Keep Tax Paperwork How Long

Introduction to Tax Paperwork

When it comes to managing your finances, one of the most important aspects is keeping track of your tax paperwork. This includes receipts, invoices, bank statements, and any other documents related to your income and expenses. The question of how long to keep tax paperwork is a common one, and the answer can vary depending on your individual circumstances. In this article, we will explore the different types of tax paperwork, how long to keep them, and why it’s essential to maintain accurate records.

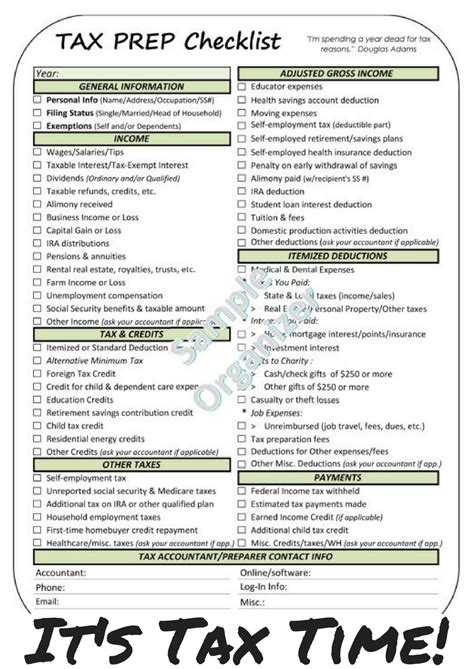

Types of Tax Paperwork

There are several types of tax paperwork that you may need to keep, including: * Income tax returns: These are the forms you fill out each year to report your income and claim deductions and credits. * Receipts and invoices: These are documents that show the amount you paid for goods and services, and can be used to support deductions on your tax return. * Bank statements: These show your income and expenses, and can be used to verify the information on your tax return. * W-2 and 1099 forms: These are forms that show your income from employment or self-employment, and are used to report your income on your tax return. * Charitable donation receipts: These are documents that show the amount you donated to charity, and can be used to claim a deduction on your tax return.

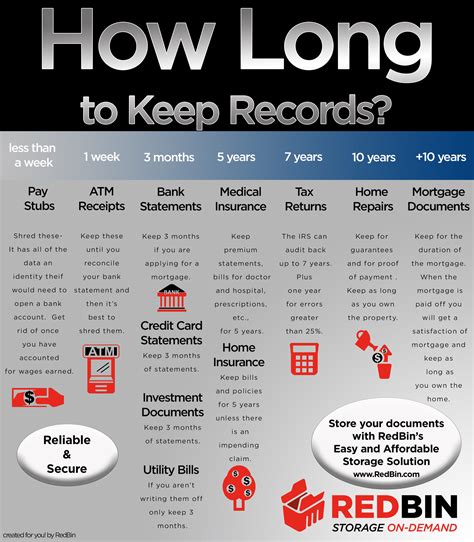

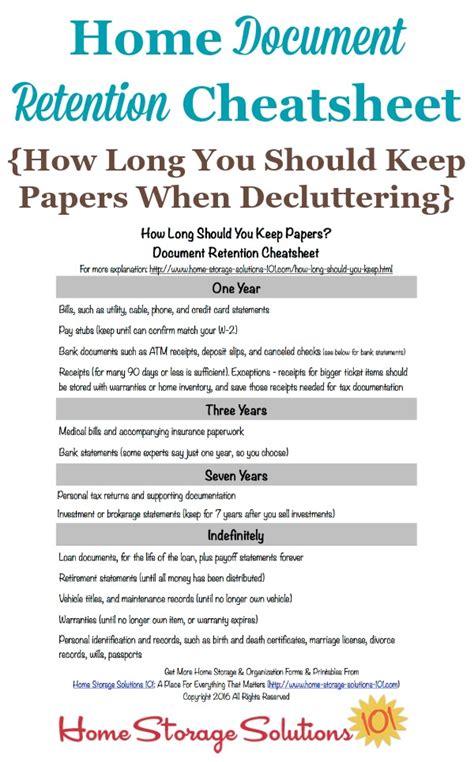

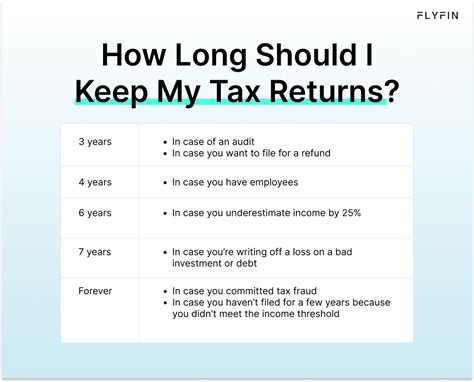

How Long to Keep Tax Paperwork

The length of time you should keep tax paperwork varies depending on the type of document and your individual circumstances. Here are some general guidelines: * Income tax returns: Keep for at least 3 years from the date you filed your return, in case of an audit. * Receipts and invoices: Keep for at least 3 years from the date you filed your return, in case of an audit. * Bank statements: Keep for at least 1 year, to verify the information on your tax return. * W-2 and 1099 forms: Keep for at least 3 years from the date you filed your return, in case of an audit. * Charitable donation receipts: Keep for at least 3 years from the date you filed your return, in case of an audit.

📝 Note: It's essential to keep tax paperwork for the recommended length of time, in case of an audit or if you need to file an amended return.

Why Keep Tax Paperwork

Keeping tax paperwork is essential for several reasons: * Audit protection: If you’re audited, you’ll need to provide documentation to support the information on your tax return. * Amended returns: If you need to file an amended return, you’ll need to provide documentation to support the changes. * Record-keeping: Keeping tax paperwork helps you keep track of your income and expenses, and can help you make informed financial decisions. * Tax planning: Keeping tax paperwork can help you plan for future tax liabilities, and make informed decisions about your financial situation.

Best Practices for Keeping Tax Paperwork

Here are some best practices for keeping tax paperwork: * Keep documents organized: Use a filing system to keep your tax paperwork organized, and make it easy to find the documents you need. * Keep documents in a safe place: Keep your tax paperwork in a safe place, such as a fireproof safe or a secure online storage service. * Make digital copies: Make digital copies of your tax paperwork, in case the original documents are lost or destroyed. * Review and update regularly: Review your tax paperwork regularly, and update your records as needed.

| Type of Document | Recommended Retention Period |

|---|---|

| Income tax returns | At least 3 years |

| Receipts and invoices | At least 3 years |

| Bank statements | At least 1 year |

| W-2 and 1099 forms | At least 3 years |

| Charitable donation receipts | At least 3 years |

In summary, keeping tax paperwork is an essential part of managing your finances, and can help you protect yourself in case of an audit, file amended returns, and make informed financial decisions. By following the guidelines outlined in this article, you can ensure that you’re keeping the right documents for the right amount of time, and staying on top of your tax obligations.

What is the recommended retention period for income tax returns?

+

The recommended retention period for income tax returns is at least 3 years from the date you filed your return.

What types of documents should I keep to support my tax return?

+

You should keep documents such as receipts, invoices, bank statements, W-2 and 1099 forms, and charitable donation receipts to support your tax return.

How long should I keep bank statements?

+

You should keep bank statements for at least 1 year, to verify the information on your tax return.