5 Ways Get EIN

Introduction to Obtaining an Employer Identification Number (EIN)

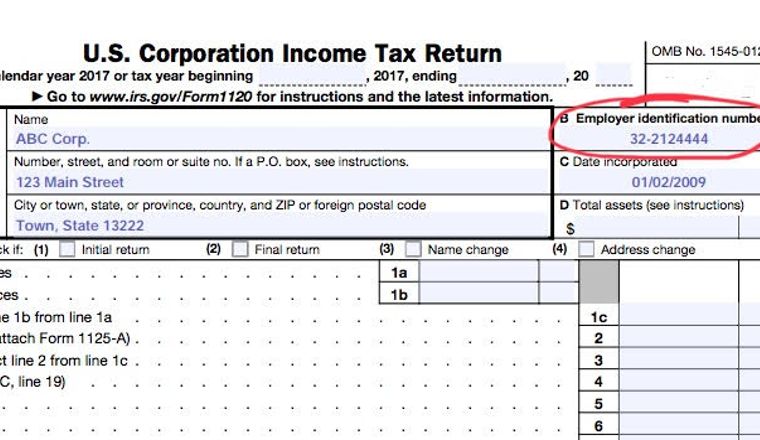

Obtaining an Employer Identification Number (EIN) is a crucial step for any business, as it serves as a unique identifier for tax purposes and is required for various business operations, such as opening a business bank account, hiring employees, and filing tax returns. The process of getting an EIN is relatively straightforward and can be completed online, by phone, or through the mail. In this article, we will explore the different ways to obtain an EIN, highlighting the benefits and requirements of each method.

Understanding the Importance of an EIN

Before diving into the methods of obtaining an EIN, it’s essential to understand its significance. An EIN is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity. It’s used to report employment taxes, income tax, and other business-related taxes. Having an EIN also helps to establish a business’s credibility and legitimacy, making it easier to open business accounts, apply for loans, and conduct other business operations.

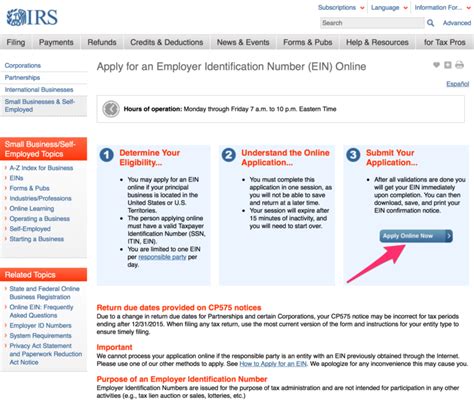

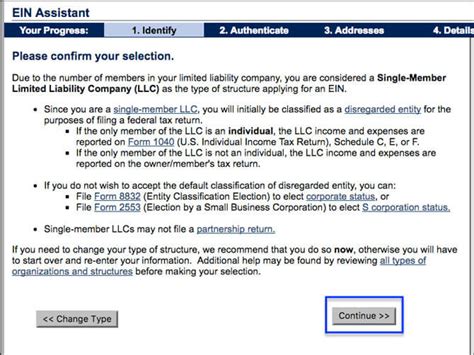

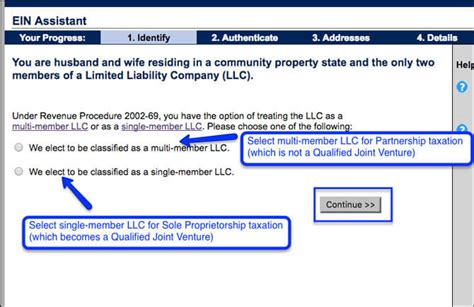

Method 1: Applying Online

The most convenient way to obtain an EIN is through the IRS website. The online application process is available from 7:00 a.m. to 10:00 p.m. local time, and it typically takes about 15-30 minutes to complete. To apply online, you’ll need to provide basic business information, such as the business name, address, and type of business. You’ll also need to provide your personal identification information, including your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

Method 2: Applying by Phone

If you prefer to apply for an EIN over the phone, you can call the IRS Business and Specialty Tax Line at (800) 829-4933. The phone application process is available from 7:00 a.m. to 7:00 p.m. local time, and it’s recommended that you have all the necessary information ready before calling. The IRS representative will guide you through the application process, and you’ll receive your EIN immediately after completing the application.

Method 3: Applying by Mail

You can also apply for an EIN by mail using Form SS-4, Application for Employer Identification Number. The form can be downloaded from the IRS website or obtained by calling the IRS at (800) 829-4933. Once you’ve completed the form, mail it to the IRS address listed on the form. The processing time for mail applications can take up to 4-6 weeks, so it’s essential to plan ahead and apply well in advance of when you need the EIN.

Method 4: Applying by Fax

Another option for applying for an EIN is by fax. You can complete Form SS-4 and fax it to the IRS at (855) 214-2225. The fax application process is available 24⁄7, and you’ll receive your EIN by mail within 4-6 weeks. Make sure to include your fax number on the application so the IRS can send you the EIN confirmation.

Method 5: Using a Third-Party Service

If you’re short on time or prefer to have someone else handle the application process, you can use a third-party service to obtain an EIN. These services typically charge a fee and will handle the application process on your behalf. However, be cautious when using third-party services, as some may charge excessive fees or have hidden costs.

📝 Note: When applying for an EIN, make sure to have all the necessary information ready, including your business name, address, and type of business, as well as your personal identification information.

Comparison of EIN Application Methods

The following table summarizes the different EIN application methods, including their benefits and requirements:

| Method | Benefits | Requirements | Processing Time |

|---|---|---|---|

| Online | Fast, convenient, and available 24/7 | Business information, personal identification | Immediate |

| Phone | Personalized assistance, immediate EIN | Business information, personal identification | Immediate |

| No fee, can be done at any time | Completed Form SS-4, business information, personal identification | 4-6 weeks | |

| Fax | Fast, convenient, and available 24/7 | Completed Form SS-4, business information, personal identification, fax number | 4-6 weeks |

| Third-Party Service | Convenient, handles application process | Business information, personal identification, fee payment | Varies |

In summary, obtaining an EIN is a crucial step for any business, and there are various methods to apply for one. By understanding the benefits and requirements of each method, you can choose the one that best suits your needs and ensure a smooth and efficient application process.

What is an EIN, and why do I need one?

+

An EIN is a unique identifier assigned by the IRS to identify a business entity. You need an EIN to report employment taxes, income tax, and other business-related taxes, as well as to open a business bank account, hire employees, and conduct other business operations.

How long does it take to get an EIN?

+

The processing time for an EIN varies depending on the application method. Online and phone applications typically provide an immediate EIN, while mail and fax applications can take up to 4-6 weeks.

Can I apply for an EIN without a Social Security number or ITIN?

+

No, you cannot apply for an EIN without a Social Security number or ITIN. You must provide your personal identification information, including your name, address, and Social Security number or ITIN, to apply for an EIN.