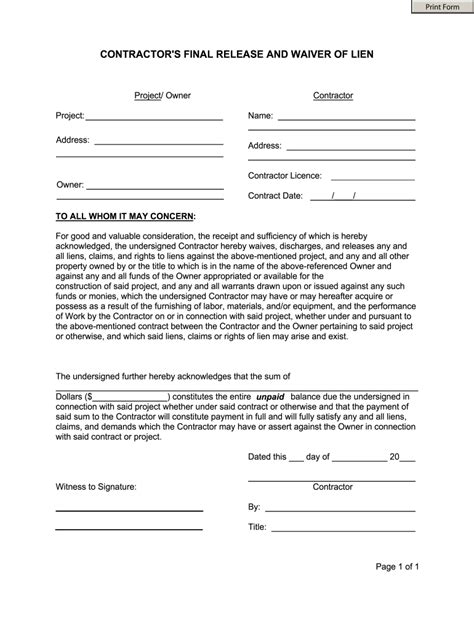

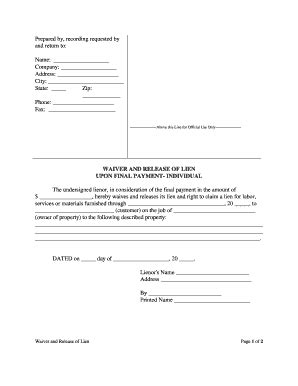

Understanding Lien Sale Paperwork

Lien sale paperwork includes a wide range of documents, such as: * Notice of Default: A formal notice sent to the borrower indicating that they have defaulted on their loan. * Notice of Sale: A public notice announcing the sale of the property. * Deed of Trust: A document that secures the loan and grants the lender a lien on the property. * Title Report: A document that outlines the property’s ownership history and any outstanding liens. * Sale Agreement: A contract between the buyer and seller outlining the terms of the sale. These documents must be retained for a specified period to ensure compliance with regulations and to provide a paper trail in case of disputes or audits.

Regulations and Retention Periods

The retention period for lien sale paperwork varies depending on the jurisdiction and type of document. Some common regulations and retention periods include: * IRS Regulations: The Internal Revenue Service (IRS) requires that documents related to tax liabilities be retained for at least three years. * State Regulations: State laws may require that lien sale documents be retained for a specific period, such as five years or seven years. * Industry Standards: Professional organizations, such as the Mortgage Bankers Association, recommend retaining documents for 10 years or more.

| Document Type | Retention Period |

|---|---|

| Notice of Default | 3-5 years |

| Notice of Sale | 5-7 years |

| Deed of Trust | 10 years or more |

| Title Report | 10 years or more |

| Sale Agreement | 5-10 years |

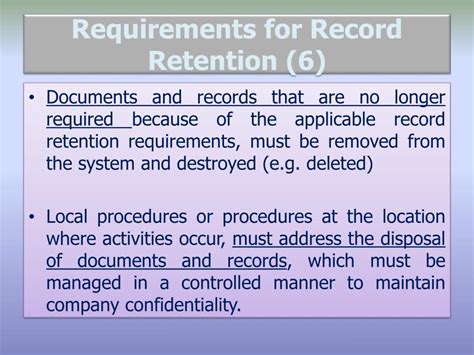

Best Practices for Paperwork Retention

To ensure effective paperwork retention, consider the following best practices: * Centralized Storage: Store all lien sale documents in a centralized location, such as a secure online repository or a locked file cabinet. * Digitalization: Consider digitizing documents to reduce storage space and improve accessibility. * Indexing and Cataloging: Create an index or catalog of retained documents to facilitate easy retrieval. * Access Control: Implement access controls to ensure that only authorized personnel can access retained documents. * Regular Audits: Conduct regular audits to ensure that retained documents are accurate, complete, and compliant with regulations.

📝 Note: Regularly review and update retention policies to ensure compliance with changing regulations and industry standards.

Conclusion and Final Thoughts

In conclusion, retaining lien sale paperwork is a critical aspect of compliance, accounting, and auditing. By understanding the types of documents involved, regulations, and retention periods, organizations can ensure that they are meeting their obligations. Implementing best practices, such as centralized storage, digitalization, and access control, can help streamline the retention process and reduce the risk of non-compliance. Ultimately, a well-organized paperwork retention system can provide peace of mind and help organizations avoid costly fines and reputational damage.

What is the recommended retention period for lien sale documents?

+

The recommended retention period for lien sale documents varies depending on the jurisdiction and type of document. However, a general guideline is to retain documents for at least 10 years or more.

What are the consequences of not retaining lien sale documents?

+

Failure to retain lien sale documents can result in non-compliance with regulations, costly fines, and reputational damage. It can also lead to disputes and audits, which can be time-consuming and costly to resolve.

How can I ensure that my organization is complying with lien sale document retention regulations?

+

To ensure compliance, regularly review and update your retention policies to ensure they align with changing regulations and industry standards. Implement best practices, such as centralized storage, digitalization, and access control, and conduct regular audits to ensure accuracy and completeness.