Paperwork

Business Paperwork Retention Period

Introduction to Business Paperwork Retention

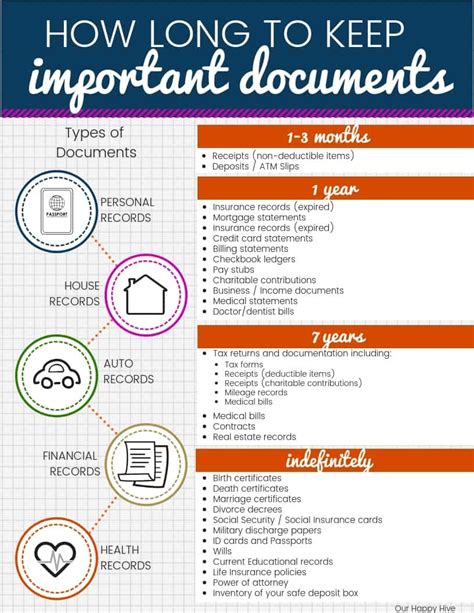

In the realm of business operations, paperwork and document management play a crucial role. With the increasing volume of documents, both physical and digital, managing and retaining them has become a significant challenge for businesses. The retention period of business paperwork is a critical aspect that businesses must consider, as it affects compliance with laws and regulations, storage needs, and ultimately, the bottom line. Understanding the retention period for different types of documents is essential for businesses to maintain compliance and efficiency.

Why Retain Business Paperwork?

Retaining business paperwork is necessary for several reasons, including: - Compliance with Laws and Regulations: Many laws and regulations require businesses to keep records for a specified period. This includes tax returns, employment records, and financial statements. - Audit and Financial Purposes: Retained documents can serve as evidence in audits and financial analyses, ensuring the accuracy of financial statements and compliance with accounting standards. - Litigation and Dispute Resolution: In cases of legal disputes, retained documents can provide critical evidence, supporting a business’s position and protecting its interests. - Historical and Research Purposes: For some businesses, especially those in research and development, retaining historical documents can be invaluable for future projects and innovations.

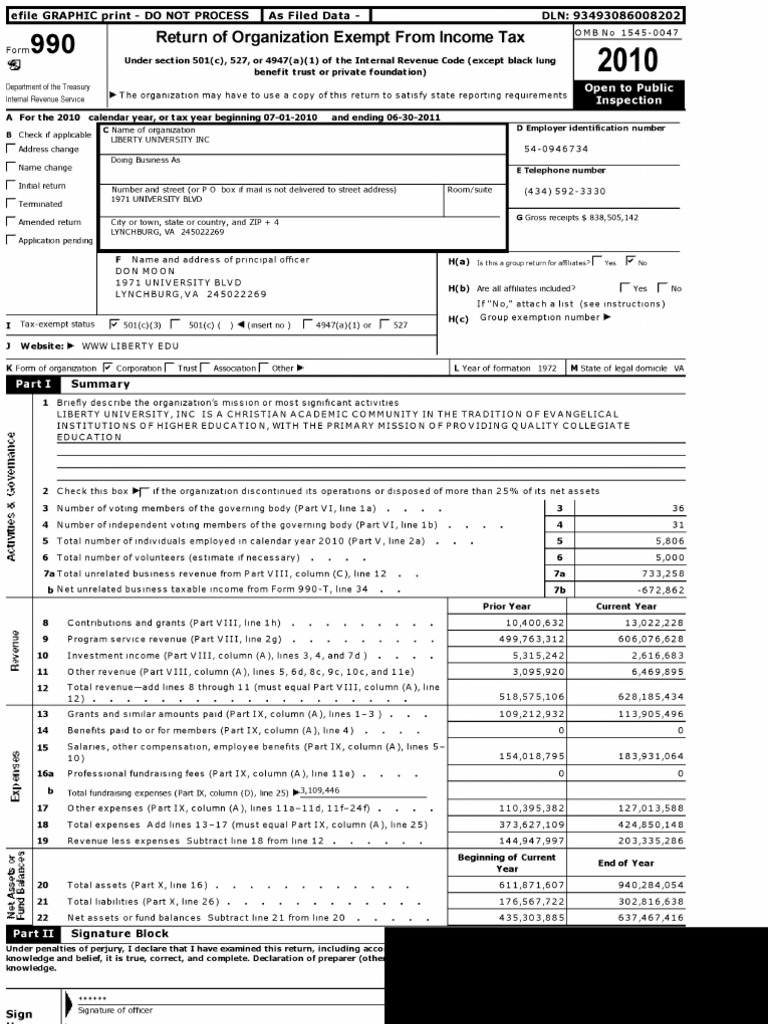

Retention Periods for Common Business Documents

The retention period for business documents varies widely depending on the type of document, the industry, and the applicable laws and regulations. Here are some general guidelines for common business documents: - Tax Returns and Related Documents: Typically, these should be kept for at least 3 to 7 years, depending on the jurisdiction and the specific tax laws. - Employment Records: These can include employee contracts, payroll records, and benefits information. The retention period is usually 3 to 5 years after the employee leaves the company. - Financial Statements and Accounts: Annual financial statements and accounts should be retained permanently, as they provide a historical financial record of the company. - Minutes of Meetings and Resolutions: These documents are crucial for corporate governance and should be retained permanently.

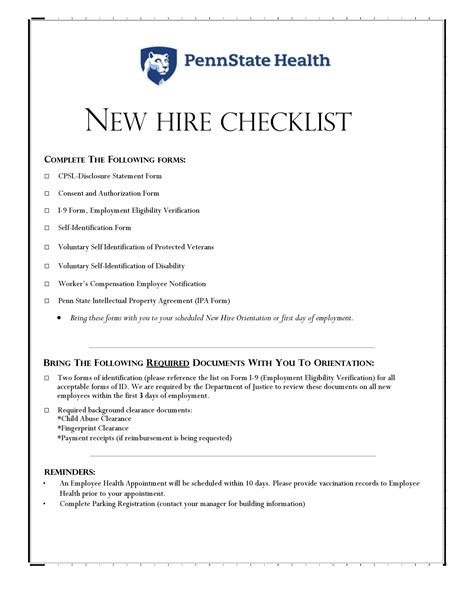

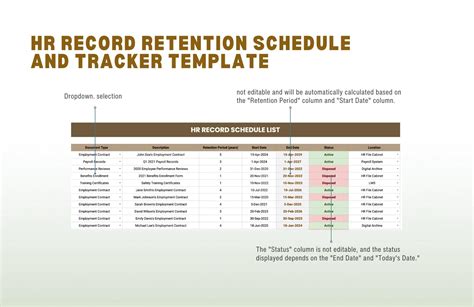

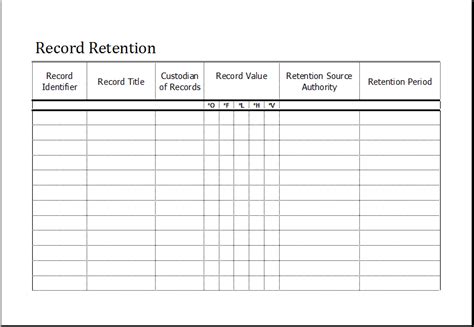

Best Practices for Document Retention

Implementing an effective document retention policy involves several best practices: - Develop a Clear Policy: Outline which documents to keep, for how long, and in what format. - Use a Centralized System: Whether physical or digital, a centralized system helps in organizing and accessing documents efficiently. - Ensure Compliance: Regularly review and update the policy to ensure it complies with changing laws and regulations. - Train Staff: Educate employees on the importance of document retention and how to follow the policy. - Consider Digital Storage: Digital storage solutions can offer secure, accessible, and space-efficient options for document retention.

Challenges in Document Retention

Despite the importance of document retention, businesses face several challenges, including: - Space and Storage: Physical documents require significant storage space, which can be costly. - Digital Security: Digital documents are vulnerable to cyber threats and data breaches. - Compliance: Keeping up with changing regulations and ensuring compliance can be complex and time-consuming. - Cost: Implementing and maintaining a document retention system can be expensive.

💡 Note: Regularly reviewing and updating the document retention policy can help mitigate these challenges by ensuring the policy remains relevant, compliant, and efficient.

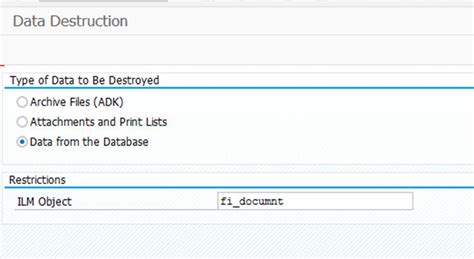

Technological Solutions for Document Retention

Technology offers several solutions to enhance document retention, including: - Document Management Systems (DMS): Software solutions that help in organizing, storing, and retrieving documents efficiently. - Cloud Storage: Offers scalable, secure, and accessible storage solutions for digital documents. - Digital Signature Tools: Facilitates the signing and verification of digital documents, enhancing their legal validity.

| Document Type | Retention Period | Purpose |

|---|---|---|

| Tax Returns | 3 to 7 years | Compliance and Audit |

| Employment Records | 3 to 5 years | HR and Legal Compliance |

| Financial Statements | Permanently | Financial History and Compliance |

Future of Document Retention

The future of document retention is likely to be shaped by technology, with trends moving towards more digital and cloud-based solutions. These solutions will offer enhanced security, accessibility, and compliance features, making document retention more efficient and less cumbersome for businesses.

In summary, the retention period of business paperwork is a critical aspect of business operations, influenced by legal requirements, business needs, and technological advancements. By understanding the retention periods for different documents and implementing best practices and technological solutions, businesses can ensure compliance, efficiency, and the strategic use of retained documents. This approach not only supports legal and financial obligations but also contributes to the long-term success and resilience of the business.