5 Tax Credit Tips

Understanding Tax Credits: A Guide to Maximizing Your Refund

When it comes to tax season, one of the most confusing and overwhelming aspects for many individuals is navigating the world of tax credits. Tax credits can significantly reduce the amount of taxes owed, and in some cases, even provide a refund. However, understanding which credits you are eligible for and how to claim them can be a daunting task. In this guide, we will break down five essential tax credit tips to help you maximize your refund and make the most out of your tax return.

Tip 1: Familiarize Yourself with Available Tax Credits

There are numerous tax credits available, each with its own set of eligibility criteria and application process. Some of the most common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the Education Credits. It is crucial to research and understand which credits you may be eligible for, as this can significantly impact your tax refund. Consider consulting with a tax professional or using tax preparation software to help you navigate the process.

Tip 2: Keep Accurate Records and Documentation

To claim tax credits, you will need to provide supporting documentation and records. This can include items such as: * W-2 forms * 1099 forms * Receipts for education expenses * Proof of child care costs * Records of charitable donations It is essential to keep accurate and organized records throughout the year, as this will make it easier to claim your tax credits when the time comes. Consider using a tax organizer or spreadsheet to help you keep track of your expenses and documentation.

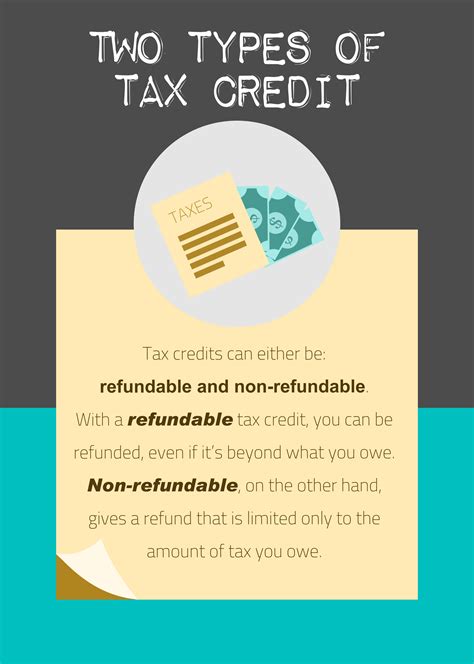

Tip 3: Understand the Difference Between Refundable and Non-Refundable Credits

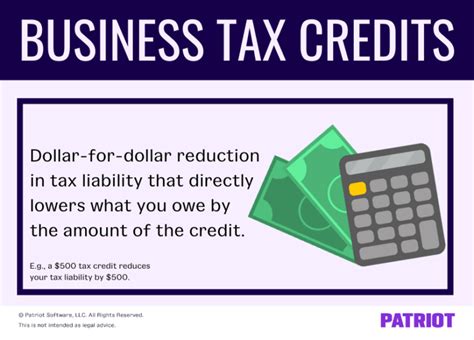

Tax credits can be either refundable or non-refundable. Refundable credits can provide a refund if the credit amount exceeds the amount of taxes owed. Non-refundable credits, on the other hand, can only reduce the amount of taxes owed to zero. Understanding the difference between these two types of credits can help you better plan your tax strategy and maximize your refund.

Tip 4: Claim Credits for Education Expenses

If you or a family member is pursuing higher education, you may be eligible for education credits. These credits can help offset the cost of tuition, fees, and other education-related expenses. Some common education credits include the American Opportunity Tax Credit and the Lifetime Learning Credit. Be sure to research and understand the eligibility criteria and application process for these credits, as they can provide significant savings.

Tip 5: Don’t Overlook Credits for Child and Dependent Care

If you have children or dependents, you may be eligible for child and dependent care credits. These credits can help offset the cost of child care, adult care, and other dependent-related expenses. Some common credits include the Child and Dependent Care Credit and the Credit for Other Dependents. Be sure to research and understand the eligibility criteria and application process for these credits, as they can provide significant savings.

📝 Note: It is essential to consult with a tax professional or use tax preparation software to ensure you are eligible for the credits you are claiming and to avoid any potential errors or audits.

In summary, understanding and claiming tax credits can be a complex and overwhelming process. However, by familiarizing yourself with available credits, keeping accurate records, understanding the difference between refundable and non-refundable credits, claiming credits for education expenses, and not overlooking credits for child and dependent care, you can maximize your refund and make the most out of your tax return. By following these tips and seeking professional guidance when needed, you can navigate the world of tax credits with confidence and ensure you are taking advantage of all the credits you are eligible for.

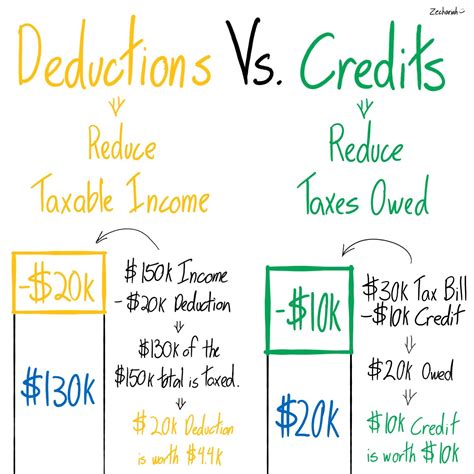

What is the difference between a tax credit and a tax deduction?

+

A tax credit directly reduces the amount of taxes owed, while a tax deduction reduces the amount of taxable income.

How do I know if I am eligible for a specific tax credit?

+

To determine eligibility, research the specific credit and its requirements, and consult with a tax professional or use tax preparation software if needed.

Can I claim tax credits if I am self-employed?

+

Yes, self-employed individuals may be eligible for certain tax credits, such as the Earned Income Tax Credit or education credits.