5 Credit Tips

Understanding Credit: The Foundation of Financial Stability

Building a strong credit profile is essential for achieving financial stability and securing favorable loan terms. Credit scores play a crucial role in determining an individual’s creditworthiness, influencing the interest rates they qualify for, and even affecting their ability to rent an apartment or purchase a home. In this article, we will delve into the world of credit, exploring five valuable tips to help you manage your credit effectively and maintain a healthy financial standing.

Tip 1: Monitor Your Credit Report

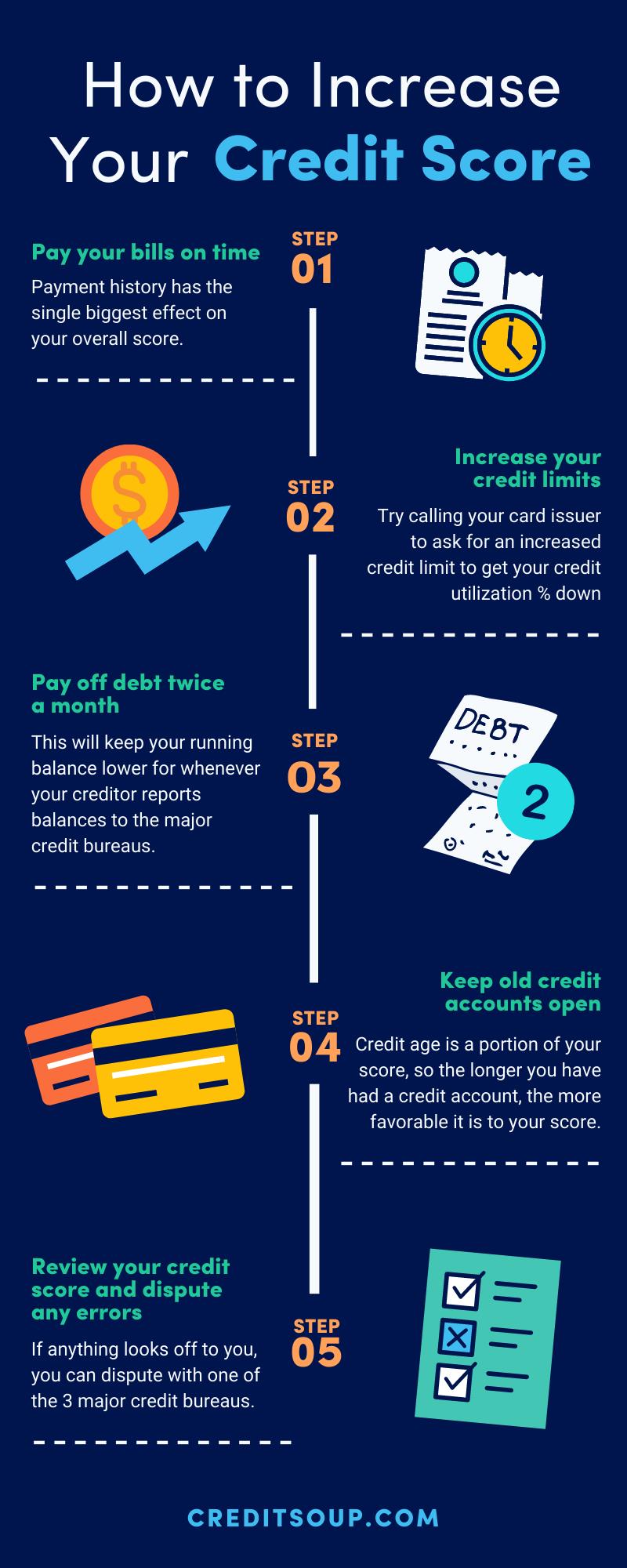

Your credit report is a detailed record of your credit history, including information about your credit accounts, payment history, and any derogatory marks such as late payments or collections. It is essential to regularly review your credit report to ensure it is accurate and up-to-date. You can request a free credit report from each of the three major credit reporting bureaus (Experian, TransUnion, and Equifax) once a year from AnnualCreditReport.com. By monitoring your credit report, you can:

- Identify and dispute any errors or inaccuracies

- Track changes to your credit score

- Detect potential signs of identity theft

Tip 2: Make On-Time Payments

Payment history accounts for a significant portion of your credit score, making it vital to make on-time payments on all your credit accounts. Late payments can negatively impact your credit score, while a consistent record of timely payments can help improve it. Consider setting up payment reminders or automating your payments to ensure you never miss a payment. Additionally, try to:

- Pay more than the minimum payment on your credit cards

- Pay off high-interest debt first

- Avoid making multiple late payments in a row

Tip 3: Keep Credit Utilization Ratio Low

Your credit utilization ratio, which is the percentage of available credit being used, plays a significant role in determining your credit score. It is recommended to keep your credit utilization ratio below 30%. A lower ratio indicates to lenders that you can manage your credit responsibly and are less likely to default on payments. To maintain a low credit utilization ratio:

- Keep credit card balances low

- Avoid maxing out your credit cards

- Consider increasing your credit limit (but avoid overspending)

Tip 4: Avoid New Credit Inquiries

When you apply for new credit, lenders will typically perform a hard inquiry on your credit report. Multiple hard inquiries in a short period can negatively affect your credit score, as they may indicate to lenders that you are taking on too much debt. To minimize the impact of new credit inquiries:

- Only apply for credit when necessary

- Space out credit applications if you need to apply for multiple lines of credit

- Consider alternative options, such as a personal loan or balance transfer, instead of applying for new credit cards

Tip 5: Diversify Your Credit Portfolio

A diverse credit portfolio, which includes a mix of different credit types, such as credit cards, loans, and a mortgage, can help improve your credit score. This is because it demonstrates to lenders that you can manage different types of credit responsibly. To diversify your credit portfolio:

- Consider taking out a personal loan or applying for a credit card

- Make timely payments on all credit accounts

- Avoid over-relying on a single type of credit

📝 Note: By following these five credit tips, you can maintain a healthy credit profile, qualify for better loan terms, and achieve long-term financial stability.

As you work to manage your credit effectively, remember that it is a continuous process. By staying informed, monitoring your credit report, and making responsible financial decisions, you can build a strong foundation for a secure financial future. In the end, a good credit score is not just a number; it is a key to unlocking better financial opportunities and achieving your long-term goals.

What is the most important factor in determining my credit score?

+

Payment history is the most important factor in determining your credit score, accounting for approximately 35% of your total score.

How can I improve my credit utilization ratio?

+

To improve your credit utilization ratio, focus on keeping your credit card balances low, avoiding maxing out your credit cards, and considering increasing your credit limit (but avoid overspending).

Will checking my credit report affect my credit score?

+

Checking your credit report will not affect your credit score, as it is considered a soft inquiry. However, applying for new credit may result in a hard inquiry, which can temporarily lower your credit score.