Keep Insurance Paperwork

Introduction to Insurance Paperwork

When it comes to managing your finances, one of the most critical aspects is keeping track of your insurance paperwork. Insurance policies are designed to provide financial protection against various risks, and having the necessary documents in order is crucial for making claims and ensuring that you receive the benefits you are entitled to. In this article, we will explore the importance of keeping insurance paperwork, the different types of documents you should maintain, and provide tips on how to organize and store them.

Types of Insurance Paperwork

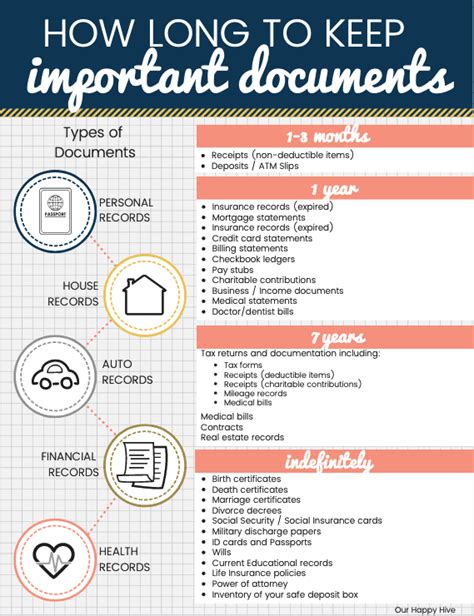

There are several types of insurance paperwork that you should keep, including: * Policy documents: These are the contracts between you and the insurance company, outlining the terms and conditions of the policy. * Premium payment records: These documents show that you have paid your premiums on time and can be useful in case of a dispute. * Claims documents: If you have made a claim, keep a record of the claim form, supporting documents, and any correspondence with the insurance company. * Renewal notices: Keep a record of renewal notices to ensure that you do not miss a payment or allow your policy to lapse. * Cancellation notices: If you have cancelled a policy, keep a record of the cancellation notice to avoid any potential disputes.

Importance of Keeping Insurance Paperwork

Keeping insurance paperwork is essential for several reasons: * Proof of coverage: In case of a claim, you will need to provide proof of coverage to the insurance company. * Dispute resolution: If there is a dispute with the insurance company, having a record of your paperwork can help resolve the issue. * Financial planning: Keeping track of your insurance paperwork can help you plan your finances and make informed decisions about your coverage. * Compliance with regulatory requirements: In some cases, you may be required to keep insurance paperwork for regulatory purposes.

Organizing and Storing Insurance Paperwork

To keep your insurance paperwork organized and easily accessible, consider the following tips: * Use a file folder or binder: Keep all your insurance documents in a designated file folder or binder, making it easy to find what you need. * Scan and digitize documents: Consider scanning and digitizing your insurance documents to create a digital record. * Keep a record of policy numbers and contact information: Keep a record of your policy numbers and the contact information of your insurance company, including phone numbers and email addresses. * Review and update your records regularly: Regularly review your insurance paperwork to ensure that it is up-to-date and accurate.

Best Practices for Managing Insurance Paperwork

To ensure that you are managing your insurance paperwork effectively, consider the following best practices: * Keep your paperwork in a safe and secure location: Keep your insurance paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service. * Make copies of important documents: Make copies of important documents, such as policy documents and claims forms, and store them in a separate location. * Stay organized and keep track of deadlines: Stay organized and keep track of deadlines, such as premium payment due dates and renewal notices. * Seek professional advice if needed: If you are unsure about any aspect of your insurance paperwork, consider seeking professional advice from a licensed insurance agent or broker.

| Type of Document | Retention Period |

|---|---|

| Policy documents | Permanent |

| Premium payment records | 5-7 years |

| Claims documents | 5-7 years |

| Renewal notices | 1-2 years |

| Cancellation notices | 1-2 years |

📝 Note: The retention period for insurance paperwork may vary depending on the type of policy and the jurisdiction in which you live. It is essential to check with your insurance company or a licensed insurance professional to determine the specific retention requirements for your documents.

In summary, keeping insurance paperwork is crucial for managing your finances and ensuring that you receive the benefits you are entitled to. By understanding the different types of insurance paperwork, organizing and storing them effectively, and following best practices for management, you can ensure that you are well-prepared in case of a claim or dispute.

To summarize the key points, it is essential to keep your insurance paperwork organized, including policy documents, premium payment records, claims documents, renewal notices, and cancellation notices. Additionally, keeping a record of policy numbers and contact information, reviewing and updating your records regularly, and seeking professional advice if needed can help you manage your insurance paperwork effectively. By following these tips and best practices, you can ensure that you are well-prepared and can make informed decisions about your insurance coverage.

What types of insurance paperwork should I keep?

+

You should keep policy documents, premium payment records, claims documents, renewal notices, and cancellation notices.

How long should I keep my insurance paperwork?

+

The retention period for insurance paperwork varies depending on the type of policy and jurisdiction. Generally, you should keep policy documents permanently, premium payment records for 5-7 years, and claims documents for 5-7 years.

What is the best way to organize and store my insurance paperwork?

+

Consider using a file folder or binder to keep your insurance documents organized. You can also scan and digitize your documents to create a digital record. Keep your paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service.