Paperwork

Bankruptcy Paperwork Retention Period

Understanding the Importance of Bankruptcy Paperwork Retention

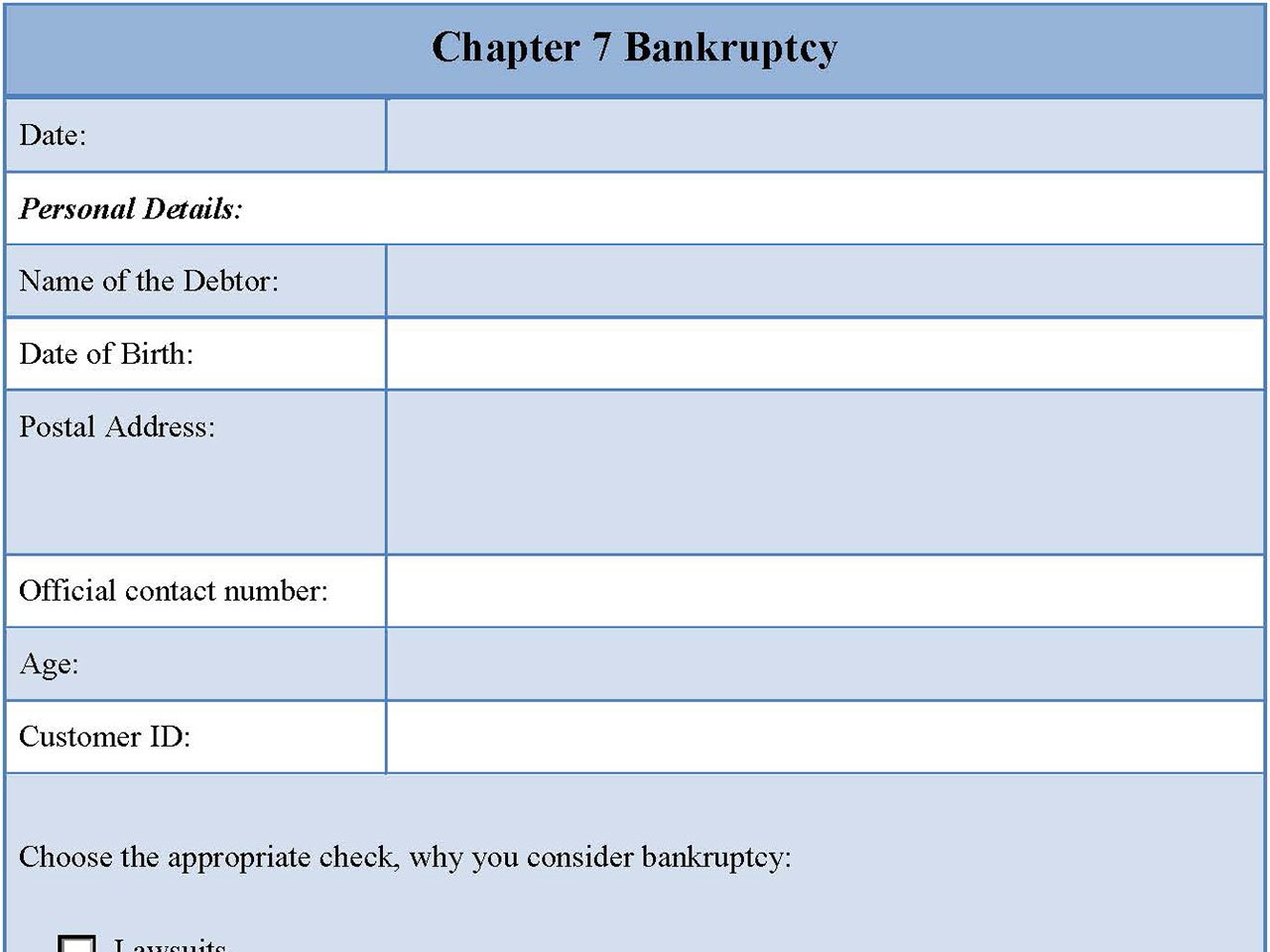

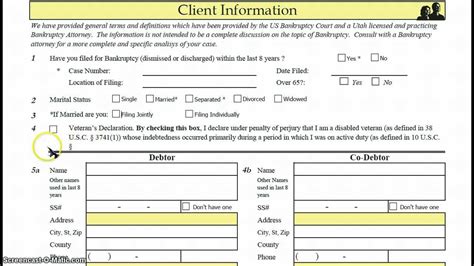

When individuals or businesses file for bankruptcy, they are required to provide a significant amount of documentation to support their claim. This paperwork can include financial records, tax returns, and other relevant documents. The retention period for these documents is crucial, as it ensures that all parties involved in the bankruptcy process have access to the necessary information. In this article, we will explore the importance of bankruptcy paperwork retention and provide guidance on the recommended retention periods for various documents.

Types of Bankruptcy Paperwork

There are several types of bankruptcy paperwork that must be retained, including: * Financial records: This includes balance sheets, income statements, and other financial documents that provide a snapshot of the individual’s or business’s financial situation. * Tax returns: Tax returns are essential in bankruptcy cases, as they provide information about the individual’s or business’s income and expenses. * Credit reports: Credit reports are used to verify the individual’s or business’s credit history and identify any potential creditors. * Bank statements: Bank statements provide a record of the individual’s or business’s financial transactions and can be used to track income and expenses.

Retention Periods for Bankruptcy Paperwork

The retention period for bankruptcy paperwork varies depending on the type of document and the jurisdiction. In general, it is recommended that individuals and businesses retain their bankruptcy paperwork for at least 7-10 years after the bankruptcy case has been closed. This allows for the statute of limitations to expire and ensures that all parties involved in the bankruptcy process have access to the necessary information.

| Document Type | Retention Period |

|---|---|

| Financial records | 7-10 years |

| Tax returns | 7-10 years |

| Credit reports | 5-7 years |

| Bank statements | 5-7 years |

Best Practices for Bankruptcy Paperwork Retention

To ensure that bankruptcy paperwork is properly retained, individuals and businesses should follow these best practices: * Store documents securely: Bankruptcy paperwork should be stored in a secure location, such as a safe or a locked file cabinet. * Organize documents: Documents should be organized in a logical and consistent manner, making it easy to locate specific documents when needed. * Use a document retention policy: Individuals and businesses should establish a document retention policy that outlines the types of documents to be retained, the retention period, and the storage and disposal procedures. * Consider digital storage: Digital storage can provide an additional layer of security and convenience, allowing individuals and businesses to access their documents from anywhere.

📝 Note: It is essential to consult with a qualified attorney or financial advisor to determine the specific retention periods and best practices for bankruptcy paperwork retention in your jurisdiction.

Conclusion and Final Thoughts

In summary, the retention period for bankruptcy paperwork is crucial, and individuals and businesses must ensure that they retain their documents for the recommended period. By following best practices and using a document retention policy, individuals and businesses can ensure that their bankruptcy paperwork is properly retained and easily accessible. It is also essential to consult with a qualified attorney or financial advisor to determine the specific retention periods and best practices for bankruptcy paperwork retention in your jurisdiction. By taking these steps, individuals and businesses can protect themselves and their financial interests during the bankruptcy process.

What is the recommended retention period for bankruptcy paperwork?

+

The recommended retention period for bankruptcy paperwork is at least 7-10 years after the bankruptcy case has been closed.

What types of documents should be retained in a bankruptcy case?

+

The types of documents that should be retained in a bankruptcy case include financial records, tax returns, credit reports, and bank statements.

How should bankruptcy paperwork be stored?

+

Bankruptcy paperwork should be stored in a secure location, such as a safe or a locked file cabinet, and organized in a logical and consistent manner.