LLC Organization Paperwork Requirements

Understanding the Basics of LLC Organization Paperwork Requirements

When it comes to forming a Limited Liability Company (LLC), one of the most critical steps is completing and filing the necessary paperwork. This process can seem daunting, especially for those who are new to the world of business. However, with a clear understanding of the requirements, entrepreneurs can navigate the system with ease. In this article, we will delve into the world of LLC organization paperwork, exploring the key documents and filings necessary for establishing a successful and legally compliant LLC.

The Importance of LLC Paperwork

Before diving into the specifics of the required paperwork, it’s essential to understand why this documentation is so crucial. Properly filed LLC paperwork helps to establish the company’s legal existence, protects the personal assets of its members, and ensures compliance with state and federal regulations. Furthermore, having all the necessary documents in order can facilitate future business operations, such as opening bank accounts, securing loans, and entering into contracts.

Key Components of LLC Paperwork

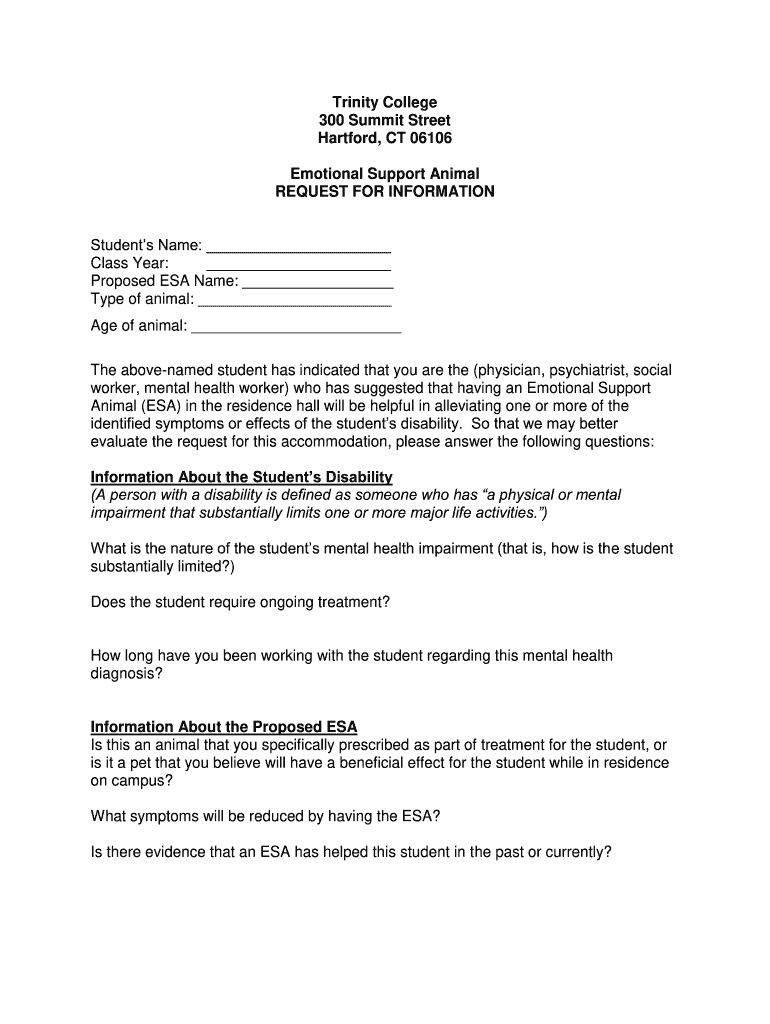

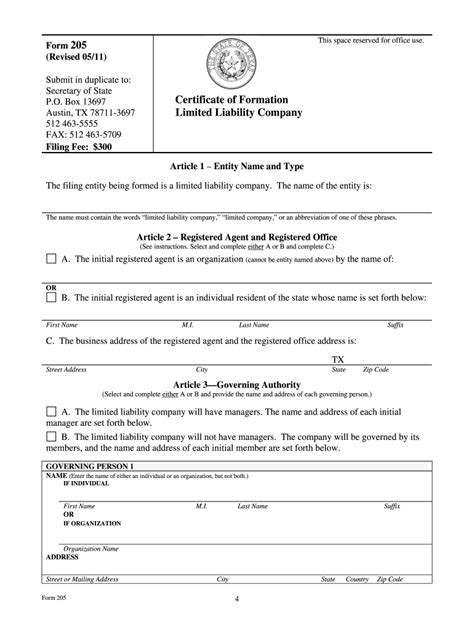

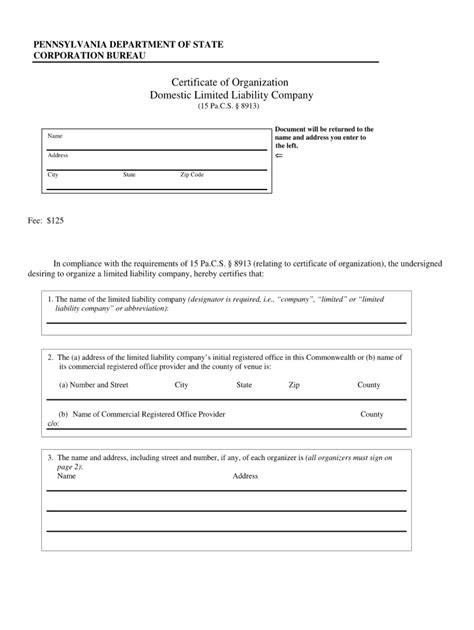

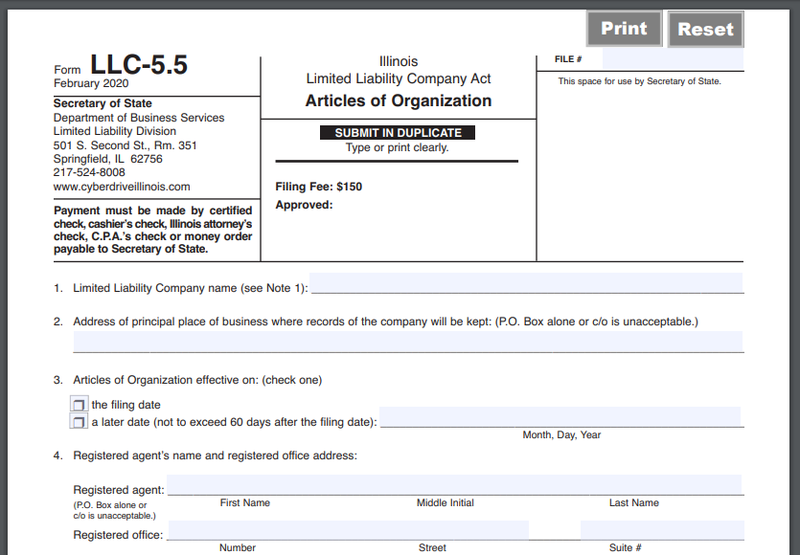

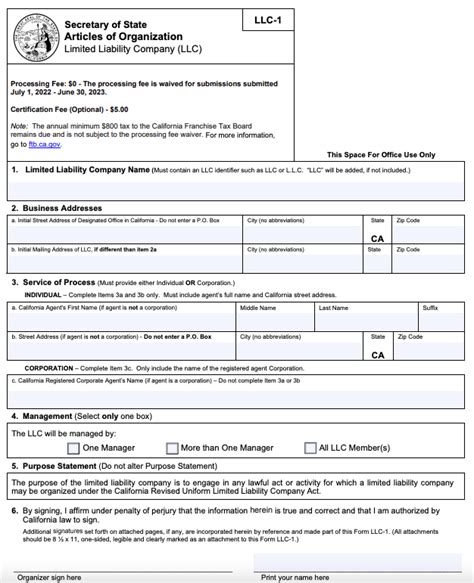

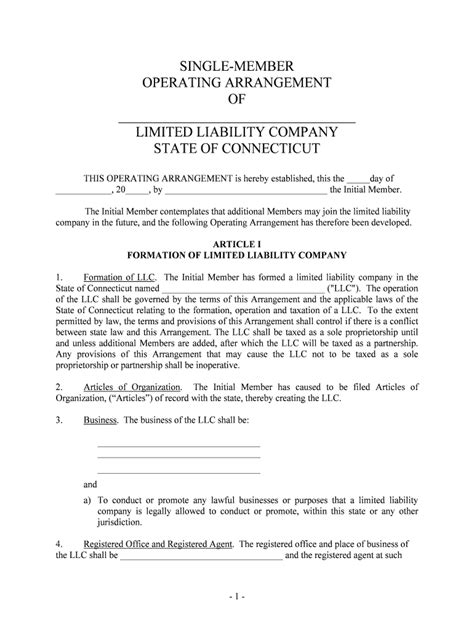

The paperwork requirements for an LLC can vary depending on the state in which the company is formed. However, there are several key components that are generally universal: - Articles of Organization: This document, also known as the Certificate of Formation or Certificate of Organization, is filed with the state to officially create the LLC. It typically includes the company’s name, address, purpose, and the names and addresses of its members or managers. - Operating Agreement: While not always required to be filed with the state, an operating agreement is a vital internal document that outlines the ownership, management structure, and operational procedures of the LLC. It helps to prevent misunderstandings and disputes among members by clearly defining their roles and responsibilities. - EIN (Employer Identification Number): Obtained from the IRS, an EIN is used to identify the business for tax purposes and is necessary for opening bank accounts, hiring employees, and filing tax returns. - Business Licenses and Permits: Depending on the nature of the business and its location, the LLC may need to obtain various licenses and permits to operate legally.

Steps to Complete LLC Paperwork

Completing the necessary paperwork for an LLC involves several steps: 1. Choose a Business Name: Ensure the name is unique, complies with state regulations, and is available as a web domain. 2. File the Articles of Organization: Submit the Articles of Organization to the state’s business registration office, usually the Secretary of State. 3. Obtain an EIN: Apply for an EIN through the IRS website or by mail/fax. 4. Draft an Operating Agreement: Even if not required by the state, it’s highly recommended to have an operating agreement in place. 5. Secure Business Licenses and Permits: Research and obtain any necessary licenses and permits for the business to operate.

State Variations in LLC Paperwork Requirements

It’s crucial to note that the specific requirements for LLC paperwork can vary significantly from one state to another. For example: - Filing Fees: The cost to file the Articles of Organization ranges from state to state. - Publication Requirements: Some states require newly formed LLCs to publish a notice of their formation in a local newspaper. - Annual Reporting: Many states require LLCs to file annual reports, which may include updating business information and paying a filing fee.

Common Challenges and Solutions

Entrepreneurs forming an LLC may encounter several challenges, including: - Complexity of Forms: The paperwork itself can be confusing, especially for those without legal or business experience. - Timeliness: Missing deadlines for filings can result in penalties or even the dissolution of the LLC. - Compliance: Ensuring ongoing compliance with all state and federal regulations can be overwhelming.

To overcome these challenges, it’s often helpful to: - Consult with an Attorney: Especially for complex situations or large businesses. - Use Online Formation Services: These services can guide you through the formation process and handle the paperwork. - Stay Organized: Keep detailed records and set reminders for important filing deadlines.

📝 Note: It's essential to keep all LLC paperwork and correspondence well-organized, as this will simplify future interactions with the state and federal governments, as well as internal business operations.

Conclusion and Future Considerations

In summary, the paperwork requirements for forming and maintaining an LLC are critical for its legal existence and operational success. By understanding the key components of LLC paperwork, navigating the steps to complete these documents, and being aware of state variations, entrepreneurs can ensure their businesses are properly established and compliant with all regulations. As the business grows, it’s also important to consider future implications, such as expansion into other states, which may require additional filings and registrations.

What is the primary purpose of filing Articles of Organization?

+

The primary purpose of filing Articles of Organization is to officially create the LLC with the state, establishing its legal existence and protecting the personal assets of its members.

Do all states require an operating agreement to be filed with the state?

+

No, not all states require an operating agreement to be filed with the state. However, it is highly recommended to have one in place to outline the ownership, management, and operational procedures of the LLC.

What happens if an LLC fails to file annual reports as required by the state?

+

If an LLC fails to file annual reports as required, it may face penalties, fines, and potentially even dissolution of the company by the state. It’s crucial to stay compliant with all state requirements.