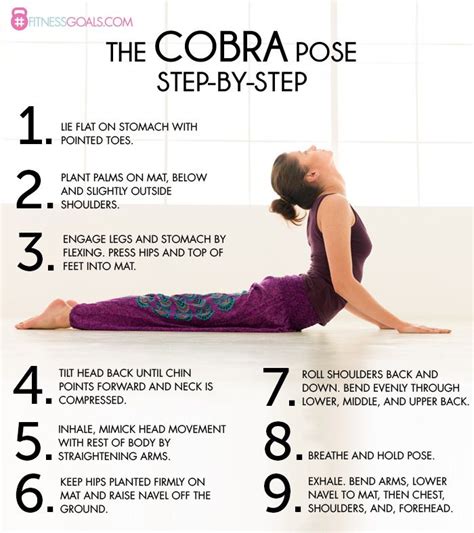

5 COBRA Tips

Introduction to COBRA

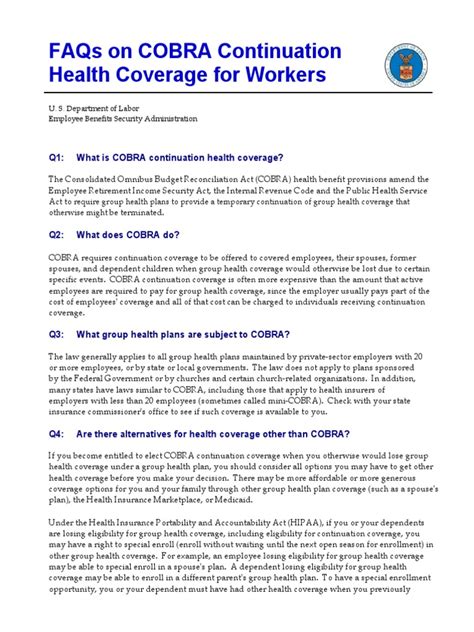

COBRA, or the Consolidated Omnibus Budget Reconciliation Act, is a federal law that allows certain individuals to continue their health insurance coverage after experiencing a qualifying event, such as job loss or divorce. Understanding COBRA is essential for those who want to maintain their health insurance benefits during times of transition. In this article, we will provide 5 COBRA tips to help individuals navigate the process of continuing their health insurance coverage.

Tip 1: Determine Eligibility

To be eligible for COBRA, an individual must experience a qualifying event, such as:

- Job loss or reduction in work hours

- Divorce or legal separation

- Death of the covered employee

- Dependent child losing dependent status

Tip 2: Understand the Enrollment Process

The COBRA enrollment process typically involves the following steps:

- The employer or plan administrator must notify the individual of their COBRA eligibility within 14 days of the qualifying event

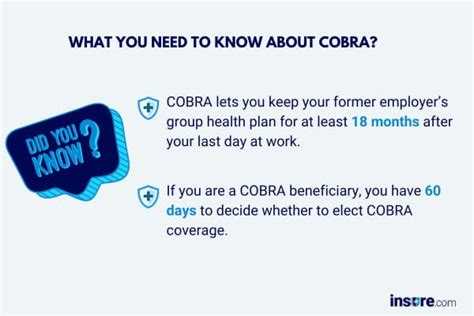

- The individual must respond to the notification within 60 days to elect COBRA coverage

- The individual must pay the first premium payment within 45 days of electing COBRA coverage

Tip 3: Calculate the Cost of COBRA

COBRA coverage can be expensive, as the individual is responsible for paying the full premium, including the portion that was previously paid by the employer. The cost of COBRA can vary depending on the plan and the individual’s circumstances. To calculate the cost of COBRA, you can use the following formula:

| Monthly Premium | Employer Contribution | Individual Contribution |

|---|---|---|

| 500</td> <td>70%</td> <td>30%</td> </tr> <tr> <td>COBRA Premium</td> <td>500 (100% of monthly premium) |

In this example, the individual would be responsible for paying the full $500 monthly premium.

📝 Note: The cost of COBRA can be expensive, so it is essential to review your budget and explore alternative options before electing COBRA coverage.

Tip 4: Explore Alternative Options

While COBRA can provide temporary health insurance coverage, it may not be the most cost-effective option. Alternative options may include:

- Spouse’s employer-sponsored health plan

- Individual health insurance plan

- Short-term health insurance plan

- Medicaid or CHIP (if eligible)

Tip 5: Review the Duration of COBRA Coverage

The duration of COBRA coverage varies depending on the qualifying event and the individual’s circumstances. Typically, COBRA coverage lasts for 18 months, but it can be extended to 29 months in certain circumstances, such as disability. It is crucial to review the duration of COBRA coverage to ensure that you understand when your coverage will end.

As we summarize the key points of this article, it is clear that COBRA can provide essential health insurance coverage during times of transition. By understanding the eligibility requirements, enrollment process, cost, alternative options, and duration of COBRA coverage, individuals can make informed decisions about their health insurance benefits.

What is COBRA, and how does it work?

+

COBRA is a federal law that allows certain individuals to continue their health insurance coverage after experiencing a qualifying event, such as job loss or divorce. It works by requiring the employer or plan administrator to notify the individual of their COBRA eligibility, and then the individual must respond to the notification and pay the first premium payment to elect COBRA coverage.

How long does COBRA coverage last?

+

Typically, COBRA coverage lasts for 18 months, but it can be extended to 29 months in certain circumstances, such as disability.

Can I enroll in COBRA if I am not eligible for a qualifying event?

+

No, you must experience a qualifying event, such as job loss or divorce, to be eligible for COBRA.