5 Tax Tips

Introduction to Tax Planning

Tax planning is an essential aspect of personal and business finance, as it can help individuals and companies reduce their tax liabilities and maximize their savings. With the ever-changing tax laws and regulations, it’s crucial to stay informed and up-to-date on the latest tax tips and strategies. In this article, we will discuss five tax tips that can help you navigate the complex world of taxation and make informed decisions about your financial affairs.

Understanding Tax Deductions

Tax deductions are expenses that can be subtracted from your taxable income, reducing the amount of taxes you owe. There are various types of tax deductions, including charitable donations, medical expenses, and business expenses. To qualify for these deductions, you must keep accurate records and meet the necessary requirements. For example, charitable donations must be made to qualified organizations, and medical expenses must exceed a certain threshold.

Tax Tip 1: Maximize Your Retirement Contributions

Contributing to a retirement account is an excellent way to reduce your taxable income and save for your future. You can contribute to a 401(k) or an IRA, and the funds will grow tax-deferred until withdrawal. Additionally, some employers offer matching contributions, which can significantly boost your retirement savings. It’s essential to contribute at least enough to take full advantage of the matching contributions, as this is essentially free money.

Tax Tip 2: Take Advantage of Tax Credits

Tax credits are more valuable than tax deductions because they directly reduce the amount of taxes you owe, rather than just reducing your taxable income. There are various tax credits available, including the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit. To qualify for these credits, you must meet specific requirements, such as income limits and family size.

Tax Tip 3: Keep Accurate Records

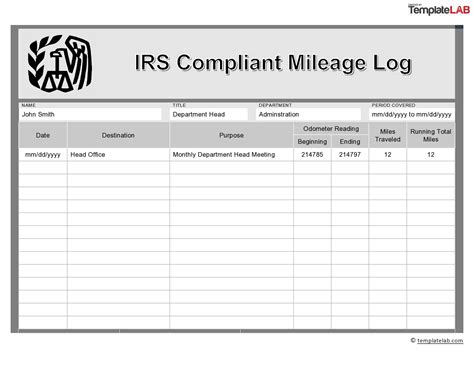

Keeping accurate records is crucial for tax planning, as it helps you track your income, expenses, and tax-related documents. You should keep records of: * Income statements * Receipts for expenses * Charitable donation receipts * Medical expense records * Business expense records It’s also essential to keep digital copies of your records, in case the physical copies are lost or damaged.

Tax Tip 4: Consider Itemizing Deductions

Itemizing deductions involves listing out your expenses on your tax return, rather than taking the standard deduction. This can be beneficial if you have significant expenses, such as medical bills or mortgage interest. To itemize deductions, you must keep accurate records and complete the necessary tax forms. It’s also essential to consult with a tax professional to ensure you’re taking advantage of all the deductions you’re eligible for.

Tax Tip 5: Stay Informed About Tax Law Changes

Tax laws and regulations are constantly changing, and it’s essential to stay informed about these changes to ensure you’re taking advantage of all the tax savings available to you. You can stay up-to-date by: * Following tax professionals on social media * Subscribing to tax-related newsletters * Attending tax seminars and workshops * Visiting the IRS website for the latest tax information

📝 Note: Tax laws and regulations are subject to change, and it's essential to consult with a tax professional to ensure you're in compliance with all tax requirements.

In summary, tax planning is a complex and ever-changing field, and it’s essential to stay informed and up-to-date on the latest tax tips and strategies. By maximizing your retirement contributions, taking advantage of tax credits, keeping accurate records, considering itemizing deductions, and staying informed about tax law changes, you can reduce your tax liabilities and maximize your savings.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of taxes you owe.

How do I know if I should itemize deductions or take the standard deduction?

+

You should itemize deductions if your expenses exceed the standard deduction amount. It’s essential to consult with a tax professional to determine the best approach for your specific situation.

What is the Earned Income Tax Credit (EITC), and how do I qualify?

+

The EITC is a tax credit for low-to-moderate-income working individuals and families. To qualify, you must meet specific income and family size requirements, which vary by year.