Paperwork

Tax Paperwork Retention Period

Introduction to Tax Paperwork Retention

When it comes to managing tax-related documents, understanding the retention period is crucial for both individuals and businesses. Tax paperwork can include a wide range of documents, from receipts and invoices to tax returns and audit reports. The retention period refers to the length of time these documents should be kept, either for personal records or in case of an audit. In this article, we will delve into the specifics of tax paperwork retention periods, highlighting the importance of maintaining accurate and comprehensive records.

Why Retain Tax Paperwork?

Retaining tax paperwork is essential for several reasons: - Audit Protection: In the event of an audit, having detailed records can help prove the accuracy of your tax returns and reduce the risk of penalties or additional taxes owed. - Financial Record Keeping: Tax documents provide a clear picture of financial transactions, helping with budgeting, financial planning, and making informed investment decisions. - Compliance with Tax Laws: Many tax laws require the retention of specific documents for a certain period. Failure to comply can result in fines or other penalties.

General Guidelines for Retention Periods

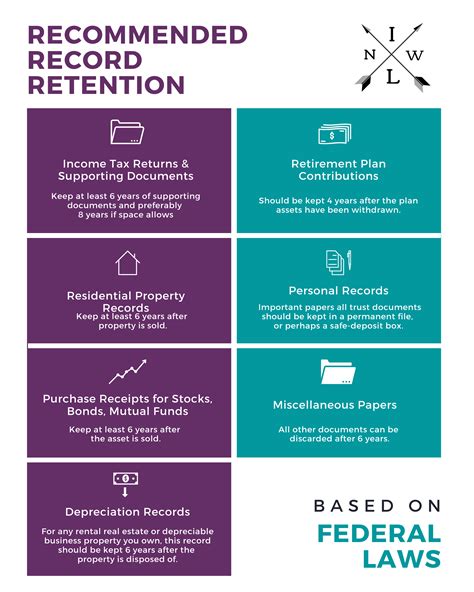

The retention period for tax paperwork varies depending on the type of document and the tax authority’s requirements. Here are some general guidelines: - Tax Returns: It is generally recommended to keep tax returns indefinitely, as they provide a historical record of your financial situation and tax obligations. - Supporting Documents: Documents that support items on your tax return, such as receipts, invoices, and bank statements, should be kept for at least three to seven years, depending on the jurisdiction and the specific requirements of the tax authority. - Employment Records: For employment-related tax documents, such as W-2 forms or records of employment expenses, a retention period of four to seven years is often advised. - Business Records: Businesses may need to retain records for a longer period, often up to ten years, to account for depreciation, amortization, and potential audits.

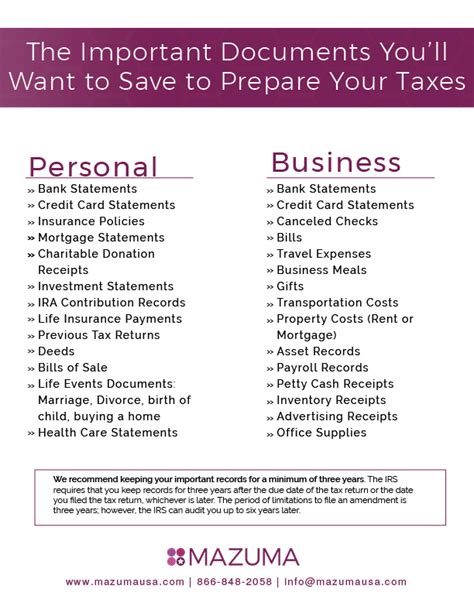

Specific Documents and Their Retention Periods

Understanding the retention periods for specific documents is vital. Here is a list of common tax-related documents and their recommended retention periods: - Personal Tax Returns: Keep forever. - Supporting Documents for Tax Returns (e.g., receipts, invoices): 3 to 7 years. - W-2 Forms: 4 to 7 years. - Records of Charitable Donations: Until the statute of limitations expires (often 3 years from the date the return was filed). - Medical Expense Records: Until the statute of limitations expires (often 3 years from the date the return was filed). - Business Ledgers and Journals: 7 to 10 years. - Employee Records: 4 to 7 years after termination. - Payroll Tax Records: 4 years from the date the tax became due or was paid, whichever is later.

📝 Note: These are general guidelines, and specific requirements may vary based on your location, the type of business you operate, or other factors. It's always a good idea to consult with a tax professional to ensure compliance with all applicable laws and regulations.

Digital vs. Physical Storage

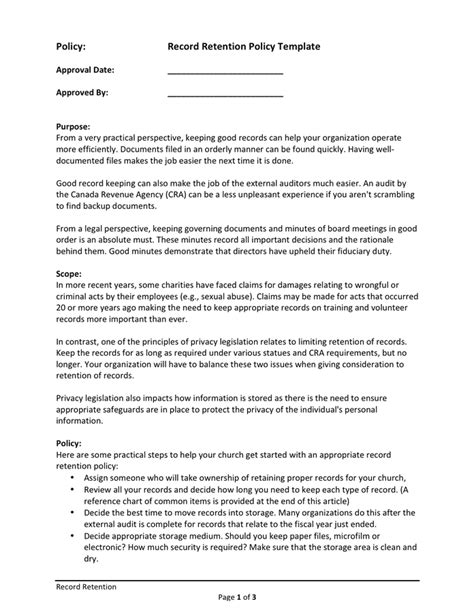

In today’s digital age, storing tax paperwork can be done both physically and digitally. Each method has its pros and cons: - Physical Storage: Offers a tangible record but can be bulky and prone to damage or loss. - Digital Storage: Provides convenience, accessibility, and the ability to easily duplicate records for safekeeping. However, it requires reliable backup systems to prevent data loss.

Best Practices for Storage

Regardless of the storage method chosen, it’s essential to follow best practices: - Organization: Keep documents well-organized, either in labeled folders physically or in clearly named digital files. - Accessibility: Ensure that you and any authorized individuals can easily access the documents when needed. - Security: Protect your documents from unauthorized access, damage, or theft, especially sensitive information like Social Security numbers or financial account details. - Backup: For digital storage, maintain regular backups, preferably in more than one location (e.g., an external hard drive and cloud storage).

Conclusion Without A Title But Still Concluding

In summary, the retention period for tax paperwork is a critical aspect of financial management and tax compliance. Understanding the specific requirements for different types of documents and maintaining a well-organized storage system, whether physical or digital, can protect individuals and businesses from potential issues during audits and ensure compliance with tax laws. Remember, it’s always better to err on the side of caution when deciding how long to keep tax-related documents.

What is the general retention period for tax returns?

+

It is generally recommended to keep tax returns indefinitely, as they provide a historical record of your financial situation and tax obligations.

How long should supporting documents for tax returns be kept?

+

Supporting documents, such as receipts and invoices, should be kept for at least three to seven years, depending on the jurisdiction and specific tax authority requirements.

What are the best practices for storing tax paperwork digitally?

+

Best practices include keeping documents well-organized, ensuring accessibility, maintaining security, and regularly backing up files to prevent data loss.