Paperwork

Keep Paperwork How Long

Introduction to Record Keeping

When it comes to managing personal or business finances, keeping accurate and detailed records is essential. One of the most common questions people have is how long they should keep their paperwork. The answer to this question varies depending on the type of document, its significance, and the potential need for future reference. In this article, we will explore the different types of documents, their importance, and the recommended retention periods.

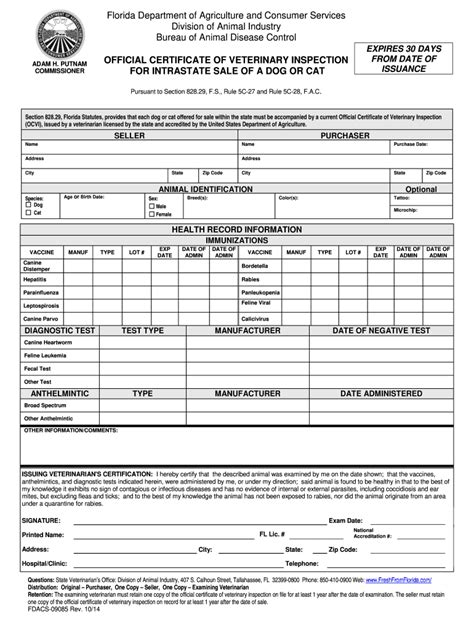

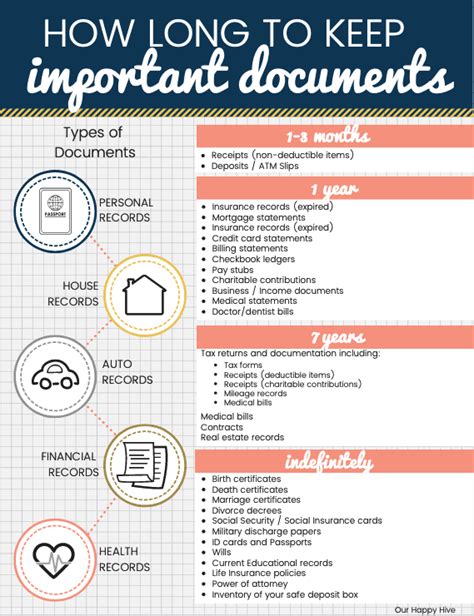

Understanding Document Types

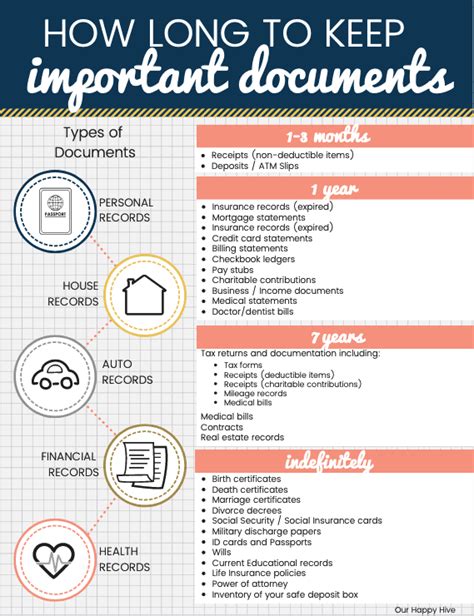

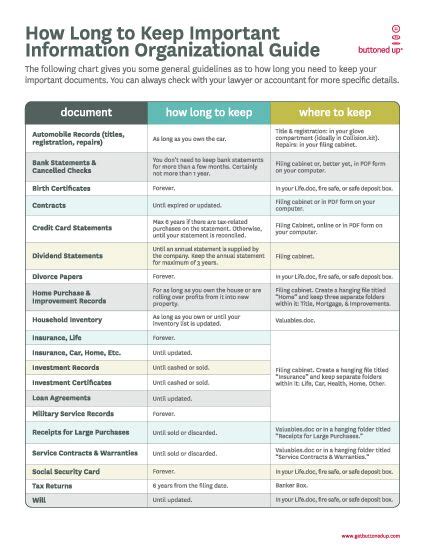

There are several types of documents that individuals and businesses need to keep, including: * Financial documents: bank statements, invoices, receipts, and tax returns * Personal documents: identification documents, birth and marriage certificates, and divorce or separation agreements * Business documents: contracts, meeting minutes, and employee records * Tax documents: W-2 forms, 1099 forms, and other tax-related documents

Retention Periods for Documents

The retention period for documents depends on their significance and potential future use. Here are some general guidelines: * Financial documents: 3-7 years + Bank statements: 3 years + Invoices and receipts: 3-7 years + Tax returns: 7 years * Personal documents: permanently + Identification documents: permanently + Birth and marriage certificates: permanently + Divorce or separation agreements: permanently * Business documents: 3-10 years + Contracts: 3-10 years + Meeting minutes: 3-10 years + Employee records: 3-10 years * Tax documents: 7 years + W-2 forms: 7 years + 1099 forms: 7 years + Other tax-related documents: 7 years

📝 Note: The retention periods mentioned above are general guidelines and may vary depending on the specific laws and regulations in your country or state.

Storage and Organization

Proper storage and organization of documents are crucial to maintain their integrity and accessibility. Here are some tips: * Physical storage: use a fireproof safe or a secure filing cabinet to store physical documents * Digital storage: use a secure cloud storage service or an external hard drive to store digital documents * Organization: use a filing system to categorize and label documents, making them easy to find and retrieve

Disposal of Documents

When disposing of documents, it’s essential to do so securely to prevent identity theft and protect sensitive information. Here are some tips: * Shredding: use a shredder to destroy physical documents * Electronic disposal: use a secure deletion method to erase digital documents * Recycling: recycle paper documents to reduce waste and minimize environmental impact

Conclusion Summary

In summary, keeping accurate and detailed records is essential for managing personal or business finances. The retention period for documents varies depending on their significance and potential future use. By understanding the different types of documents, their importance, and the recommended retention periods, individuals and businesses can maintain a well-organized and secure record-keeping system.

What is the recommended retention period for tax returns?

+

The recommended retention period for tax returns is 7 years.

How should I store my physical documents?

+

You should store your physical documents in a fireproof safe or a secure filing cabinet.

What is the best way to dispose of sensitive documents?

+

The best way to dispose of sensitive documents is to shred them or use a secure deletion method for digital documents.