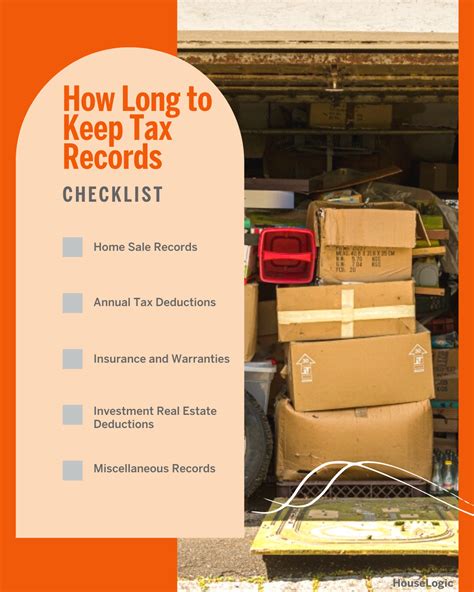

Keep Tax Paperwork For How Long

Introduction to Tax Paperwork Retention

When it comes to tax paperwork, one of the most common questions individuals and businesses have is how long they should keep these documents. The answer can vary depending on the type of tax paperwork and the potential need for it in the future, especially in case of an audit or if adjustments need to be made to previous tax returns. Proper retention of tax documents is crucial for ensuring compliance with tax laws and for personal financial management.

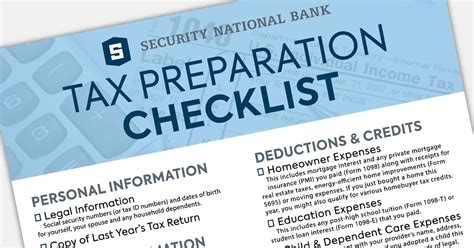

Understanding Different Types of Tax Paperwork

There are several types of tax paperwork that individuals and businesses need to keep track of. These include, but are not limited to: - Income tax returns: These are the annual returns filed with the tax authority, detailing income, deductions, and the amount of tax owed or refund due. - Receipts and invoices: These are crucial for documenting expenses that can be claimed as deductions on tax returns. - W-2 and 1099 forms: These forms are used to report income from employment and freelance or contract work, respectively. - Charitable donation receipts: Donations to qualified charitable organizations can be deducted from taxable income. - Medical expense receipts: Certain medical expenses can be deducted, and having detailed receipts is essential for claiming these deductions.

Guidelines for Retaining Tax Paperwork

The general rule of thumb is to keep tax paperwork for at least three years from the date the tax return was filed. This is because the IRS typically has three years from the filing date to initiate an audit. However, there are circumstances where it’s advisable to keep tax documents for a longer period: - Employment tax records should be kept for four years in case of an employment tax audit. - Records related to assets, such as property purchases or investments, should be kept for as long as you own the asset, plus three years after you dispose of it. This is crucial for calculating capital gains or losses. - Records of tax losses or credits that can be carried forward should be kept until the carryforward period expires, plus three years after you’ve claimed the last of the carryforward.

Best Practices for Organizing and Storing Tax Paperwork

Given the importance of retaining tax paperwork, it’s essential to have a system for organizing and storing these documents. Here are some best practices: - Digital Storage: Consider scanning your tax documents and storing them digitally. This can help reduce physical storage needs and make it easier to access your documents. - Secure Storage: Whether physical or digital, ensure that your tax documents are stored securely to protect against loss, theft, or unauthorized access. - Regular Review: Periodically review your stored documents to ensure they are up to date and to dispose of any documents that are no longer needed, in a secure manner.

Table of Tax Paperwork Retention Guidelines

| Type of Document | Retention Period |

|---|---|

| Income Tax Returns | At least 3 years from the filing date |

| Employment Tax Records | 4 years |

| Asset Purchase/Sale Records | Until asset is disposed of, plus 3 years |

| Charitable Donation Receipts | At least 3 years from the filing date of the return claiming the deduction |

📝 Note: The retention periods mentioned above are general guidelines. It's always best to consult with a tax professional for specific advice tailored to your situation.

Conclusion and Final Thoughts

In summary, keeping tax paperwork for the appropriate amount of time is crucial for complying with tax laws, managing personal finances, and being prepared in case of an audit. By understanding the different types of tax paperwork, following guidelines for retention, and implementing best practices for organization and storage, individuals and businesses can ensure they are well-prepared for any tax-related situation that may arise. Remember, it’s always better to err on the side of caution when deciding how long to keep tax documents.

How long should I keep my income tax returns?

+

You should keep your income tax returns for at least three years from the date the tax return was filed. However, it’s recommended to keep them for longer if you have assets or potential carryforward items.

What is the best way to store tax paperwork?

+

The best way to store tax paperwork is securely, either physically in a locked cabinet or digitally with strong encryption. Consider scanning your documents to reduce physical storage needs and make them easier to access.

Do I need to keep receipts for everything I purchase?

+

No, you don’t need to keep receipts for every purchase. However, it’s a good idea to keep receipts for items that could be deducted on your tax return, such as charitable donations, medical expenses, and business expenses.