Keep Tax Paperwork How Long

Introduction to Tax Paperwork

When it comes to tax paperwork, one of the most common questions people ask is how long they should keep their tax-related documents. The answer to this question can vary depending on several factors, including the type of tax return, the presence of any audits or disputes, and the individual’s personal financial situation. In this article, we will explore the different types of tax paperwork, the recommended retention periods, and provide guidance on how to manage and store these important documents.

Types of Tax Paperwork

There are several types of tax paperwork that individuals and businesses need to keep, including: * Tax returns (Form 1040, Form 1120, etc.) * W-2 forms and 1099 forms * Receipts for deductions and credits * Records of charitable donations * Records of business expenses * Records of home improvements and mortgage interest These documents are essential for preparing tax returns, supporting deductions and credits, and responding to audits or disputes.

Recommended Retention Periods

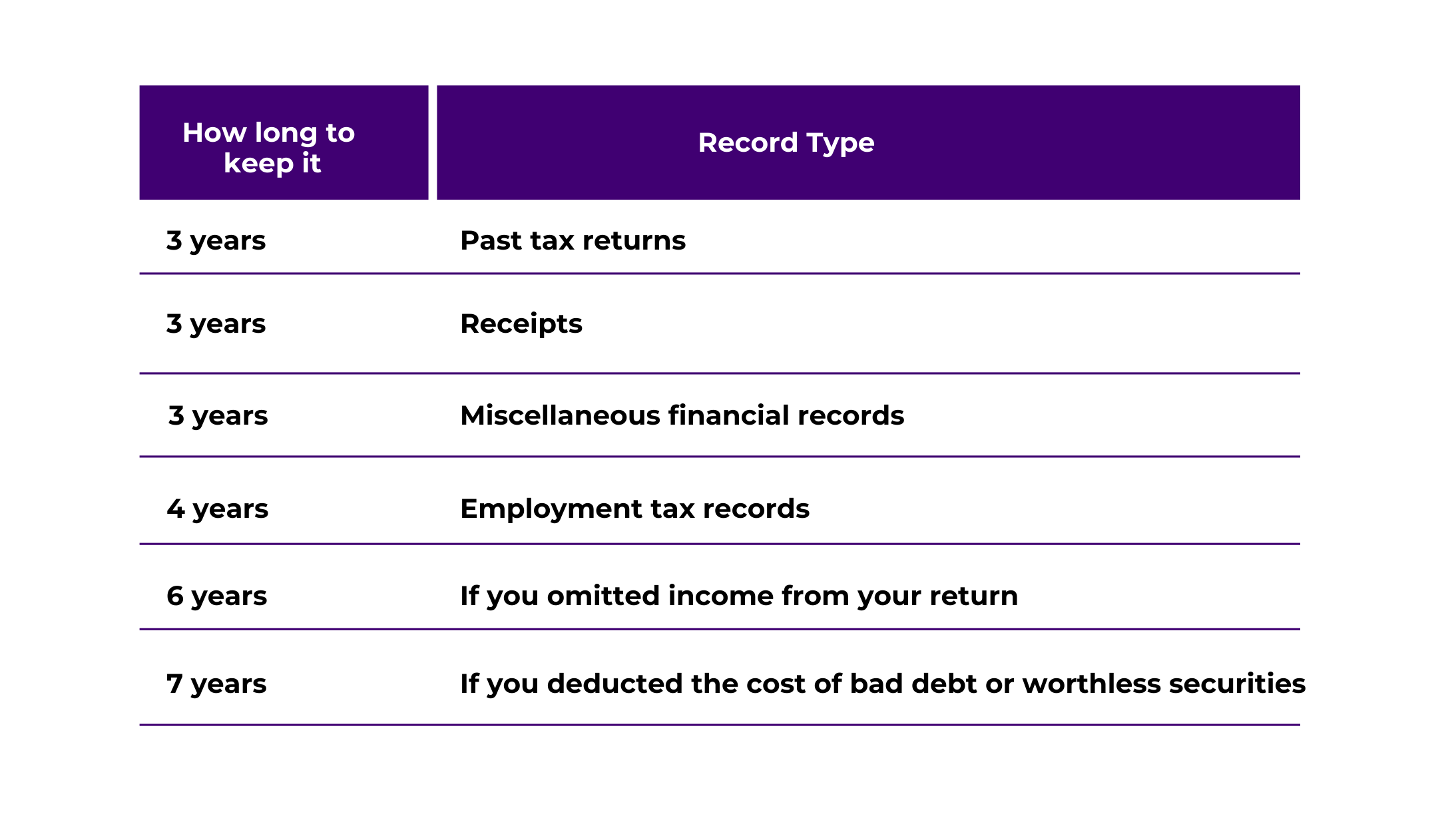

The Internal Revenue Service (IRS) recommends keeping tax-related documents for at least three years from the date of filing. However, this period can vary depending on the type of tax return and the presence of any audits or disputes. Here are some general guidelines: * Tax returns: 3-7 years * W-2 forms and 1099 forms: 3-7 years * Receipts for deductions and credits: 3-7 years * Records of charitable donations: 3-7 years * Records of business expenses: 3-7 years * Records of home improvements and mortgage interest: 6-10 years

Factors Affecting Retention Periods

Several factors can affect the recommended retention period for tax paperwork, including: * Audits and disputes: If you are audited or have a dispute with the IRS, you may need to keep your tax paperwork for a longer period. * Amended tax returns: If you file an amended tax return, you should keep the original return and the amended return for the recommended retention period. * Business ownership: Business owners may need to keep tax paperwork for a longer period, especially if they have employees or claim business deductions. * Home ownership: Homeowners may need to keep tax paperwork related to their home, such as mortgage interest and home improvement records, for a longer period.

Managing and Storing Tax Paperwork

Proper management and storage of tax paperwork are essential for maintaining accurate records and responding to audits or disputes. Here are some tips: * Use a secure and organized filing system, such as a file cabinet or digital storage system. * Keep tax paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service. * Consider scanning and digitizing tax paperwork to reduce storage space and improve accessibility. * Keep a record of the retention period for each type of tax paperwork and review and update your records regularly.

Important Notes

📝 Note: The recommended retention periods are general guidelines and may vary depending on individual circumstances. It’s always best to consult with a tax professional or financial advisor for specific guidance on managing and storing tax paperwork.

Best Practices for Tax Paperwork Management

To ensure accurate and efficient management of tax paperwork, follow these best practices: * Keep accurate records: Maintain accurate and complete records of all tax-related documents, including receipts, invoices, and bank statements. * Use a centralized filing system: Use a centralized filing system to store and manage all tax-related documents, making it easier to access and retrieve information. * Review and update records regularly: Regularly review and update tax paperwork to ensure accuracy and completeness. * Consider digital storage: Consider using digital storage services to reduce storage space and improve accessibility.

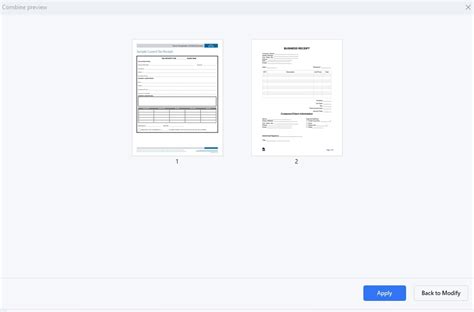

| Type of Tax Paperwork | Recommended Retention Period |

|---|---|

| Tax returns | 3-7 years |

| W-2 forms and 1099 forms | 3-7 years |

| Receipts for deductions and credits | 3-7 years |

| Records of charitable donations | 3-7 years |

| Records of business expenses | 3-7 years |

| Records of home improvements and mortgage interest | 6-10 years |

In summary, keeping tax paperwork for the recommended retention period is essential for maintaining accurate records, responding to audits or disputes, and ensuring compliance with tax laws and regulations. By following the guidelines and best practices outlined in this article, individuals and businesses can ensure proper management and storage of tax paperwork, reducing the risk of errors, penalties, and fines.

To wrap up, managing tax paperwork requires attention to detail, organization, and a thorough understanding of tax laws and regulations. By keeping accurate records, using a centralized filing system, and reviewing and updating records regularly, individuals and businesses can ensure compliance with tax laws and regulations, reduce the risk of errors and penalties, and maintain a stress-free tax season.

How long should I keep my tax returns?

+

The recommended retention period for tax returns is 3-7 years. However, this period can vary depending on individual circumstances, such as audits or disputes.

What types of tax paperwork should I keep?

+

You should keep all tax-related documents, including tax returns, W-2 forms, 1099 forms, receipts for deductions and credits, records of charitable donations, records of business expenses, and records of home improvements and mortgage interest.

How should I store my tax paperwork?

+

You should store your tax paperwork in a secure and organized filing system, such as a file cabinet or digital storage system. Consider scanning and digitizing your tax paperwork to reduce storage space and improve accessibility.