5 Tips Review Real Estate Paperwork

Introduction to Real Estate Paperwork

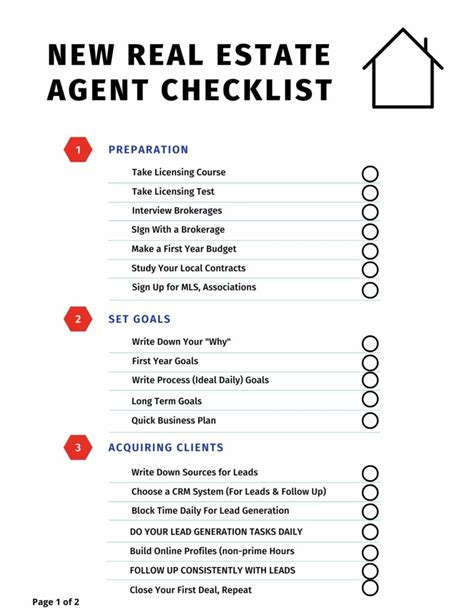

When dealing with real estate, whether you’re buying, selling, or investing, the paperwork involved can be overwhelming. Real estate paperwork encompasses a wide range of documents, from purchase agreements and deeds to title reports and closing statements. Understanding these documents is crucial for a smooth transaction. In this article, we’ll explore five tips for reviewing real estate paperwork to ensure you’re well-prepared for your next real estate venture.

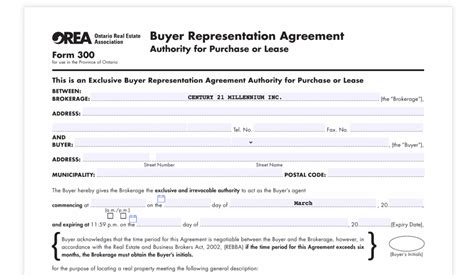

Tip 1: Understand the Purchase Agreement

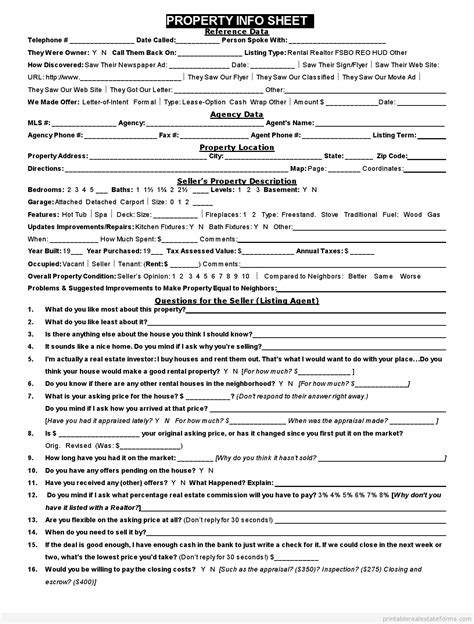

The purchase agreement is one of the most critical documents in a real estate transaction. It outlines the terms of the sale, including the price, contingencies, and closing date. When reviewing the purchase agreement, pay close attention to the following:

- Price and Payment Terms: Ensure the agreed-upon price is clearly stated, along with the payment method and any financing conditions.

- Contingencies: Understand what conditions must be met for the sale to proceed, such as a home inspection or mortgage approval.

- Closing Date: Verify the expected closing date and any penalties for late closing.

Tip 2: Review the Property Deed

The property deed is the document that transfers ownership of the property from the seller to the buyer. There are different types of deeds, including:

- Warranty Deed: Guarantees the seller has clear title to the property and is responsible for any liabilities.

- Quitclaim Deed: Transfers the seller’s interest in the property but does not guarantee clear title.

- Property Description: A detailed description of the property, including its address and boundaries.

- Granting Clause: The clause that transfers ownership from the seller to the buyer.

- Signature and Acknowledgment: The seller’s signature and an acknowledgment that the deed was signed voluntarily.

Tip 3: Examine the Title Report

A title report is a document that outlines the ownership history of the property and any liens or encumbrances. When reviewing the title report, look for:

- Chain of Title: A record of all previous owners of the property.

- Liens and Encumbrances: Any outstanding debts or restrictions on the property, such as mortgages, judgments, or easements.

- Exceptions: Any items that are not covered by the title insurance policy.

Tip 4: Review the Closing Statement

The closing statement is a document that outlines all the costs associated with the transaction, including:

- Purchase Price: The agreed-upon price of the property.

- Credits and Debits: Any credits or debits to the buyer or seller, such as prorated taxes or repair credits.

- Transaction Costs: Fees associated with the transaction, including title insurance, escrow fees, and recording fees.

Tip 5: Don’t Forget the Disclosures

Disclosures are documents that provide additional information about the property, such as:

- Lead-Based Paint Disclosure: A disclosure that informs buyers about the potential presence of lead-based paint in the property.

- Environmental Hazards: Disclosures about potential environmental hazards, such as nearby industrial sites or flood zones.

- Property Condition: Disclosures about the property’s condition, including any known defects or needed repairs.

📝 Note: It's essential to have a real estate attorney review all paperwork to ensure your rights are protected and you understand all the terms and conditions of the transaction.

In summary, reviewing real estate paperwork carefully is crucial to ensure a smooth transaction. By following these five tips, you’ll be better prepared to navigate the complex world of real estate paperwork and avoid potential pitfalls. Remember to always have a real estate attorney review your paperwork to ensure your rights are protected.

What is a real estate attorney, and why do I need one?

+

A real estate attorney is a lawyer who specializes in real estate law and can help you navigate the complex process of buying or selling a property. They can review your paperwork, ensure your rights are protected, and represent you in negotiations and disputes.

What is the difference between a warranty deed and a quitclaim deed?

+

A warranty deed guarantees the seller has clear title to the property and is responsible for any liabilities, while a quitclaim deed transfers the seller’s interest in the property but does not guarantee clear title.

Why is title insurance important?

+

Title insurance protects you from potential title defects, such as unknown liens or encumbrances, and can provide financial protection in case of a title dispute.