Estate Paperwork Retention Period

Understanding the Importance of Estate Paperwork Retention

When it comes to managing an estate, whether it’s your own or that of a loved one, paperwork plays a crucial role. From wills and trusts to property deeds and tax returns, the documentation involved can be overwhelming. One of the key considerations in estate management is the retention period for these documents. Knowing how long to keep each type of paperwork is essential for ensuring that you have the necessary records when you need them, without cluttering your space with unnecessary documents.

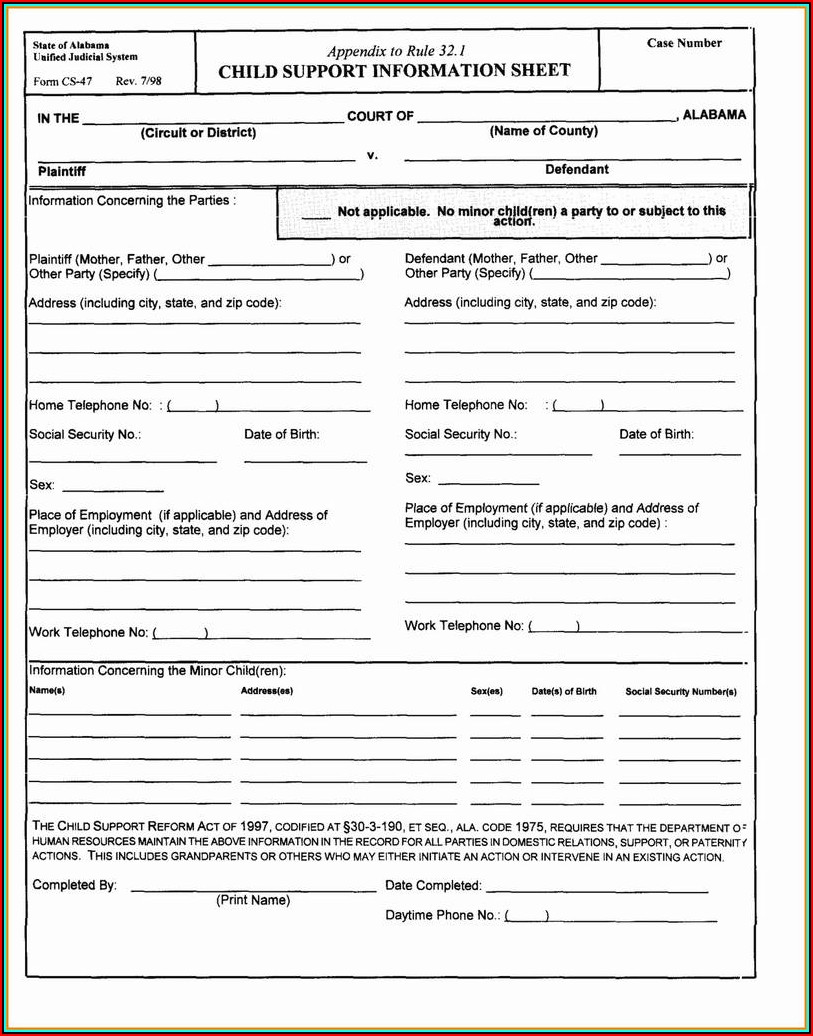

Types of Estate Paperwork

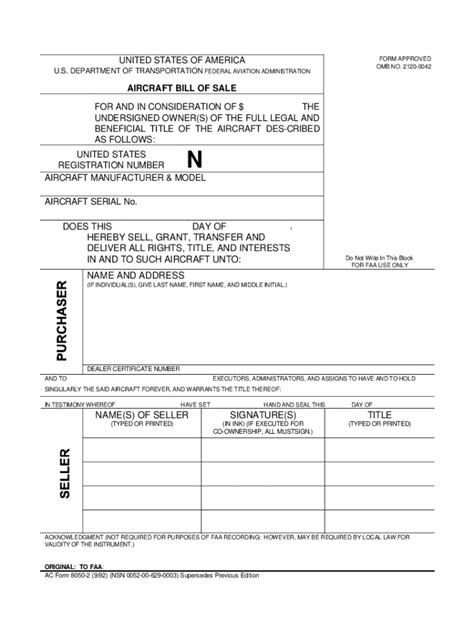

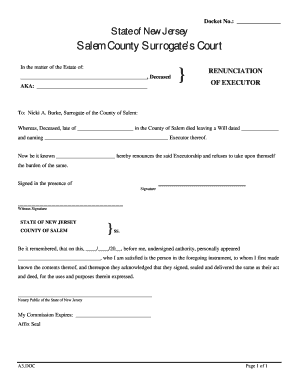

There are various types of paperwork associated with estate management, each with its own retention period. Some of the most common include: - Wills and Codicils: These are the foundation of estate planning, outlining how assets should be distributed after death. - Trusts: Trust documents detail the management and distribution of assets placed in a trust. - Property Deeds: These documents prove ownership of real estate. - Tax Returns: Estate tax returns are crucial for understanding the tax obligations of the estate. - Insurance Policies: Life insurance, homeowners insurance, and other policies are important for managing risk. - Financial Statements: Bank statements, investment accounts, and other financial records help in tracking the estate’s assets.

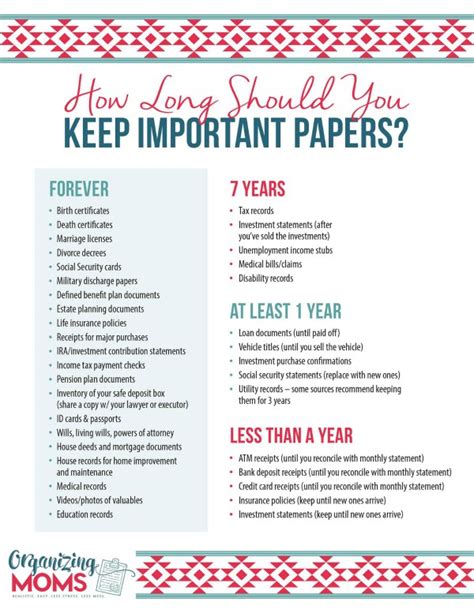

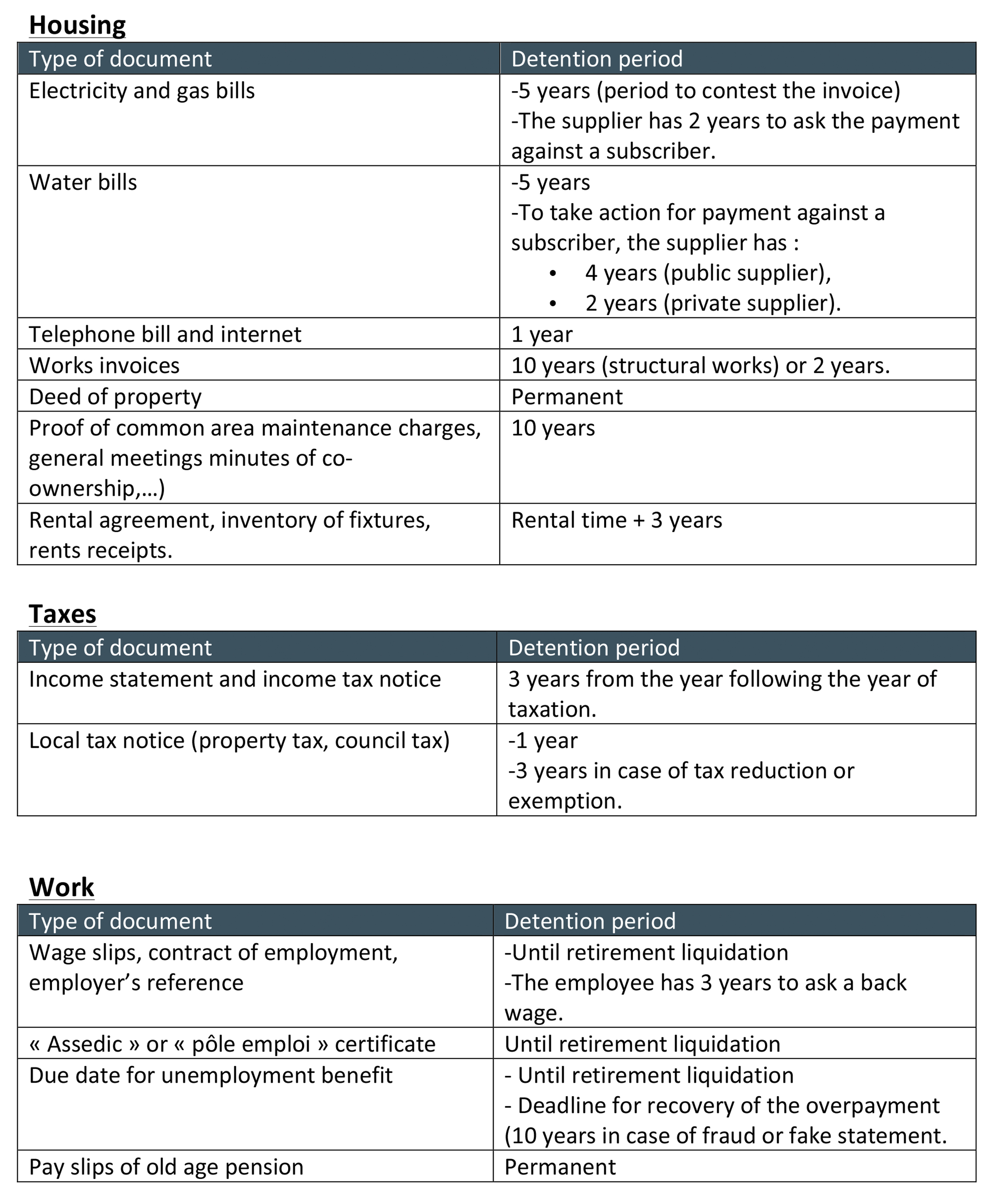

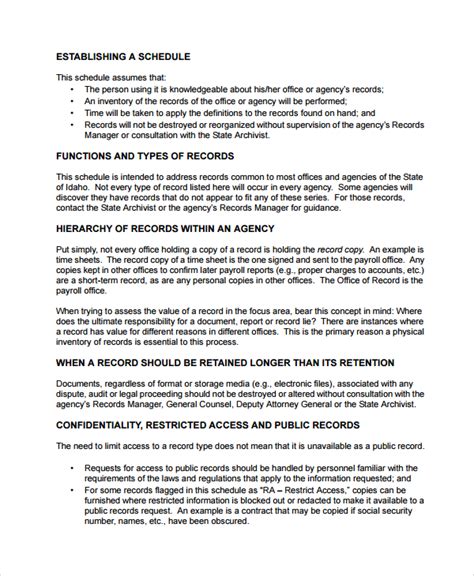

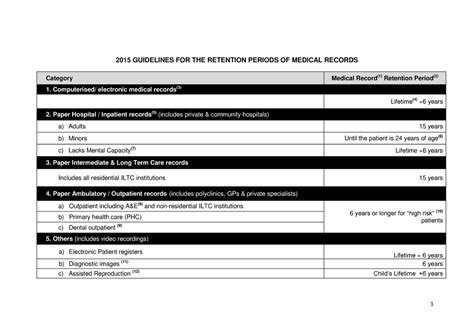

Retention Periods for Estate Paperwork

The retention period for estate paperwork can vary significantly depending on the type of document and local laws. Here are some general guidelines: - Wills and Trusts: These should be kept indefinitely, as they are foundational to the estate plan. - Property Deeds: Keep these for as long as you own the property, plus a reasonable period thereafter (often 6 years after sale). - Tax Returns: The IRS recommends keeping federal tax returns and supporting documents for at least three years in case of an audit. However, if you file a claim for a loss from worthless securities or bad debt deduction, you should keep records for seven years. If you’ve failed to file a return or have filed a fraudulent return, it’s recommended to keep records indefinitely. - Insurance Policies: Keep these for as long as the policy is in effect, plus a reasonable period after cancellation or expiration. - Financial Statements: It’s generally recommended to keep these for one year for tax purposes, but you may want to keep them longer for personal financial tracking.

Best Practices for Document Retention

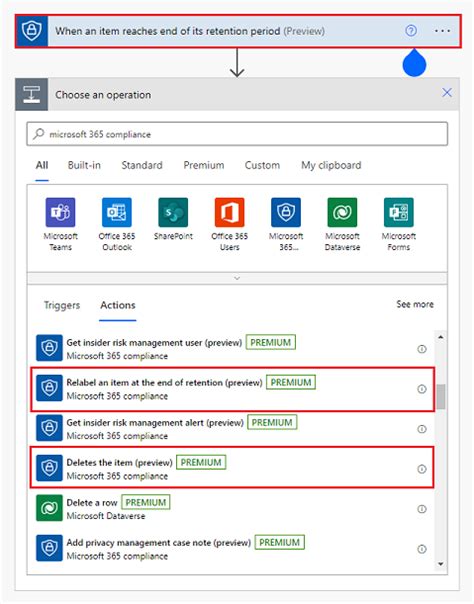

- Digitize Your Documents: Scanning physical documents and saving them digitally can help reduce clutter and make it easier to access and share documents when needed. - Use a Secure Storage Method: Whether physical or digital, ensure that your documents are stored securely. For physical documents, consider a fireproof safe or a safe deposit box. For digital documents, use encrypted storage solutions. - Organize Your Documents: Keep documents well-organized and easily accessible. This can be done by categorizing them (e.g., tax documents, estate planning documents) and using clear, descriptive file names. - Review and Update Regularly: Estate paperwork should be reviewed regularly to ensure it remains relevant and up-to-date. This includes updating beneficiary information on insurance policies and retirement accounts.

| Document Type | Retention Period |

|---|---|

| Wills and Trusts | Indefinitely |

| Property Deeds | As long as ownership, plus 6 years |

| Tax Returns | At least 3 years, 7 years for certain claims |

| Insurance Policies | Policy duration, plus a reasonable period |

| Financial Statements | 1 year for tax purposes, longer for personal tracking |

📝 Note: The retention periods mentioned are general guidelines and may vary based on specific circumstances or local regulations. It's always a good idea to consult with a legal or financial advisor for personalized advice.

In summary, managing estate paperwork requires a thorough understanding of the different types of documents involved and their respective retention periods. By digitizing, securing, organizing, and regularly reviewing these documents, individuals can ensure they are well-prepared for any situation that may arise. Whether you’re planning your own estate or managing that of a loved one, following these best practices can provide peace of mind and help avoid potential legal or financial complications.

What are the most important estate documents to retain?

+

The most critical documents include wills, trusts, property deeds, tax returns, and insurance policies. These documents form the basis of an estate plan and are essential for managing and distributing assets.

How long should I keep tax returns and supporting documents?

+

It’s recommended to keep federal tax returns and supporting documents for at least three years in case of an audit. However, this period can extend to seven years for certain claims, and indefinitely if you’ve failed to file a return or have filed a fraudulent return.

What’s the best way to store estate documents securely?

+

For physical documents, consider using a fireproof safe or a safe deposit box. For digital documents, use encrypted storage solutions to protect against unauthorized access. Always ensure that your documents are organized and easily accessible when needed.