Business Paperwork Retention Periods

Introduction to Business Paperwork Retention

When it comes to managing business paperwork, one of the most critical aspects to consider is the retention period. The retention period refers to the length of time that businesses are required to keep specific documents, records, and paperwork. This can vary depending on the type of document, the industry, and the relevant laws and regulations. In this blog post, we will explore the different types of business paperwork, their respective retention periods, and the importance of maintaining accurate and organized records.

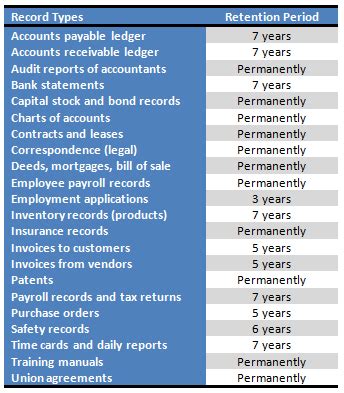

Types of Business Paperwork and Retention Periods

There are various types of business paperwork that require different retention periods. Some of the most common types include: * Financial records: This includes documents such as income statements, balance sheets, and tax returns. The retention period for financial records typically ranges from 3 to 7 years, depending on the specific document and the relevant laws. * Employee records: Employee records include documents such as personnel files, payroll records, and benefits information. The retention period for employee records typically ranges from 3 to 5 years after the employee has left the company. * Contractual agreements: Contractual agreements include documents such as contracts, agreements, and leases. The retention period for contractual agreements typically ranges from 3 to 7 years after the contract has expired or been terminated. * Tax records: Tax records include documents such as tax returns, receipts, and invoices. The retention period for tax records typically ranges from 3 to 7 years, depending on the specific document and the relevant laws.

Importance of Maintaining Accurate Records

Maintaining accurate and organized records is crucial for businesses. Some of the key benefits include: * Compliance with laws and regulations: Businesses are required to comply with various laws and regulations, and maintaining accurate records helps to ensure compliance. * Financial management: Accurate records help businesses to manage their finances effectively, including tracking income and expenses, and making informed decisions. * Risk management: Maintaining accurate records helps businesses to manage risk, including identifying potential risks and taking steps to mitigate them. * Dispute resolution: Accurate records can help to resolve disputes, including contractual disputes and employee-related disputes.

Best Practices for Maintaining Business Paperwork

To maintain accurate and organized business paperwork, businesses should follow best practices such as: * Implementing a record-keeping system: This includes using a centralized system to store and manage records, and ensuring that all records are accurate and up-to-date. * Training employees: Employees should be trained on the importance of maintaining accurate records, and how to use the record-keeping system. * Conducting regular audits: Regular audits help to ensure that records are accurate and compliant with laws and regulations. * Storing records securely: Records should be stored securely, including using encryption and secure storage facilities.

| Type of Record | Retention Period |

|---|---|

| Financial records | 3-7 years |

| Employee records | 3-5 years |

| Contractual agreements | 3-7 years |

| Tax records | 3-7 years |

📝 Note: The retention periods listed in the table are general guidelines and may vary depending on the specific laws and regulations applicable to your business.

As we summarize the key points, it is clear that maintaining accurate and organized business paperwork is crucial for compliance, financial management, risk management, and dispute resolution. By following best practices such as implementing a record-keeping system, training employees, conducting regular audits, and storing records securely, businesses can ensure that their paperwork is accurate and compliant with laws and regulations.

What is the typical retention period for financial records?

+

The typical retention period for financial records is 3-7 years, depending on the specific document and the relevant laws.

Why is it important to maintain accurate employee records?

+

Maintaining accurate employee records is important for compliance with laws and regulations, and for managing employee-related disputes.

How can businesses ensure that their records are secure?

+

Businesses can ensure that their records are secure by using encryption, secure storage facilities, and limiting access to authorized personnel.