Rent to Own Homes Arkansas Paperwork

Introduction to Rent to Own Homes in Arkansas

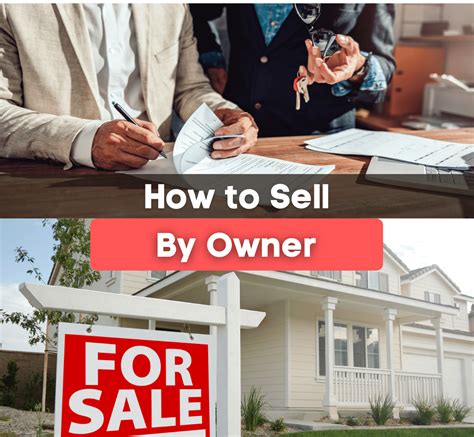

When it comes to rent to own homes in Arkansas, the process can be quite complex, involving various legal and financial aspects. For individuals who are looking to own a home but may not qualify for a traditional mortgage, rent to own homes can provide a viable alternative. However, understanding the paperwork involved is crucial to navigate this process successfully. In this article, we will delve into the specifics of rent to own homes in Arkansas, focusing on the necessary paperwork and the steps involved in this unique form of home ownership.

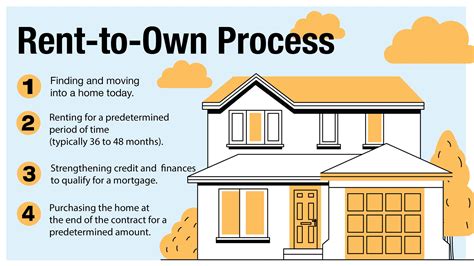

Understanding Rent to Own Homes

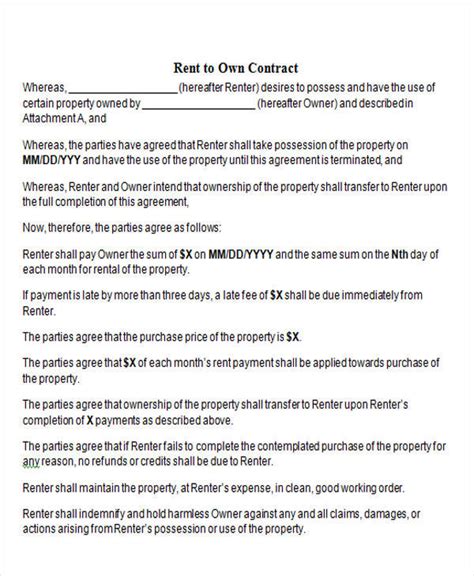

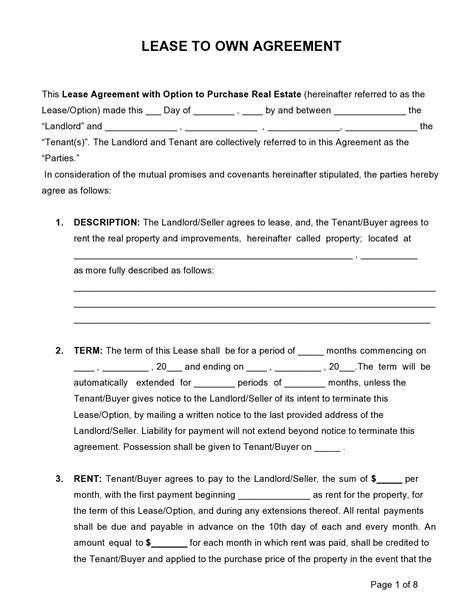

Rent to own homes, also known as lease-to-own or lease-option homes, allow potential buyers to rent a property with the intention of buying it in the future. This arrangement is typically facilitated through a rent-to-own contract, which outlines the terms of the agreement, including the rental period, purchase price, and any rent credits that may apply towards the down payment. This option is particularly appealing to those who are working on improving their credit score or saving for a down payment.

Key Paperwork Involved

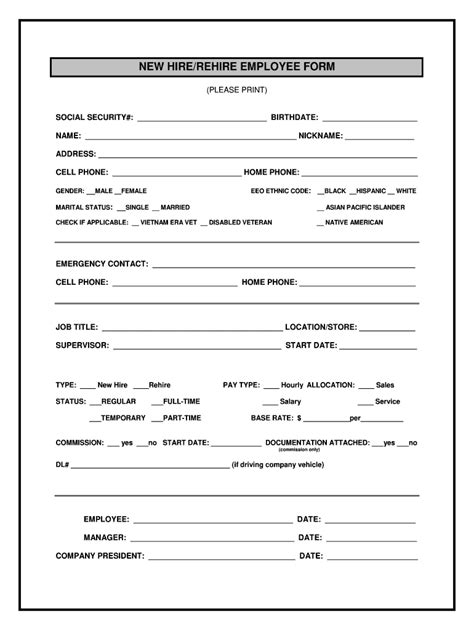

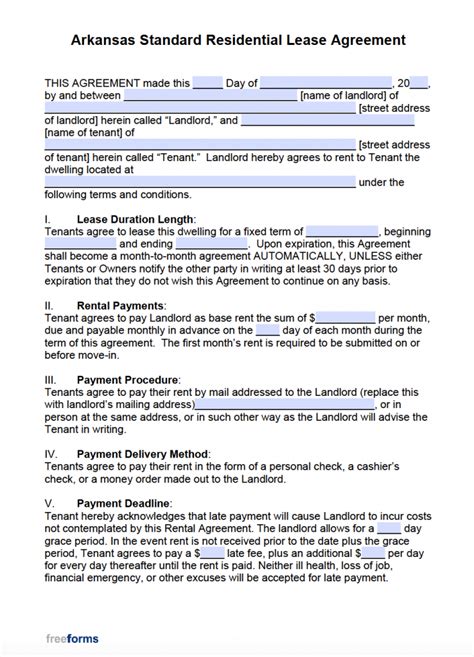

Several key documents are involved in the rent to own process in Arkansas. These include: - Lease Agreement: This document outlines the terms of the rental, including the monthly rent, length of the lease, and responsibilities of both the landlord and tenant. - Option to Purchase Agreement: This gives the tenant the option to buy the property at a predetermined price within a certain timeframe. It’s essential to understand that this is an option, not an obligation, to purchase. - Contract for Deed: In some cases, a contract for deed may be used, where the seller agrees to transfer the property to the buyer once all payments have been made.

Arkansas Laws and Regulations

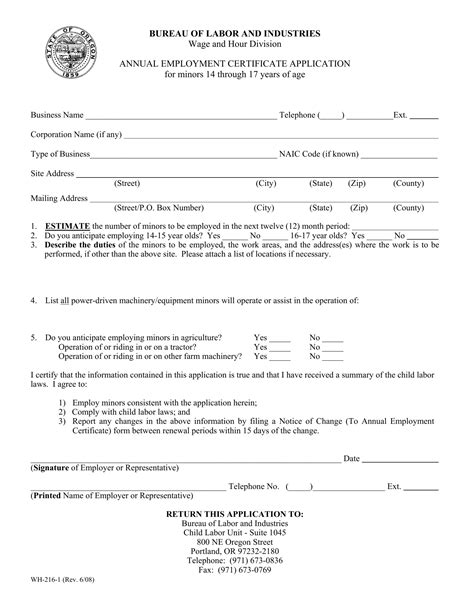

Arkansas has specific laws and regulations governing rent to own homes. For instance, the Arkansas Lease Purchase Agreement Act provides guidelines for lease-purchase agreements, ensuring that both parties are protected. It’s crucial for both landlords and tenants to be aware of these laws to avoid any potential disputes.

Benefits of Rent to Own Homes

There are several benefits to considering rent to own homes in Arkansas: - Flexibility: Rent to own agreements can offer more flexibility than traditional mortgage arrangements, especially for those with credit issues. - Rent Credits: A portion of the monthly rent may be applied towards the down payment, helping to build equity in the property. - Test Drive: It allows potential buyers to live in the home before committing to purchase, ensuring it’s the right fit.

Potential Drawbacks

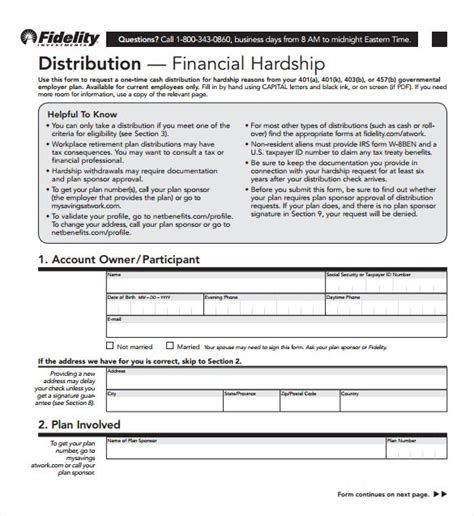

While rent to own homes can be beneficial, there are also potential drawbacks to consider: - Higher Monthly Payments: Monthly rent payments may be higher than traditional rentals to account for the rent credit towards the purchase price. - Risk of Loss: If the buyer decides not to purchase the property or cannot secure financing, they may forfeit any rent credits applied towards the down payment. - Maintenance Responsibilities: The agreement may require the tenant to handle maintenance and repairs, which can be costly.

Steps to Rent to Own in Arkansas

The process of securing a rent to own home in Arkansas involves several steps: 1. Find a Property: Look for properties advertised as rent to own. 2. Review and Understand the Contract: Ensure you comprehend all terms, including the lease duration, purchase price, and rent credits. 3. Inspect the Property: Conduct a thorough inspection to identify any needed repairs. 4. Secure Financing: Work on improving your credit score or saving for a down payment during the rental period. 5. Exercise Your Option to Purchase: If you decide to buy, ensure you follow the process outlined in your agreement.

📝 Note: It's highly recommended to consult with a real estate attorney to review any agreements before signing, to protect your interests and ensure a smooth process.

Conclusion Summary

In summary, rent to own homes in Arkansas offer a unique pathway to homeownership, especially for those facing challenges with traditional financing methods. Understanding the paperwork, laws, and potential benefits and drawbacks is essential for navigating this process successfully. By being informed and prepared, individuals can make the most of rent to own opportunities and work towards achieving their goal of homeownership.

What is the primary benefit of rent to own homes in Arkansas?

+

The primary benefit is the flexibility it offers, especially for those with credit issues or who are saving for a down payment, allowing them to move into a home they intend to purchase with a pathway to building equity.

How do I find rent to own homes in Arkansas?

+

You can find rent to own homes through real estate agents specializing in rent to own properties, online listings, and sometimes through direct contact with property owners who are open to this arrangement.

What should I look for in a rent to own contract in Arkansas?

+

Look for the purchase price, rent amount, duration of the lease, how much of the rent goes towards the down payment, and the conditions under which you can exercise your option to purchase. It’s also crucial to understand your responsibilities and those of the seller.

Related Terms:

- Free rent to own contract