5 Tips COBRA Deadline

Understanding COBRA Deadlines: A Guide to Making Informed Decisions

The Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 is a federal law that allows certain former employees, retirees, spouses, former spouses, and dependent children to temporarily continue health coverage at group rates. This provision is crucial for individuals who would otherwise lose their health insurance due to a qualifying event, such as job loss, divorce, or death of a covered employee. A key aspect of COBRA is understanding and meeting the deadlines associated with it, as these timelines dictate the window within which one can elect to continue their health coverage. Here are five tips to help navigate COBRA deadlines effectively.

Tip 1: Identify Your Qualifying Event

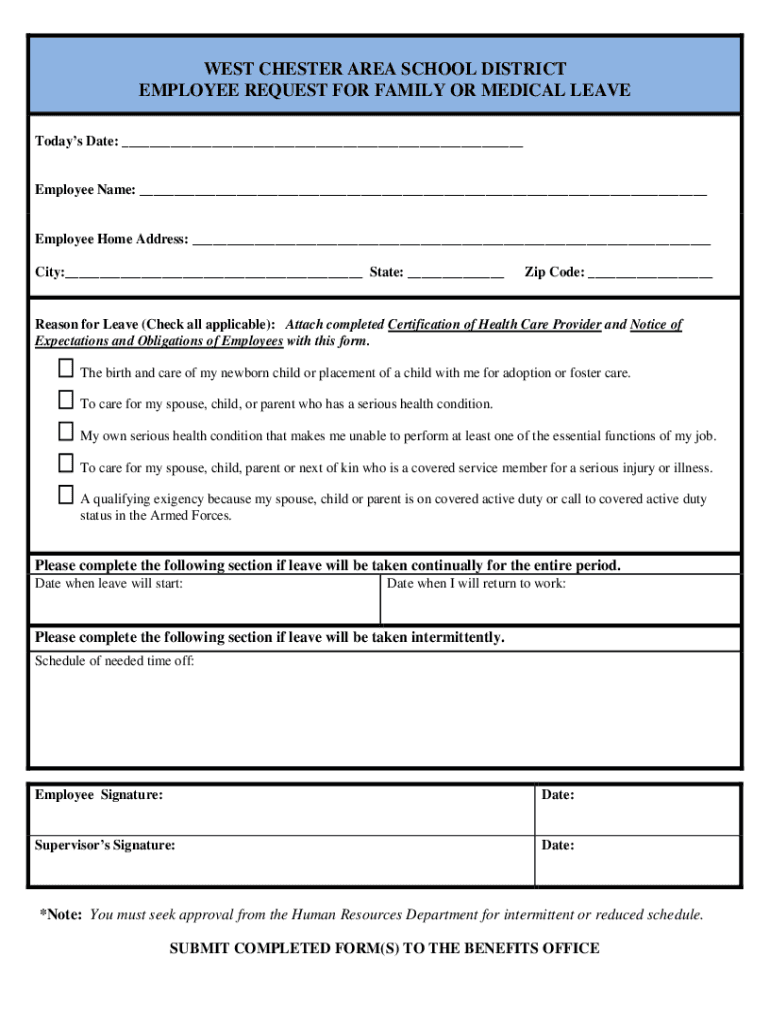

To start the COBRA process, it’s essential to recognize what constitutes a qualifying event. These events typically include: - Voluntary or involuntary termination of employment (except for gross misconduct) - Divorce or legal separation from the covered employee - Death of the covered employee - Dependent child ceasing to be a dependent under the plan - Employee becoming entitled to Medicare Understanding your qualifying event is the first step in determining your COBRA deadline, as the type of event can influence the election period and the duration of coverage.

Tip 2: Know Your Election Period

After a qualifying event, COBRA requires that the employer or plan administrator notify the qualified beneficiaries of their right to elect COBRA coverage. Generally, qualified beneficiaries have 60 days from the date they receive the COBRA election notice (or the date of the qualifying event, if later) to decide whether to elect COBRA coverage. This period is known as the election period. It’s crucial to understand that: - The election notice must be provided within 14 days after the plan administrator receives notice of the qualifying event. - The start of the election period can vary depending on when the notice is given and the type of qualifying event.

Tip 3: Calculate Your Coverage Period The length of time you can continue your health coverage under COBRA depends on the qualifying event. For most events, such as termination of employment or divorce, COBRA coverage can last 18 months. However, in certain situations, like the death of the covered employee or the employee becoming entitled to Medicare, coverage can extend to 36 months. Understanding the duration of your COBRA coverage is vital for planning your health insurance needs.

Tip 4: Plan for Payments

COBRA requires that individuals pay 100% of the premium cost (plus a possible 2% administrative fee) for their continued health coverage. Since employers are no longer contributing to the premium, the cost can be significantly higher than what individuals were paying before electing COBRA. It’s essential to: - Budget accordingly for the increased premium costs. - Understand that premium payments are usually due on a monthly basis and must be made on time to maintain coverage. - Be aware of any grace periods for late payments, as missing a payment can result in termination of COBRA coverage.

Tip 5: Explore Alternative Options

While COBRA provides a safety net, it’s not always the most affordable or suitable option for everyone. Before making a decision, consider exploring alternative health insurance options, such as: - Spouse’s plan, if available - Individual health insurance plans through the Health Insurance Marketplace - Short-term health insurance, for temporary gaps in coverage Evaluating these alternatives within the COBRA election period can help you make an informed decision that best fits your health insurance needs and budget.

📝 Note: COBRA laws and regulations can vary by state, with some states offering additional protections or benefits. It’s crucial to consult with your plan administrator or a benefits advisor to understand the specifics of your situation.

As you navigate the complexities of COBRA deadlines and options, remembering these tips can help ensure you make the most informed decision for your health insurance needs. The process of electing and maintaining COBRA coverage requires careful consideration of the timelines, costs, and alternative options available. By understanding these aspects, individuals can better protect their health insurance coverage during times of transition.

What is the typical duration of COBRA coverage?

+

The typical duration of COBRA coverage is 18 months for most qualifying events, such as termination of employment or divorce. However, it can extend to 36 months in certain situations, like the death of the covered employee or the employee becoming entitled to Medicare.

How long do I have to elect COBRA coverage after a qualifying event?

+

Generally, you have 60 days from the date you receive the COBRA election notice (or the date of the qualifying event, if later) to decide whether to elect COBRA coverage. This period is known as the election period.

Can I change my mind after electing COBRA coverage?

+

Once you elect COBRA coverage, you are committed to paying the premiums for the duration of your coverage period. However, you may be able to disenroll if you become eligible for another group health plan or Medicare. It’s essential to review your plan’s rules and consult with the plan administrator for specifics.