7 Tax Paper Tips

Introduction to Tax Paper Tips

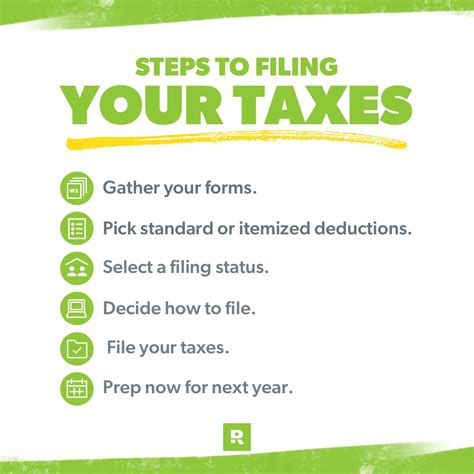

When it comes to handling tax papers, whether for personal or business purposes, organization and accuracy are key. The process can be daunting, especially for those who are new to filing taxes or who have complex financial situations. However, with the right approach and tools, navigating through tax papers can become significantly less stressful. This guide provides seven essential tips to help individuals and businesses manage their tax papers effectively, ensuring compliance with tax laws and maximizing their refunds.

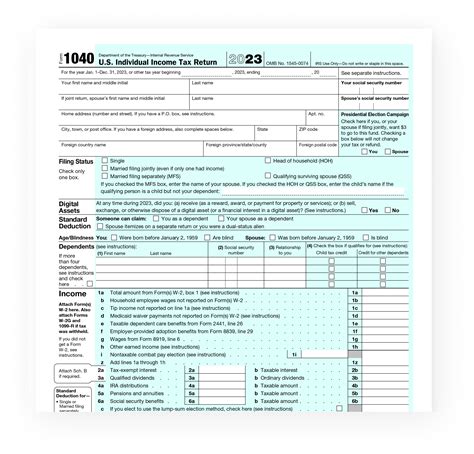

Understanding Tax Requirements

Before diving into the tips, it’s crucial to understand the basic requirements for tax filing. This includes knowing what documents are needed, such as W-2 forms, 1099 forms for freelance or contract work, and any receipts for deductions. Being aware of the filing deadline is also vital to avoid late penalties. The IRS website and tax professionals can provide detailed information on these requirements.

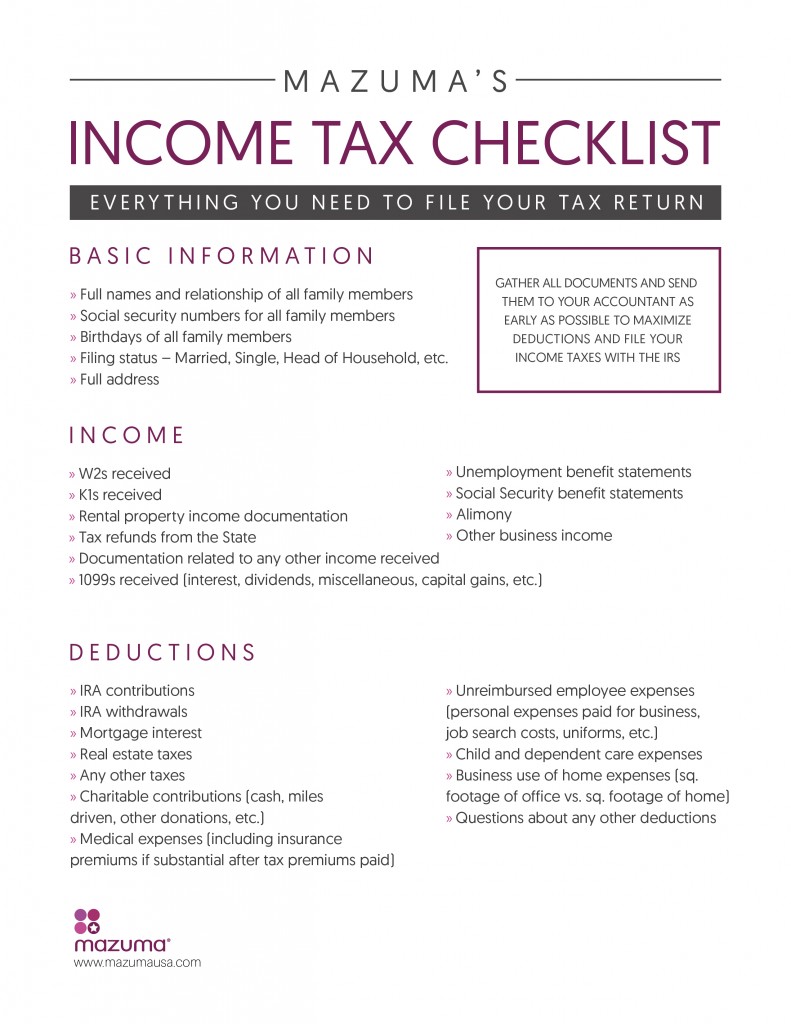

Tax Paper Tip 1: Keep All Documents Organized

One of the most critical steps in managing tax papers is keeping all relevant documents organized and easily accessible. This can be achieved by: - Using a dedicated folder or digital storage for tax-related documents. - Implementing a filing system that categorizes documents by type (e.g., income, deductions, business expenses). - Ensuring all documents are labeled clearly and include the tax year they pertain to.

Tax Paper Tip 2: Utilize Digital Tools

Digital tools and software can significantly streamline the process of managing tax papers. Programs like TurboTax, H&R Block, and QuickBooks offer: - Automated organization of financial documents. - Guided filing processes to ensure all necessary information is included. - Error checking to reduce the risk of audits.

Tax Paper Tip 3: Take Advantage of Deductions

Deductions can substantially reduce the amount of taxes owed. It’s essential to be aware of all eligible deductions, including: - Charitable donations: Keep receipts for donations to qualified organizations. - Business expenses: For self-employed individuals, track all business-related expenses. - Home office deductions: Calculate the portion of rent or mortgage interest that can be deducted for a home office.

Tax Paper Tip 4: Seek Professional Help When Necessary

For complex tax situations or for those who are unsure about how to proceed, seeking professional help can be invaluable. Tax professionals can: - Provide personalized advice tailored to specific financial situations. - Identify potential deductions that might be overlooked. - Ensure compliance with all tax laws and regulations.

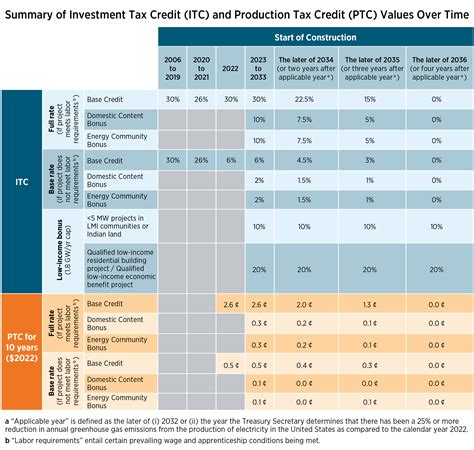

Tax Paper Tip 5: Stay Informed About Tax Law Changes

Tax laws and regulations change frequently, and being informed about these changes can help in making the most of tax savings opportunities. Staying updated can be achieved by: - Following reliable tax news sources. - Subscribing to tax professional newsletters. - Attending tax seminars or workshops.

Tax Paper Tip 6: File Electronically

Electronic filing (e-filing) offers several benefits, including: - Faster refunds: E-filing typically results in quicker refund processing. - Reduced errors: Electronic filings are less prone to errors compared to paper filings. - Environmentally friendly: It reduces the need for paper, contributing to a more sustainable environment.

Tax Paper Tip 7: Review and Plan Ahead

After filing taxes, it’s essential to review the outcome and plan for the next tax year. This includes: - Analyzing deductions to see if there are areas for improvement. - Adjusting withholding if the current withholding is not accurate. - Setting financial goals that consider tax implications.

📝 Note: Keeping detailed records throughout the year can significantly simplify the tax filing process and reduce the risk of errors or audits.

In the end, managing tax papers effectively is about being informed, organized, and proactive. By following these seven tips, individuals and businesses can navigate the complex world of taxes with more confidence, ensuring they are in compliance with tax laws and making the most of their hard-earned money.

What are the most common tax deductions for individuals?

+

The most common tax deductions for individuals include mortgage interest, charitable donations, medical expenses, and state and local taxes. It’s essential to keep receipts and records for these expenses to claim them on your tax return.

How can I ensure I’m taking advantage of all eligible business deductions?

+

To ensure you’re taking advantage of all eligible business deductions, maintain detailed records of business expenses throughout the year. Consider consulting with a tax professional who can provide guidance based on your specific business activities and expenses.

What are the benefits of filing taxes electronically?

+

Filing taxes electronically offers several benefits, including faster refunds, reduced errors, and it’s more environmentally friendly. Electronic filings are processed quicker than paper filings, resulting in faster access to your refund.