Keep Tax Return Paperwork

Importance of Keeping Tax Return Paperwork

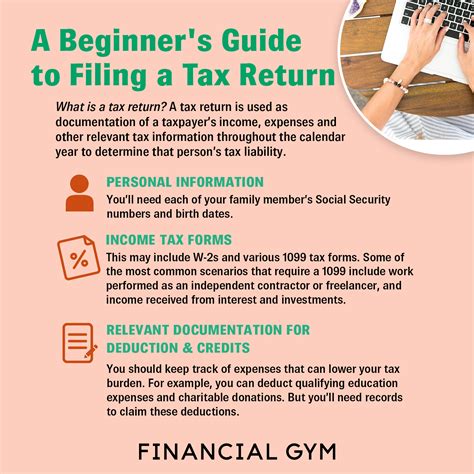

Keeping tax return paperwork is essential for individuals and businesses alike. This paperwork serves as a record of your financial transactions, income, and expenses, which can be crucial in case of an audit or when applying for loans and credit. Accurate and detailed records can help you avoid penalties, fines, and even legal issues. In this article, we will explore the reasons why keeping tax return paperwork is vital and provide tips on how to organize and maintain your records.

Benefits of Keeping Tax Return Paperwork

There are several benefits to keeping tax return paperwork, including: * Reduced risk of audit penalties: By keeping accurate records, you can ensure that you are complying with tax laws and regulations, reducing the risk of penalties and fines. * Improved financial management: Tax return paperwork can help you track your income and expenses, making it easier to manage your finances and make informed decisions. * Increased creditworthiness: Lenders and creditors often require tax return paperwork as part of the loan or credit application process. By keeping accurate records, you can demonstrate your creditworthiness and increase your chances of approval. * Enhanced security: Tax return paperwork can help protect you from identity theft and fraud by providing a record of your financial transactions and personal information.

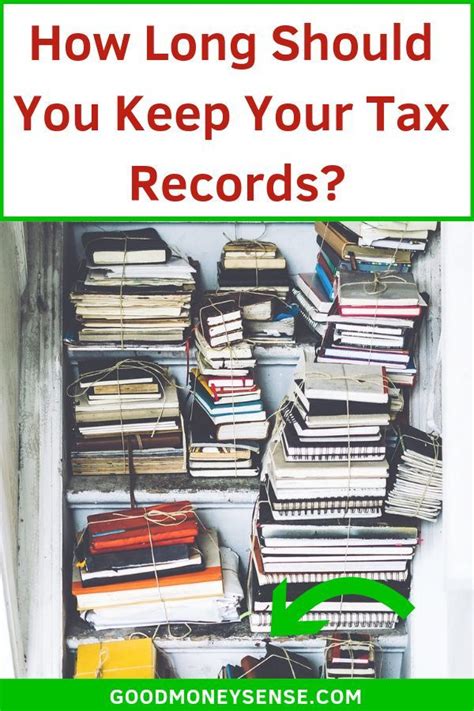

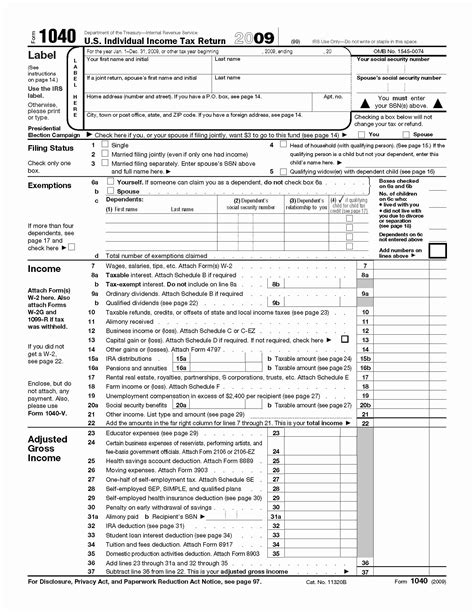

What to Keep and For How Long

It’s essential to keep tax return paperwork for an extended period, as the IRS can audit returns from up to six years ago. Here are some guidelines on what to keep and for how long: * Tax returns: Keep copies of your tax returns, including W-2s, 1099s, and schedule Cs, for at least six years. * Receipts and invoices: Keep receipts and invoices for business expenses, charitable donations, and medical expenses for at least three years. * Bank statements: Keep bank statements and cancelled checks for at least two years. * Investment records: Keep records of investments, including stock certificates and investment statements, for at least seven years.

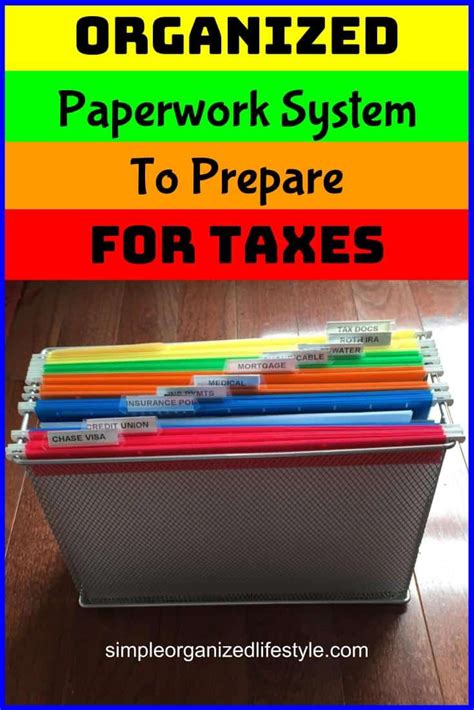

Organizing Your Tax Return Paperwork

To keep your tax return paperwork organized, consider the following tips: * Use a filing system: Create a filing system that separates your tax return paperwork into categories, such as income, expenses, and investments. * Label and date documents: Label and date each document, making it easier to find and identify specific records. * Use a secure storage method: Consider using a safe or a secure online storage method to protect your tax return paperwork from loss or damage. * Scan and digitize documents: Scan and digitize your tax return paperwork to create electronic copies, making it easier to access and store your records.

| Document | Retention Period |

|---|---|

| Tax returns | At least 6 years |

| Receipts and invoices | At least 3 years |

| Bank statements | At least 2 years |

| Investment records | At least 7 years |

📝 Note: The retention periods listed in the table are general guidelines and may vary depending on your specific situation and location.

As we wrap up our discussion on the importance of keeping tax return paperwork, it’s clear that maintaining accurate and detailed records is essential for individuals and businesses alike. By understanding the benefits of keeping tax return paperwork, knowing what to keep and for how long, and using a organized filing system, you can reduce the risk of audit penalties, improve your financial management, and increase your creditworthiness. Remember to always keep your tax return paperwork secure and easily accessible, and consider seeking the advice of a tax professional if you’re unsure about what records to keep or how to organize them.

What is the minimum amount of time I should keep my tax returns?

+

You should keep your tax returns for at least 6 years, as the IRS can audit returns from up to six years ago.

Can I keep my tax return paperwork electronically?

+

Yes, you can keep your tax return paperwork electronically, but make sure to use a secure storage method and keep a backup copy in case of loss or damage.

Do I need to keep receipts and invoices for personal expenses?

+

It’s not necessary to keep receipts and invoices for personal expenses, but it’s a good idea to keep them for business expenses, charitable donations, and medical expenses, as these can be deductible on your tax return.