5 Bankruptcy Tips

Understanding Bankruptcy: A Comprehensive Guide

Bankruptcy is a legal process that allows individuals or businesses to reorganize or eliminate debts under the protection of the federal bankruptcy court. It can be a complex and overwhelming experience, but with the right guidance, it can also be a fresh start. Filing for bankruptcy is a significant decision that should not be taken lightly, and it’s essential to understand the process, its benefits, and its drawbacks. In this article, we will explore five essential bankruptcy tips to help you navigate this challenging situation.

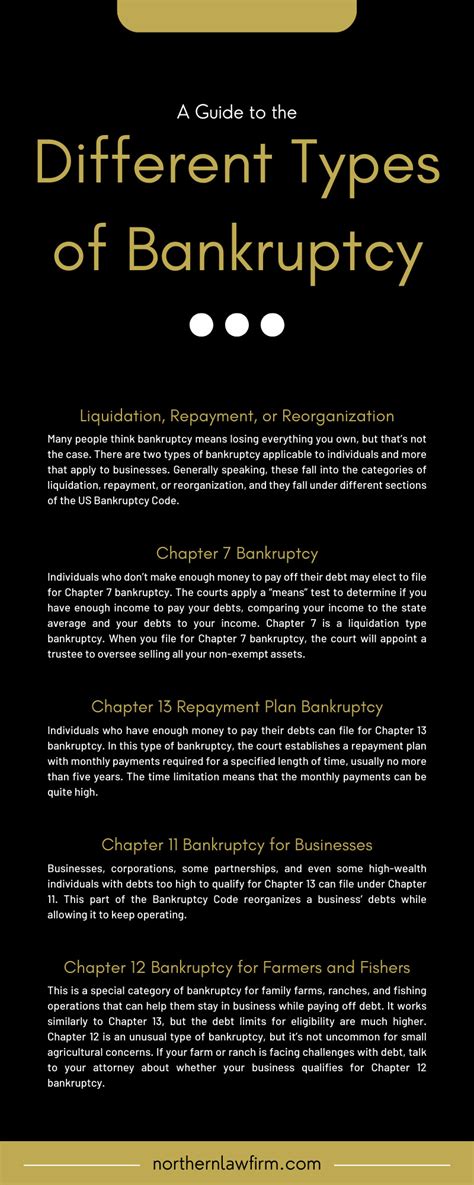

Tip 1: Determine the Right Type of Bankruptcy

There are two primary types of bankruptcy for individuals: Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves liquidating assets to pay off creditors, while Chapter 13 involves creating a repayment plan to pay off debts over time. Chapter 11 bankruptcy is typically used for businesses, but it can also be used by individuals with significant assets or complex financial situations. It’s crucial to consult with a bankruptcy attorney to determine which type of bankruptcy is best for your situation.

Tip 2: Gather Necessary Documents

To file for bankruptcy, you will need to gather various documents, including: * Financial records: income statements, expense reports, and debt lists * Asset information: property deeds, vehicle titles, and investment accounts * Identification: driver’s license, passport, and social security card * Tax returns: past few years’ tax returns and any pending tax obligations It’s essential to be thorough and accurate when gathering these documents, as they will be used to support your bankruptcy filing.

Tip 3: Understand the Bankruptcy Process

The bankruptcy process typically involves the following steps: * Filing a petition with the bankruptcy court * Attending a meeting of creditors (also known as a 341 meeting) * Completing a financial management course * Receiving a discharge of debts (in the case of Chapter 7) or completing a repayment plan (in the case of Chapter 13) It’s essential to understand the process and what to expect at each stage to ensure a smooth and successful bankruptcy filing.

Tip 4: Consider the Alternatives

Before filing for bankruptcy, it’s essential to explore alternative debt relief options, such as: * Debt consolidation: combining multiple debts into a single loan with a lower interest rate * Debt management plans: working with a credit counselor to create a repayment plan * Debt settlement: negotiating with creditors to reduce debt amounts These alternatives may not be suitable for everyone, but they can be effective for those with smaller debt amounts or more manageable financial situations.

Tip 5: Seek Professional Guidance

Filing for bankruptcy can be a complex and overwhelming process, and it’s highly recommended to seek the guidance of a bankruptcy attorney. A qualified attorney can help you: * Determine the best type of bankruptcy for your situation * Gather necessary documents and complete paperwork * Represent you in court and at creditor meetings * Ensure that your rights are protected throughout the process Don’t be afraid to ask questions or seek a second opinion if you’re unsure about any aspect of the bankruptcy process.

📝 Note: It's essential to keep detailed records of all correspondence and interactions with your bankruptcy attorney, as well as any documents related to your bankruptcy filing.

In summary, bankruptcy is a serious decision that requires careful consideration and planning. By understanding the different types of bankruptcy, gathering necessary documents, understanding the process, exploring alternative debt relief options, and seeking professional guidance, you can navigate this challenging situation and emerge with a fresh start. Remember to stay informed, ask questions, and prioritize your financial well-being throughout the process.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves liquidating assets to pay off creditors, while Chapter 13 involves creating a repayment plan to pay off debts over time.

How long does the bankruptcy process typically take?

+

The length of the bankruptcy process varies depending on the type of bankruptcy and individual circumstances, but it can take anywhere from a few months to several years.

Will filing for bankruptcy affect my credit score?

+

Yes, filing for bankruptcy can significantly affect your credit score, but the impact will depend on the type of bankruptcy and individual circumstances.