5 LP Paperwork Requirements

Understanding the LP Paperwork Requirements

To form a Limited Partnership (LP), certain paperwork requirements must be met. These requirements vary by state but generally include filing a certificate of limited partnership with the state and obtaining any necessary licenses and permits. It is essential to understand these requirements to ensure compliance with state laws and to avoid any potential penalties or fines.

Step 1: Choose a Business Name

The first step in forming an LP is to choose a business name. The name must include the words “Limited Partnership” or the abbreviation “LP” to indicate that it is a limited partnership. The name must also be unique and not already in use by another business in the state. It is a good idea to check with the state’s business registration office to ensure that the desired name is available.

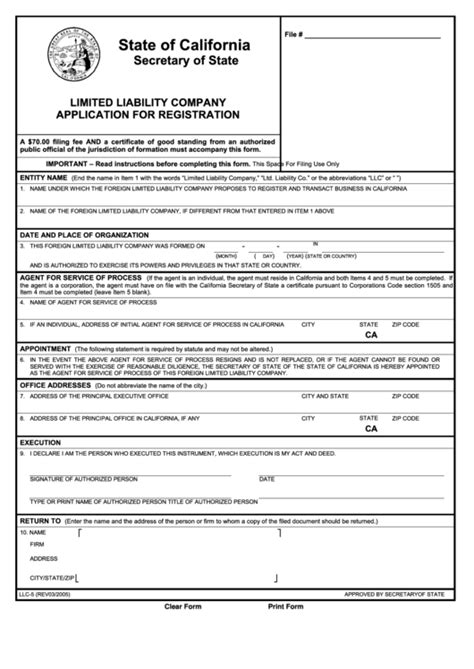

Step 2: File a Certificate of Limited Partnership

The next step is to file a certificate of limited partnership with the state. This document typically includes the following information: * The name and address of the LP * The names and addresses of the general and limited partners * The purpose of the LP * The duration of the LP * The amount of capital contributed by each partner The certificate must be signed by all general partners and filed with the state’s business registration office.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business and the state in which it is located, the LP may need to obtain certain licenses and permits. These may include: * Business license * Sales tax permit * Employer identification number (EIN) * Other permits and licenses specific to the industry or location It is essential to research and obtain all necessary licenses and permits to avoid any potential fines or penalties.

Step 4: Create a Limited Partnership Agreement

A limited partnership agreement is a document that outlines the terms of the partnership, including the roles and responsibilities of each partner, the distribution of profits and losses, and the procedure for resolving disputes. This document is essential for establishing a clear understanding among partners and can help prevent conflicts in the future.

Step 5: Obtain an Employer Identification Number (EIN)

An EIN is a unique number assigned to the LP by the IRS for tax purposes. It is required for all businesses that have employees or are required to file tax returns. The EIN can be obtained by filing Form SS-4 with the IRS.

📝 Note: The specific paperwork requirements for an LP may vary depending on the state and type of business. It is essential to consult with an attorney or business advisor to ensure compliance with all applicable laws and regulations.

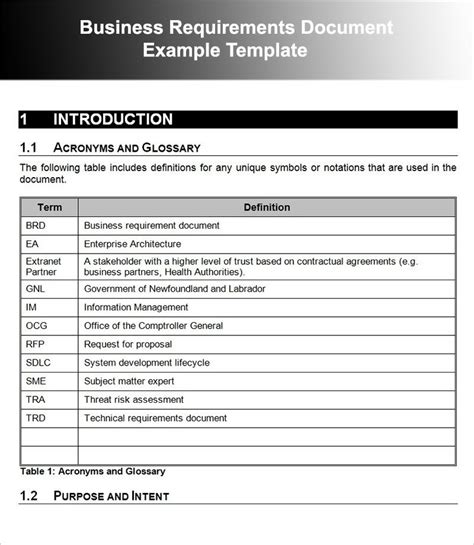

Table of LP Paperwork Requirements

The following table summarizes the typical paperwork requirements for an LP:

| Document | Description |

|---|---|

| Certificate of Limited Partnership | Filed with the state to form the LP |

| Limited Partnership Agreement | Outlines the terms of the partnership |

| Business License | Required for all businesses |

| Sales Tax Permit | Required for businesses that sell taxable goods or services |

| Employer Identification Number (EIN) | Required for all businesses that have employees or file tax returns |

In summary, forming an LP requires several paperwork requirements, including filing a certificate of limited partnership, obtaining necessary licenses and permits, creating a limited partnership agreement, and obtaining an EIN. It is crucial to comply with these requirements to ensure the legitimacy and success of the business.

The key points to remember when forming an LP are to choose a unique business name, file the necessary documents with the state, obtain all required licenses and permits, create a comprehensive limited partnership agreement, and obtain an EIN. By following these steps and understanding the specific requirements for the state and type of business, entrepreneurs can establish a successful and compliant LP.

To finalize, the process of establishing an LP involves several critical steps, each designed to ensure the business operates legally and efficiently. By carefully considering these requirements and seeking professional advice when necessary, business owners can navigate the formation process with confidence.

What is the purpose of a limited partnership agreement?

+

A limited partnership agreement outlines the terms of the partnership, including the roles and responsibilities of each partner, the distribution of profits and losses, and the procedure for resolving disputes.

Do I need to obtain an EIN for my LP?

+

Yes, an EIN is required for all businesses that have employees or are required to file tax returns.

How do I file a certificate of limited partnership?

+

The certificate of limited partnership must be filed with the state’s business registration office. The specific requirements and filing procedures may vary depending on the state.