Get Your Tax Paperwork Done

Introduction to Tax Paperwork

The tax season is upon us, and it’s time to get your tax paperwork done. Tax preparation can be a daunting task, especially for those who are new to the process. However, with the right guidance, you can navigate through the paperwork with ease. In this article, we will walk you through the steps to prepare your tax paperwork, highlighting the important documents you need to gather, the forms you need to fill out, and the deadlines you need to meet.

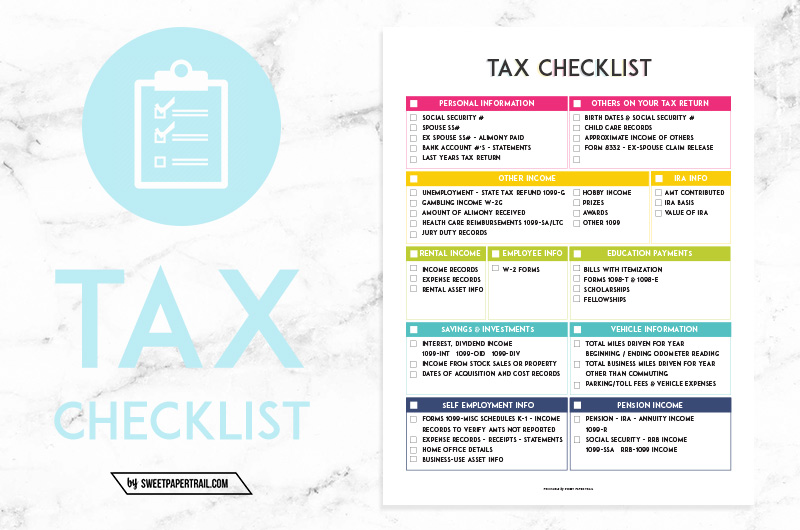

Gathering Important Documents

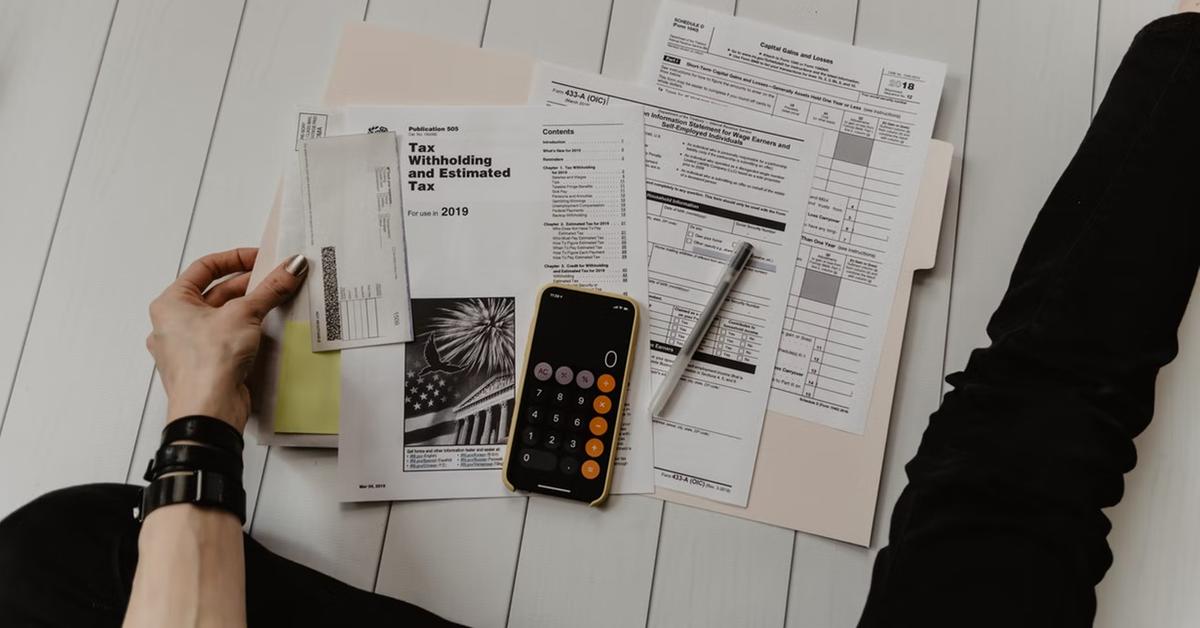

To start your tax preparation, you need to gather all the necessary documents. These include: * W-2 forms from your employer, showing your income and taxes withheld * 1099 forms for any freelance or contract work you did * Interest statements from your bank, showing the interest you earned on your savings account * Dividend statements from your investments, showing the dividends you received * Charitable donation receipts, showing the donations you made to qualified charitable organizations * Mortgage interest statements, showing the interest you paid on your mortgage

These documents will help you calculate your taxable income, deductions, and credits. Make sure you have all the necessary documents before you start filling out your tax forms.

Filling Out Tax Forms

Once you have gathered all the necessary documents, you can start filling out your tax forms. The most common tax form is the Form 1040, which is the standard form for personal income tax returns. You may also need to fill out other forms, such as: * Form 1099 for freelance or contract work * Form 8829 for business use of your home * Form 8863 for education credits

When filling out your tax forms, make sure you follow the instructions carefully and report all your income and deductions accurately. You can use tax software to help you with the process, or you can consult a tax professional if you need additional guidance.

Meeting Deadlines

The deadline for filing your tax return is typically April 15th of each year. However, if you need more time to prepare your return, you can file for an extension. This will give you an additional six months to file your return, but you will still need to pay any taxes you owe by the original deadline.

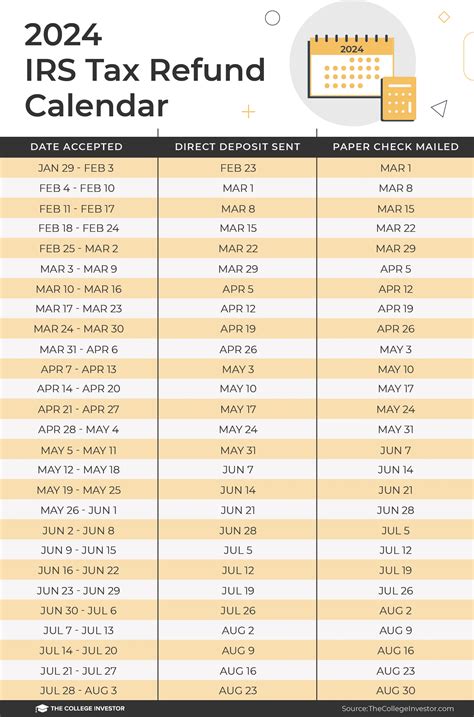

It’s also important to note that if you are due a refund, you can file your return as soon as possible to get your refund quickly. The IRS typically processes refunds within a few weeks of receiving your return.

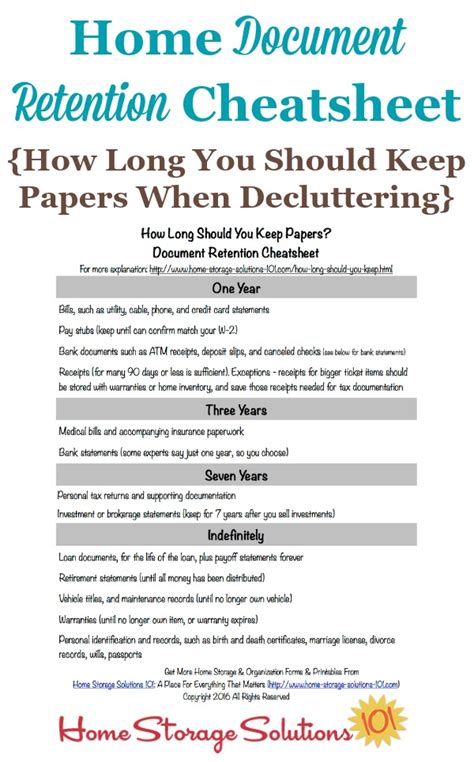

📝 Note: Make sure you keep a copy of your tax return and supporting documents for at least three years in case of an audit.

Tax Credits and Deductions

Tax credits and deductions can help reduce your taxable income and lower your tax bill. Some common tax credits and deductions include: * Earned Income Tax Credit (EITC) for low-to-moderate income workers * Child Tax Credit for families with children * Education credits for students and their families * Mortgage interest deduction for homeowners * Charitable donation deduction for donations to qualified charitable organizations

When claiming tax credits and deductions, make sure you follow the rules and regulations carefully to avoid any errors or audits.

Conclusion

Getting your tax paperwork done can be a challenging task, but with the right guidance, you can navigate through the process with ease. Remember to gather all the necessary documents, fill out your tax forms accurately, and meet the deadlines. Don’t forget to claim tax credits and deductions to reduce your taxable income and lower your tax bill. By following these steps, you can ensure a smooth and stress-free tax preparation experience.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return is typically April 15th of each year. However, if you need more time to prepare your return, you can file for an extension.

What documents do I need to gather for my tax return?

+

You will need to gather documents such as W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, and mortgage interest statements.

Can I claim tax credits and deductions on my tax return?

+

Yes, you can claim tax credits and deductions on your tax return. Some common tax credits and deductions include the Earned Income Tax Credit, Child Tax Credit, education credits, mortgage interest deduction, and charitable donation deduction.