5 Tips for Medicare

Introduction to Medicare

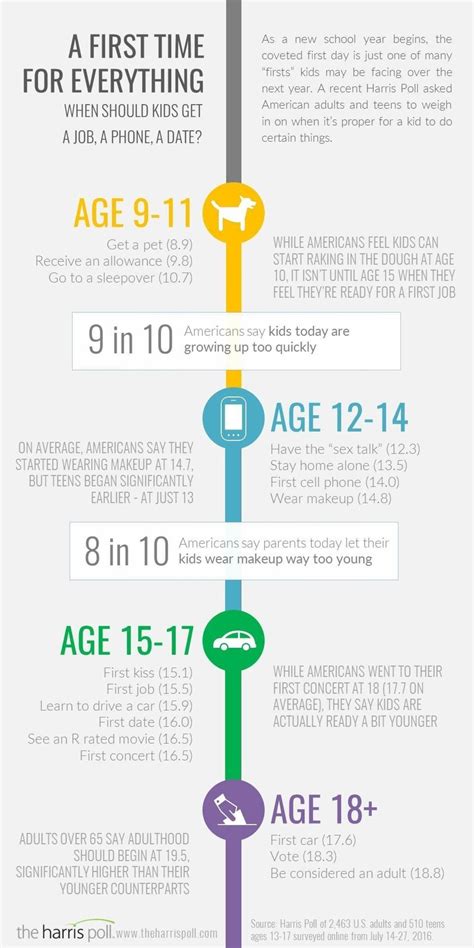

Medicare is a federal health insurance program in the United States that provides coverage to individuals who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). With so many options and complexities, navigating the Medicare system can be overwhelming. In this article, we will provide you with 5 tips to help you make the most of your Medicare benefits.

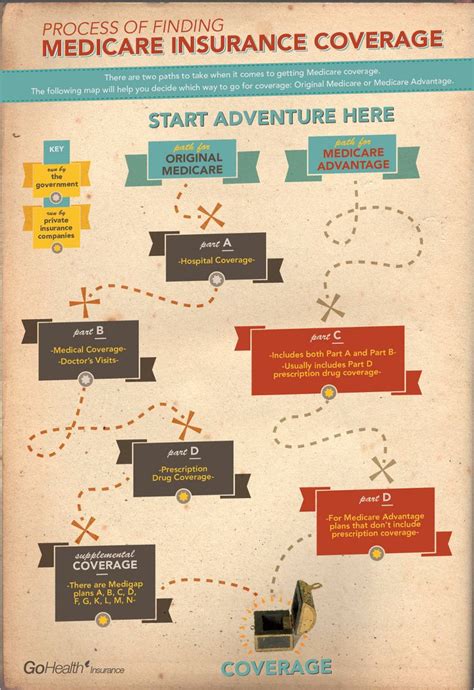

Understanding Medicare Options

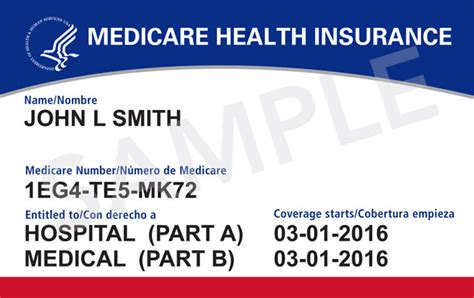

Before we dive into the tips, it’s essential to understand the different parts of Medicare. Medicare Part A covers hospital stays, skilled nursing facility care, and some home health care. Medicare Part B covers doctor visits, outpatient care, and some medical equipment. Medicare Part D covers prescription medications. Medicare Advantage Plans, also known as Medicare Part C, offer an alternative to Original Medicare, providing all the benefits of Parts A and B, and often additional benefits like dental, vision, and hearing coverage.

Tips for Maximizing Your Medicare Benefits

Here are five tips to help you get the most out of your Medicare benefits: * Tip 1: Choose the Right Plan: With so many Medicare plans available, it’s crucial to choose the one that best fits your needs. Consider factors like premiums, deductibles, copays, and coverage for services you need. You can use online tools or consult with a licensed insurance agent to find the best plan for you. * Tip 2: Understand Your Costs: Medicare costs can add up quickly, so it’s essential to understand what you’ll pay out-of-pocket. This includes premiums, deductibles, copays, and coinsurance. Make sure you factor these costs into your budget to avoid unexpected expenses. * Tip 3: Take Advantage of Preventive Services: Medicare covers a range of preventive services, including annual wellness visits, flu shots, and cancer screenings. These services can help you stay healthy and detect potential health issues early. * Tip 4: Know Your Enrollment Periods: Medicare has specific enrollment periods, during which you can sign up for or change your plan. The Initial Enrollment Period (IEP) is the 7-month period around your 65th birthday. The Annual Election Period (AEP) runs from October 15 to December 7 each year. Make sure you understand these periods to avoid missing important deadlines. * Tip 5: Review and Update Your Plan Annually: Medicare plans and your health needs can change over time. It’s essential to review your plan annually and update it as needed. This ensures you have the right coverage and don’t miss out on important benefits.

Additional Resources

For more information on Medicare, you can visit the official Medicare website or contact your local State Health Insurance Assistance Program (SHIP). These resources can provide you with personalized guidance and support to help you navigate the Medicare system.

📝 Note: It's essential to keep accurate records of your Medicare claims, payments, and correspondence. This will help you stay organized and ensure you receive the benefits you're entitled to.

To summarize, understanding your Medicare options, choosing the right plan, and taking advantage of preventive services are just a few ways to maximize your benefits. By following these tips and staying informed, you can make the most of your Medicare coverage and enjoy better health and financial security in your retirement years.

What is the difference between Medicare Advantage and Original Medicare?

+

Medicare Advantage Plans offer an alternative to Original Medicare, providing all the benefits of Parts A and B, and often additional benefits like dental, vision, and hearing coverage. Original Medicare, on the other hand, includes Parts A and B, and you can add Part D for prescription coverage.

Can I change my Medicare plan at any time?

+

No, you can only change your Medicare plan during specific enrollment periods, such as the Annual Election Period (AEP) or Special Enrollment Periods (SEPs). It’s essential to understand these periods to avoid missing important deadlines.

What are the costs associated with Medicare?

+

Medicare costs include premiums, deductibles, copays, and coinsurance. The costs vary depending on the plan you choose and your income level. It’s essential to factor these costs into your budget to avoid unexpected expenses.